Preface. It’s the energy stupid! These figures clearly show a link between energy and the economy. Conventional economic theory has to ignore energy or that would prove that there are Limits to Growth. What follows is from Nafeez Ahmed’s 2017 book “Failing States, Collapsing Systems BioPhysical Triggers of Political Violence, Springer.

Alice Friedemann www.energyskeptic.com Author of Life After Fossil Fuels: A Reality Check on Alternative Energy; When Trucks Stop Running: Energy and the Future of Transportation”, Barriers to Making Algal Biofuels, & “Crunch! Whole Grain Artisan Chips and Crackers”. Women in ecology Podcasts: WGBH, Jore, Planet: Critical, Crazy Town, Collapse Chronicles, Derrick Jensen, Practical Prepping, Kunstler 253 &278, Peak Prosperity, Index of best energyskeptic posts

***

Ahmed, Nafeez. 2017. Failing States, Collapsing Systems BioPhysical Triggers of Political Violence. Springer.

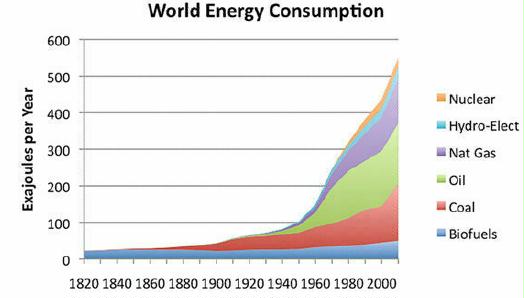

An issue largely overlooked within conventional economic theory is that all economic systems are fundamentally physical systems in which energy is transmitted and converted into different forms, in compliance with the second law of thermodynamics—and in which depletion must take place with respect to non-renewable energy resources due to the conservation of matter and energy.

Economic theory does not recognize that the laws of physics provide any meaningful constraint on the capacity of economies to grow continuously by forever increasing their material throughput. While there is scope to recognize that economic systems manifest “emergent properties” with their own distinctive rules, patterns and structures, that does not mean that these rules can be trivially deduced from—or break—the laws of physics. Rather, as with any complex system, the macro-structures emerge from but still operate within those laws. This means that however “emergent” the macro-structures of economics appear to be, they can never be free of the second law of thermodynamics (Pueyo 2014 ).

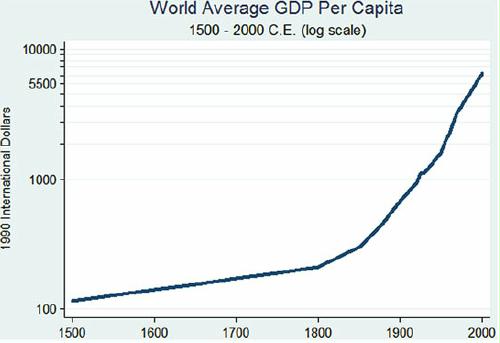

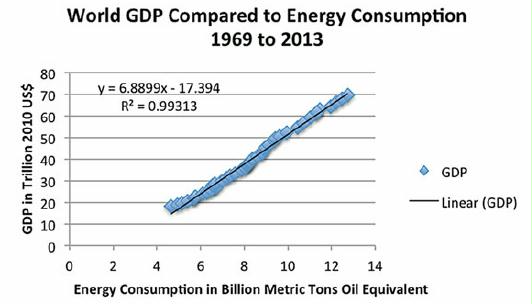

Thus, the direct correlation between economic growth and the growth of energy consumption is because economic growth is fundamentally dependent on and enabled by energy.

Human population, the global economy, and energy production have all “grown exponentially”, yet energy still “imposes fundamental constraints on economic growth and development.

Why we appear to still be growing and why this will eventually lead to violence

Despite the empirical evidence for such conclusions, “these perspectives have not been incorporated into mainstream economic theory, practice, or pedagogy…” (J. H. Brown et al. 2011).

