Many of the countries the U.S. depends on for oil and petroleum products have corrupt governments at varying levels, crime problems and face civil unrest. Whether initiated by al-Quida in Iraq, militant groups in Nigeria or armed rebels along the Columbia-Venezuela and also the Columbia-Ecuador border, attacks on the oil and gas industry can cripple and cause major economic damage. The United States spends a tremendous amount of time and money to secure our oil and counter the threats that disseminate throughout the global supply chain.

The U.S. receives nearly 60 percent of its oil and petroleum imports via tanker, according to a 2011 report from the American Petroleum Institute. Many of the tankers arriving in U.S. ports carry crude oil and petroleum from Mexico, Saudi Arabia, Venezuela and Nigeria. Threats to production in these crucial supplier countries – whether from natural disaster, crime, or terrorist or cyber attacks – threaten both the global supply chain and the Unites States’ access to oil.

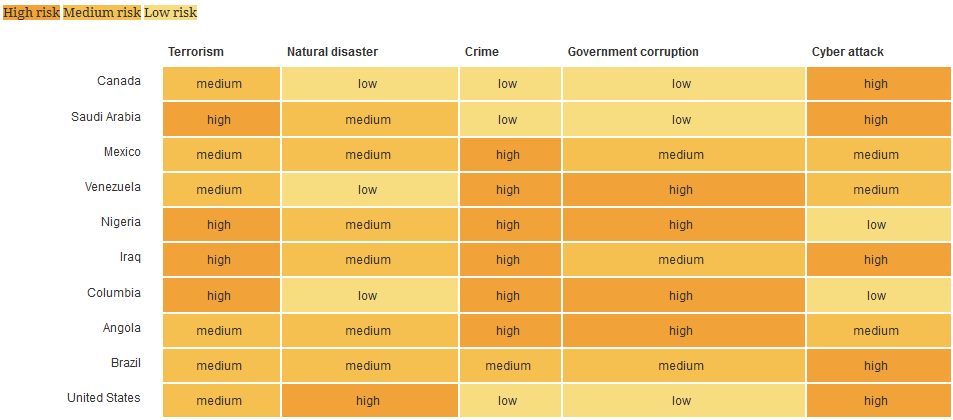

Top exporters to the U.S. A look at some of the major threats to the U.S. oil supply today:

Canada is by far the largest supplier of foreign oil to the United States, accounting for approximately 25% of U.S. crude oil imports in 2011. The majority of Canada’s estimated 180 billion barrels of oil reserves come to the U.S. via pipeline from the oil or tar sands in Alberta’s Athabasca region. “If you have a 2,000-mile pipeline from Canada to Texas, you simply cannot protect the entire pipeline“. – Paul Rosenzweig, former deputy assistant secretary for policy, Department of Homeland Security

Mexico. The United States imported roughly 1.1 million barrels of crude oil per day from Mexico in 2011, making it the third largest net exporter of oil to the United States. Almost all of Mexico’s exports arrive in the U.S. by oil tanker. “The national pipeline network [is practically taken over] by organized crime gangs, associated with heavily armed groups.” – Petroleos Mexicanos, or PEMEX, the Mexican state-owned petroleum company, August 2012

Saudi Arabia. Oil powerhouse Saudi Arabia is still the hub of the global oil market, although its importance as a supplier to the U.S. has declined in recent years. In terms of infrastructure, Saudi Arabia is a unique case because of the concentration of a lot of oil – five or six million barrels per day – running through only a few facilities each day. “Abqaiq or Ras Tanura is what Wall Street is for the financial system. What Hollywood would be for the movie industry.” – Gal Luft, Institute for the Analysis of Global Security and author of several books on oil security

Venezuela boasts the second largest oil reserves in the world, but many of the country’s fields require heavy investment to maintain production capacity. Turmoil within the country – opposition to socialist policies touted by former President Hugo Chávez, civil unrest and high crime rates, especially along the Venezuela-Colombia border – discourage foreign investment and consequently pose a challenge to the country’s profit-driving oil industry.

Nigeria. Militant groups seeking a share of Nigeria’s oil wealth – such as the Movement for the Emancipation of the Niger Delta, or MEND – repeatedly attack the country’s oil infrastructure and personnel. Since 2005, when Nigeria reached its oil production peak, the county has seen a steep increase in pipeline vandalism, kidnappings and militant takeovers of oil facilities in the Niger Delta, the heart of Nigerian oil production. “There has been attacks on oil pipelines, and foreign oil workers are being held hostage… this escalating attack is also helping drive up oil prices.” – Testimony of economist George N. N. Ayittey, U.S. House of Representatives hearing, “Nigeria’s Struggle with Corruption,” 2006