Source: American Association of Railroads.

Source: American Association of Railroads.

46% of all tonnage hauled by freight trains is Energy:

In 2014, crude oil will likely be 650,000 carloads — 2% of all carloads, 2.2% of tonnage. In addition 2.6% of rail tonnage was refined petroleum & coke.

In 2013, coal was 5,950,000 carloads of coal (693.8 million tons), 20.6% of all carloads, 39.5% of rail tonnage, 20% of rail revenue.

In 2012, ethanol was 306,000 carloads, 1% of all carloads, 1.5% of rail tonnage

It’s probably more than half if you count commodities derived from petroleum. In 2002, the last time the U.S. Dept of Transportation (RITA) published “Table 12 – U.S. Rail Total Carload and Intermodal Commodity Shipments”, 2% of rail tonnage was fertilizer, 2% plastics and rubber, and some fraction of the 1% chemical products tonnage comes from the petrochemical industry (i.e. agrochemicals, methanol, etc). In 2002, 47% of rail tonnage was coal, coal and petroleum products, fuel oils, gasoline and aviation turbine fuel, and crude petroleum.

Alice Friedemann October 8, 2014.

Nixon, R. Oct 8, 2014. As Trains Move Oil Bonanza, Delays Mount for Other Goods and Passengers. New York Times.

An energy boom that has created a sharp increase in rail freight traffic nationwide is causing major delays for vital consumer and industrial goods, including chemicals, coal, and grain shipments for farmers, likely to grow worse since record harvests of corn, soybeans, and wheat are expected this year.

On the long-distance routes, aging tracks and a shortage of train cars, locomotives and crews have also caused delays.

Rail accounts for 40% of all goods moved in the country as measured in ton-miles (multiply cargo weight by distance shipped). Trucks are second at 28%.

Frittelli, J., et al. May 5, 2014. U.S. Rail Transportation of Crude Oil: Background and Issues for Congress. Congressoinal Research Service.

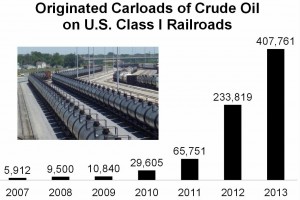

According to rail industry officials, U.S. freight railroads are estimated to have carried 434,000 carloads of crude oil in 2013 (roughly equivalent to 300 million barrels), compared to 9,500 carloads in 2008. In 2014, 650,000 carloads of crude oil are expected to be carried. Crude imports by rail from Canada have increased more than 20-fold since 2011.

The Assoc of American RR says that “crude oil accounted for 1.6 percent of total Class I originated carloads in the first half of 2014.

Assuming, for simplicity, that each rail tank car holds about 30,000 gallons (714 barrels) of crude oil, the 229,798 carloads of crude oil originated by U.S. Class I railroads in the first half of 2014 was equivalent to 900,000 barrels per day moving by rail. According to EIA data, total U.S. domestic crude oil production in the first half of 2014 was 8.2 million barrels per day, so the rail share was around 11 percent of the total.”

The volume of crude oil carried by rail increased 423% between 2011 and 2012, and the volume moving by barge, on inland waterways as well as along intracoastal routes, increased by 53%. The volume of crude oil shipped by truck rose 38% between 2011 and 2012.

Rail transportation cost is perhaps $5 to $10 per barrel higher than pipeline costs.

Given the uncertainty about the future value of the oil and the longevity of the deposits, it is not certain that investors will undertake construction of pipelines from the Bakken fields to the East Coast. In that case, large volumes of crude could be transported by rail well into the future.

Rail has also been critical to development of Canadian oil sands. Although the vast majority of crude oil imports from Canada are delivered via existing pipeline, imports by rail are estimated to have increased from 1.6 million barrels in 2011 to 40 million barrels in 2013.

A significant fall-off in railroad coal movements has increased railroads’ capacity to transport oil over some routes. In 2013, railroads carried about 395,000 more tank cars of crude than in 2005, but about 1.3 million fewer cars of coal. To put the increase in crude traffic in perspective, crude oil represented less than 1% of total rail carloads in 2012. In the first three quarters of 2013, crude carloads increased to 1.4% of total rail car loadings. While, on a national scale, increased rail car loadings of crude oil represent a relatively small percentage of total traffic, significant increases in traffic in a specific area can cause bottlenecks that can reverberate across the entire rail network.

The STB held a hearing in April 2014 to hear complaints from non-oil shippers concerning poor rail service in the upper Midwest due to oil traffic and the severe winter weather. The STB ordered BNSF and CP railroads to report how they intended to ensure delivery of fertilizer to farmers in spring 2014. At the hearing, BNSF (the railroad most directly serving the Bakken region) noted that its car loadings in North Dakota had more than doubled from 2009 to 2013, and that in October 2013, crude oil and agricultural car loadings surged by more than it could manage.

One hindrance to the expansion of crude-by-rail has been the lack of tank cars and loading and unloading infrastructure. Much of this investment is being made by the oil industry or by rail equipment leasing companies, not railroads. As of April 2014, manufacturers had 50,000 crude oil tank cars on order, on top of an existing fleet of 43,000. (This is in addition to 30,000 tank cars that carry ethanol and 27,000 that carry other flammable liquids.