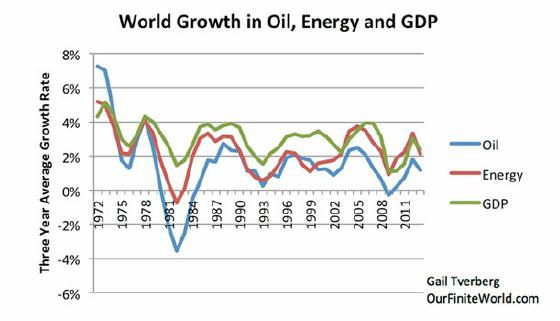

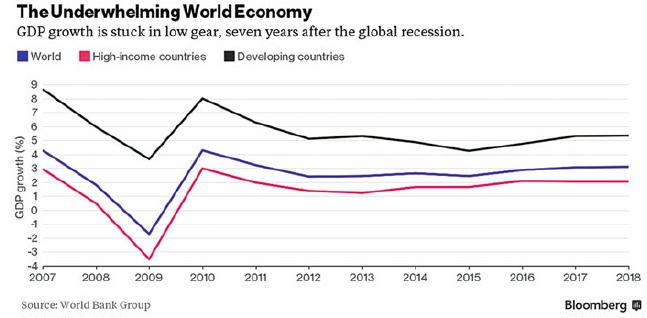

As a result, conventional economists failed to anticipate the 2008 global financial crisis, and since then have consistently failed to anticipate the major economic crises in ensuing years, while consistently and incorrectly forecasting returns to economic growth. In reality economic growth on a global scale is experiencing an unmistakable plateau, that correlates clearly with the emerging plateau in energy production (Fig. 4.4).

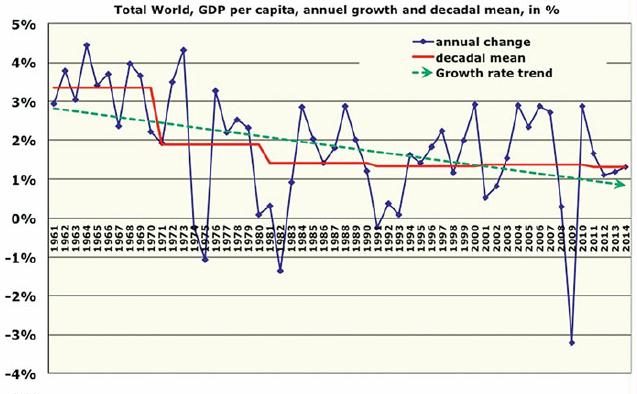

According to Jancovici, since the 1960s—which is when the EROI of the global fossil fuel system as a whole was at its highest according to most studies: “…the growth rate of the GDP per capita (world average) has been slowly—and constantly— decreasing…” (Jancovici 2013 ). In the decade after 1960, he calculates, GDP was increasing at +3.5 % per year. For the decade after 1970, this rate of increase dropped to +2 % per year. Over the last three decades, the rate of GDP growth dropped to +1.5 % per year. And in the period following the 2007–8 fi nancial crash up to 2012, it has dropped even further to 0.4 % per year on average (Fig. 4.5).

The steady decline in the rate of GDP growth thus correlates directly with the steady decline in EROI of production from the global fossil fuel resource base, even as energy production has continued to increase. However, as energy production has slowed down over the last decade since 2005—accompanying the shift to lower quality unconventional liquids—now approaching an undulating plateau, so too has GDP growth.

Consider this revealing diagram produced by Bloomberg, which illustrates how World Bank data confirms not only that economic growth is plateauing, but that it is likely to continue plateauing for the foreseeable future (Fig. 4.6)

Economic growth, to the extent that it has been able to continue, is being driven largely by an increasing availability of cheap credit—rather than any fundamental and permanent transformations in energy intensity. The ratio of global debt, excluding financial institutions, has grown from 175% of global GDP on the eve of the 2007/2008 financial crisis to 210% today. Cheap credit has enabled excessive borrowing, risk taking and sharply rising asset prices, driving the same form of unsustainable debt- driven growth that partly led to the 2008 financial crash (Stewart 2015).

