Ahmed, N. 28 Mar 2014. Ex govt adviser: “global market shock” from “oil crash” could hit in 2015. The Guardian.

Former oil geologist Dr. Jeremy Leggett, identified 5 “global systemic risks (oil depletion, carbon emissions, carbon assets, shale gas, and the financial sector) directly connected to energy” which, he says, together “threaten capital markets and hence the global economy” in a way that could trigger a global crash sometime between 2015 and 2020. Leggett warns that a wide range of experts and insiders “from diverse sectors spanning academia, industry, the military and the oil industry itself, including the International Energy Agency” are expecting an oil crunch most likely from 2015 to 2020. If we are correct, and nothing is done to soften the landing, the twenty-first century is almost certainly heading for a depression.”

Leggett also highlights the risk of parallel developments in the financial sector: “Growing numbers of financial experts are warning that failure to rein in the financial sector in the aftermath of the financial crash of 2008 makes a second crash almost inevitable.”

Leggett points to an expanding body of evidence that what he calls “the incumbency” – “most of the oil and gas industries, their financiers, and their supporters and defenders in public service” – have deliberately exaggerated the quantity of fossil fuel reserves, and the industry’s capacity to exploit them. He points to a leaked email from Shell’s head of exploration to the CEO, Phil Watts, dated November 2003: “I am becoming sick and tired of lying about the extent of our reserves issues and the downward revisions that need to be done because of far too aggressive/ optimistic bookings.”

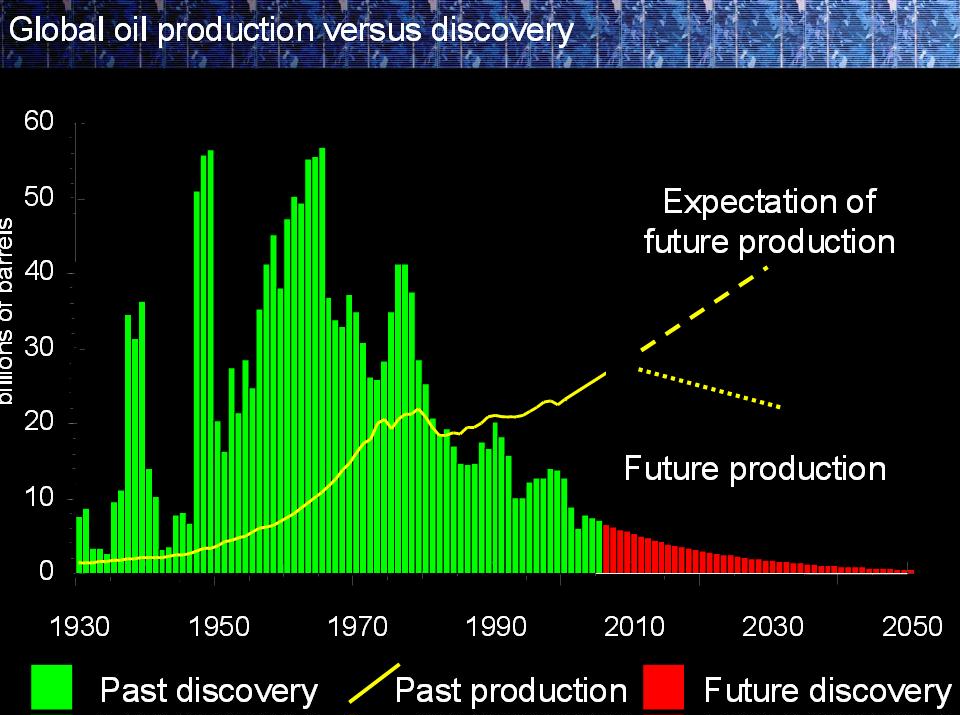

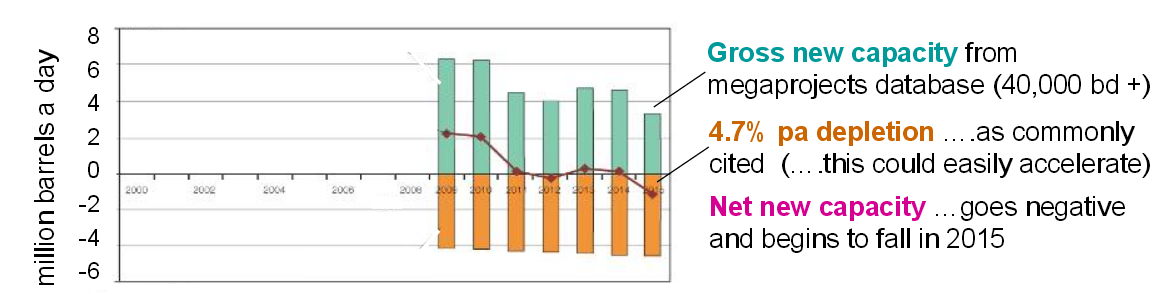

Leggett thus remains highly skeptical that shale oil and gas will change the game. Despite “soaring drilling rates,” US tight oil production has lifted “only around a million barrels a day.” As global oil consumption is at around 90 million barrels a day, with conventional crude depleting “by over 4 million barrels a day of capacity each year” according to International Energy Agency (IEA) data, tight oil additions “can hardly be material in the global picture.” He reaches a similar verdict for shale gas, which he notes “contributes well under 1% of US transport fuel. Shale-gas drilling has dropped off a cliff since 2009. It is only a matter of time now before US shale-gas production falls. This is not material to the timing of a global oil crisis, and questions the existence of a real North American ‘boom’: “How it can be that there is a prolonged and sustainable shale boom when so much investment is being written off in America – $32 billion at the last count?”