Tank trucks operating on U.S. roadways have been an important link in moving crude oil from domestic drilling sites to pipelines and rail terminals. A typical tank truck can hold 200 to 250 barrels of crude oil. Trucks readily serve the need for gathering product, as the hydraulic fracturing method of drilling employed in tight oil production involves multiple drilling sites in an area and the location of active wells is constantly in flux. A large volume of crude oil is being transported by truck between production areas and refineries in Texas because of the close proximity of the two.

While there are about 57,000 miles of crude oil pipeline in the United States, there are nearly 140,000 miles of railroad

The U.S. Dept of Transportation, Bureau of Transportation Statistics only goes up to 2009 in Table 1-61: Crude Oil and Petroleum Products Transported in the United States by Mode

2009 Combined crude and petroleum products by ton-mile, percent carried by: Pipelines (70.2), ships and barges (23.1), trucks (4.2), railroads (2.6)

Pick Your Poison For Crude — Pipeline, Rail, Truck Or Boat

by James Conca April 26, 2014 Forbes

In the U.S., 70% of crude oil and petroleum products are shipped by pipeline. 23% of oil shipments are on tankers and barges over water. Trucking only accounts for 4% of shipments, and rail for a mere 3%.

Amid a North American energy boom and a lack of pipeline capacity, crude oil shipping on rail is suddenly increasing. The trains are getting bigger and towing more and more tanker cars.

With the number of refineries decreasing, and capacity concentrating in fewer places, crude usually has to be moved some distance. There are 4 ways to move it over long distances: by pipeline, by boat, by truck, or by rail.

It’s cheaper and quicker to transport by pipeline than by rail or by truck. The difference in cost is about $50 billion a year for shipping via the Keystone pipeline versus rail.

A rail tank car carries about 30,000 gallons (÷ 42 gallons/barrel = about 700 barrels). A train of 100 cars carries about 3 million gallons (70,000 barrels) and takes over 3 days to travel from Alberta to the Gulf Coast, about a million gallons per day. The Keystone will carry about 35 million gallons per day (830,000 barrels).

The Congressional Research Service estimates that transporting crude oil by pipeline is cheaper than rail, about $5/barrel versus $10 to $15/barrel (NYTimes.com). But rail is more flexible and has 140,000 miles of track in the United States compared to 57,000 miles of crude oil pipelines. Building rail terminals to handle loading and unloading is a lot cheaper, and less of a hassle, than building and permitting pipelines.

Rail. If crude oil shipping on rail is becoming a preferred mode for oil producers in our North American energy boom, this trend is very disturbing. In 2011, crude rail capacity between southern Alberta and the northern U.S. Great Plains tripled to about 300,000 barrels per day, about a third of the Keystone XL capacity. U.S. railroads delivered 7 million barrels of crude in 2008, 46 million in 2011, 163 million in 2012, and 262 million in 2013 (almost as much as that anticipated by the Keystone XL alone). To replace the Keystone XL with rail shipments would mean another doubling of rail capacity, but that would be just another couple of years given this trend.

The Association of American Railroads points out that over 11 billion gallons of crude were shipped in 2013.

Truck. The issue with trucking is that it takes lots and lots of trucks to move billions of gallons of crude since a single tank trailer only holds about 9,000 gallons or 200 barrels, a little under a third of a rail car. Our present fleet only handles 4% of our needs, so shipping by truck instead of the Keystone XL would take another 1.5 million tanker trucks.

Refineries

Crude is a nasty material, very destructive when it spills into the environment, and very toxic when it contacts humans or animals. It’s not even useful for energy, or anything else, until it’s chemically processed, or refined, into suitable products like naphtha, gasoline, heating oil, kerosene, asphaltics, mineral spirits, natural gas liquids, and a host of others.

U.S. Refinery Capacity by PADD (Petroleum Administration for Defense Districts) in 2012.

Every crude oil has different properties, such as sulfur content (sweet to sour) or density (light to heavy), and requires a specific chemical processing facility to handle it (Permian Basin Oil&Gas). Different crudes produce different amounts and types of products, sometimes leading to a glut in one or more of them, like too much natural gas liquids that drops their price dramatically, or not enough heating oil that raises their price.

As an example, the second largest refinery in the United States, Marathon Oil’s GaryVille Louisiana facility, can handle over 520,000 barrels a day (bpd) of heavy sour crude from places like Mexico and Canada but can’t handle sweet domestic crude from New Mexico.

Thus the reason for the Keystone Pipeline or increased rail transport – to get heavy tar sand crude to refineries along the Gulf Coast than can handle it.

The last entirely new petroleum refinery in the United States opened in 1976 (Congressional Research Service). Since then, the number of refineries has steadily declined while refining capacity has concentrated in ever-larger facilities. 25% of U.S. capacity is found in only eleven refineries. Recently, Shell’s Baytown refinery in Texas, the largest in the nation, was expanded to 600,000 bpd. Most of the big refineries can handle heavy crude, but many smaller refineries can process only light to intermediate crude oil, most of which originates within the U.S.

33 states have refineries, and most refineries can handle tens-of-thousands to hundreds-of-thousands of barrels per day, but the largest capacity sits around the Gulf Coast and in California where the oil boom in America began. However, in the 1990s after production of sweet domestic crude had significantly declined from mid-century highs, the big companies like Exxon, Shell, CITCO and Valero spent billions upon billion of dollars to retool their refineries to handle foreign heavy crudes.

What is important to note, however, is that regardless of the long-hauling mode, most petroleum eventually gets onto a truck for the short moves.

Ship

Ship transport is possible along coastal waters and along large rivers and is the method that is used for almost all foreign imports except from Canada.