Growth, especially since the 1970s, has been premised increasingly on the financialization of the economy through the creation of new instruments of credit creation to permit extensive leveraging.

Such debt-driven growth, however, only offsets the apparent biophysical limits to growth by accelerating debt and socializing the costs in the event of a financial crisis onto general consumers, while protecting the financial institutions most responsible for debt-generation. In the energy sector, as oil prices have slumped, growth has increasingly been driven by debt. Oil majors ExxonMobil, Royal Dutch Shell, BP, and Chevron hold a combined net debt of $184 billion, more than double their 2014 debt levels (Williams and Olson 2016).

Global industrial civilization is thus facing a convergence of crises: the plateauing of energy production and the plateauing of economic growth, amidst an inexorable decline in EROI.

While the abundance of cheap fossil fuels played the key role in permitting the expansion of the monetary and financial system—enabling exponential economic growth—from the 1950s onwards, the accelerating reduction in EROI has accompanied an increasing reliance on financialization: the shift from the expansion of money, to the expansion of credit (debt-money). Beginning concertedly in the 1970s, this has been most exemplified in the US Federal Reserve’s post-2008 rubber-stamping of quantitative easing to use money printing or credit creation (debt-money expansionism) as a mechanism to offset economic crises and bailout insolvent banks endangered by mass consumer defaults. The policy’s fiscal twin is austerity—clamping down on state expenditures in the form of public spending on infrastructure, education, health care and other forms of critical social investments and public services, while using state power to protect ongoing debt-based profiteering in the corporate-financial sectors (Smith-Nonini 2016).

The neoliberal era, with its policies of extreme deregulation, debt-money expansionism and harsh national austerity, is thus a direct product of the changing dynamics of the global energy system and the transition into a world of more expensive, lower quality, and environmentally more destructive fossil fuels. As the ‘triple crunch’ tightens from now to mid-century, this forces the global economy as a whole into adopting a limited range of policies to address the dampening of growth underpinned by geophysical realities.

Within a framework that continues to be wedded to the idea that business-as-usual must continue —one tied into protecting the vested interests whose tremendous power remains embedded within the unequal structures of the prevailing geopolitical, economic and energy order— the only options are to rely excessively on debt-money expansionism to shore-up dying industries in the fossil fuel and financial sectors, while intensifying austerity so as to socialize the costs of this onto the wider public, while privatizing the ‘benefits’ in terms of profits

Those profits, however, will accrue to an ever tightening circle of financial and corporate institutions as more and more of the energy- financial incumbency are squeezed out under the weight of their own unsustainability. The escalation of national austerity policies cannot be sustained for long without increasingly debilitating impacts on the health and well-being of wider publics. This means that phenomena such as the 2008 Occupy movement and the 2011 Arab Spring were not just historical blips that may or may not occur again, but represented major breaking points in the system due to populations feeling unable to adjust to intolerable conditions imposed by escalating global systemic crises. Such breaking points, then, represent a taste of things to come.

The 2008 global financial crisis was partly triggered by the oil price hikes that year, which were driven by the plateau in conventional oil production since 2005. High prices fed into inflation and undermined the capacity of consumers to service their mortgage debts, thus playing a key role in the ensuing spate of defaults (Ahmed 2010).

Economic growth, to the extent that it has been able to continue, is being driven largely by an increasing availability of cheap credit—rather than any fundamental and permanent transformations in energy intensity. The ratio of global debt, excluding financial institutions, has grown from 175 % of global GDP on the eve of the 2007/2008 financial crisis to 210% today. Cheap credit has enabled excessive borrowing, risk taking and sharply rising asset prices, driving the same form of unsustainable debt driven growth that partly led to the 2008 financial crash (Stewart 2015 ).

3 Responses to Conventional economic theory ignores the laws of physics