In his book, Leggett cites a letter he had obtained in 2004 written by the First Secretary for Energy and Environment in the British embassy in Washington, referring to a presentation on oil supply by the leading oil and gas consulting firm, PFC Energy (now owned by IHS, the US government contractor which also owns Cambridge Energy Research Associates). According to Leggett, the diplomat’s letter to his colleagues in London reads as follows: “The presentation drew some gasps from the assembled energy cognoscenti. They predict a peaking of global supply in the face of high demand by as early as 2015.”

The text of the 2004 letter is corroborated by a 2009 PFC Energy report commissioned by the International Energy Forum which concluded that world conventional oil supply was approaching “peak production, where the petroleum industry’s ability to continue to increase – or even maintain – production of conventional oil (and eventually gas) is constrained…”Exploitation of unconventional oil will provide additional liquids, but in all probability only at increasingly higher costs, and it will depend on significant investments to develop appropriate technologies to convert today’s resources into tomorrow’s reserves. The challenge is coming, and this emerging world of limited conventional production will require major adjustments on the part of both consumers and producers.”

Leggett is now convener of the UK Industry Task Force on Peak Oil and Energy Security (ITPOES) and recently addressed world leaders at the World Economic Forum in Davos about his forecast.

Based on flow rate data, the ITPOES report found that “increases in extraction would be slowing down in 2011–13 and dropping thereafter.” From then on, global oil production would drop “at 1% a year from 2015. If the then IEA forecast of demand rising to 105 million barrels a day in 2030 were to prove correct, supply would fall short in 2015.”

Peak oil does not mean, Leggett insists forcefully, that oil is “running out.” The problem is the increasing costs of extraction and decreasing flow rates of unconventionals: “It will never run out. Oil reserves under the ground, we tried to say, once again, are not the same as oil flows from production pipes at the surface.”

The UK Industry Taskforce’s pinpointing of 2015, Leggett emphasizes throughout his book, is corroborated by forecasts from a range of other agencies, including the US and German militaries.

World faces oil supply crunch by 2015, warn British business leaders

04/24/2013

The world faces an oil supply crunch within the next five years, British business leaders led by Virgin tycoon Richard Branson warned on Wednesday.

The rate at which oil is produced risks hitting a peak by 2015, sparking a surge in crude prices and living costs, said a report from the UK Industry Taskforce on Peak Oil & Energy Security (ITPOES).

“The UK Industry Taskforce on Peak Oil and Energy Security (ITPOES) finds that oil shortages, insecurity of supply and price volatility will destabilize economic, political and social activity potentially by 2015. The taskforce states the impact of peak oil will include sharp increases in the cost of travel, food, heating and retail goods.”

“It finds that the transport sector will be particularly hard hit, with more vulnerable members of society the first to feel the impact. The taskforce warns that the UK must not be caught out by the oil crunch in the same way it was with the credit crunch and states that policies to address peak oil must be a priority for the new government formed after the election. Unless we do so, we face a situation during the term of the next government where fuel price unrest could lead to shortages in consumer products and the UK’s energy security will be significantly compromised.”

Supply-side constraints – lack of construction capacity, oil rigs and skilled manpower – would all contribute towards peak oil, according to the taskforce. Other concerns are Investment shortfall, State of aged infrastructure, Tar sand flow rates too low, CTL flow rates too low, GTL flow rates too low, Absence of oil shale technology, Gas needed for power, Age skew and skills shortage

2011 ITPOES report: A press release appeared last week on the website of the UK Industry Taskforce on Peak Oil and Energy Security (ITPOES) and said that during a meeting between Chris Huhne, the UK’s Secretary of State for Energy and Climate Change, and representatives of ITPOES, an agreement had been reached that Her Majesty’s Department for Energy and Climate will collaborate with ITPOES on a joint examination of concerns that global oil supply will begin to fall behind demand within as little as five years. This collaboration is seen by the British government as the first step in the development of a national peak oil contingency plan.

American readers should note that the British government recognizes that energy policy and climate change are inextricably linked so that you cannot formulate policies for one without the other, and that a major government recognizes global oil supplies will fall behind demand in as little as five years. After years of official denial this is indeed a breakthrough worthy of note. Gone is the rhetoric about the billions of barrels of oil remaining that will last for so many decades that nobody alive today needs to worry. Official recognition has been given to the concept that the remaining oil will be so expensive to extract or will be locked into the earth by intractable political disputes, so that it simply will not be available in the unlimited quantities or at the prices we have known for the last 100 years. Also implicit in the announcement is that ever-rising real energy costs will destabilize nearly all of the world’s economies and that economic growth in the form we have come to know it will no longer be possible.

2010 ITPOES forecast (hasn’t changed in 2014 – they still believe the crunch starts in 2015). In 2010 they said the recession gave us an extra 2 years before the crunch hits.