[ Of note from this U.S. House 2011 hearing:

John Hofmeister, former President of Shell Oil. Matt Simmons, who passed away this past summer, used to speak of the Straits of Hormuz as, we live one day away from an oil Pearl Harbor [because the] Straits of Hormuz transport between 20% and 25% of daily consumption of global oil, and were they to be shut in, the world would be in a panic overnight if it were not possible to pass oil… The immediate impact on crude oil prices would … double or even triple the current crude oil price… it is such a critical pinch point and so much of that oil goes both east and west that it is not only energy security for the United States, it is energy security for the world’s second largest economy, China. And so the consequence would be dramatic.

While it is great to have a million new vehicles hybrids and battery cars on the roads by 2015, 250 million automobiles and tens of millions of trucks, tractors, planes, boats, buses and other vehicles depend upon a daily supply of crude oil.

[And] we should not forget that within that 20-million-barrel-per-day demand is a petrochemical industry that needs crude oil as feedstock [to produce] the fiber [in] our clothing, pharmaceuticals, lubricants, and the food that we use to eat in this country.

Edward J. Markey, Massachusetts. Yesterday, this subcommittee held a hearing on Republican legislation that will bar EPA from doing anything further to reduce oil use from cars, trucks, planes, boats or any other source. The legislation might even nullify the progress that has already been made at the EPA in reducing demand for oil from cars and trucks … The Republican bill could result in an increase in our oil dependence of more than 5 million barrels a day by the year 2030, more than we currently import from OPEC [yet] … here we are holding a hearing on the effect of Middle East unrest on the oil market as though the Republican legislation that will dramatically increase our dependence on Middle Eastern oil didn’t even exist.

Mrs. Lois Capps. California… rejected the Koch Brothers’ attempt to remove all the clean air regulations in California by voting down Proposition 23. We hear from the majority today that the way to reduce our dependence on foreign oil is to drill our way out of the problem. … I think we know that is not true by a long shot. There is no way we could produce enough to meet our needs domestically. If we had adopted … efficiency standards for our vehicles, homes and appliances in the 1990s [which Democrats and a few Republicans tried to do], we may not have found ourselves in the situation we are in today.

Mr. Pete Olson, Texas. I think you believe as I do that we have to develop all the oil and gas resources that God has given our country. That means the East Coast, the Gulf Coast, the West Coast, Alaska, the public lands, wherever it is, we need to develop that oil.

John Sullivan, Oklahoma. We have the resources to drill at home and the American people deserve an affordable national energy policy that takes advantage of the fact that we have more energy within our borders than our nation will ever need or want.

Alice Friedemann www.energyskeptic.com author of “When Trucks Stop Running: Energy and the Future of Transportation”, 2015, Springer and “Crunch! Whole Grain Artisan Chips and Crackers”. Podcasts: KunstlerCast 253, KunstlerCast278, Peak Prosperity]

House 112-4. February 10, 2011. The effects of Middle East events on U.S. Energy markets. House of Representatives, subcommittee on energy and power 112th congress. 231 pages

Excerpts:

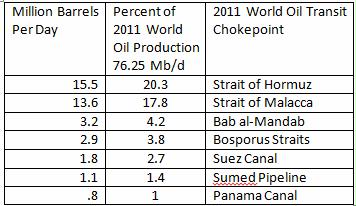

Source: EIA (data estimates based on APEX tanker data) from House 112-4. February 10, 2011. The effects of middle east events on U.S. Energy markets. House of Representatives hearing

ED WHITFIELD, KENTUCKY. We convene today’s hearing to have a discussion on recent developments in the Middle East and North Africa and their effect on world energy markets.

Violent protests and political uncertainty in Egypt 2 weeks ago caused a sudden spike in oil prices that, over the past few days, has gradually subsided. The price increase was driven by investor fears over the possible shutdown of the Suez Canal and Su-Med Pipeline, which transport up to 3 million barrels of oil per day. Events in the Middle East [show that] political events can play a major role in influencing the price of oil. Half the world’s oil is produced in OPEC member states and Russia. Some of these nations are politically and economically unstable, and in a tightening market, unreliable sources of oil will prove increasingly detrimental to price stability and international security. Events in Tunisia, Egypt, Jordan, Algeria and Yemen show how uncertain and dangerous this world is. Furthermore, these developments show how the price of oil can bend to the will of protesters thousands of miles away from our shores.

The National Petroleum Council estimates we have upwards of 40 billion barrels of oil locked away in the eastern Gulf of Mexico, Atlantic and Pacific Coasts, on- and offshore Alaska, that are currently off-limits for production.

These 40 billion barrels are double the proven reserves in the United States today. These resources could easily double our domestic production capacity and replace our imports from the Middle East.

Failing to produce domestic energy guarantees environmental harm elsewhere in the world.

John Hofmeister, former President of Shell Oil. With respect to the choke points, the 3 most serious are the Suez Canal, the Hormuz Straits, which is separating Iran from Yemen— I am sorry—Oman and Iran, and the Straits of Malacca, which is between Malaysia and Indonesia. These choke points carry enormous amounts of crude oil. Matt Simmons, who passed away this past summer, used to speak of the Straits of Hormuz as, we live one day away from an oil Pearl Harbor [because the] Straits of Hormuz transport between 20% and 25% of daily consumption of global oil, and were they to be shut in, the world would be in a panic overnight if it were not possible to pass oil….The immediate impact on crude oil prices would … double or even triple the current crude oil price… it is such a critical pinch point and so much of that oil goes both east and west that it is not only energy security for the United States, it is energy security for the world’s second largest economy, China. And so the consequence would be dramatic.

The decline in the Gulf of Mexico I believe will be sharper and deeper than what anyone is currently projecting because the decline rate from existing wells, particularly deep water, fall off naturally very quickly, and the reason we had 34 rigs drilling in the Gulf of Mexico was not so much to increase the rate of production but to sustain the rate of production in the Gulf of Mexico. While there may have been some increase, absent drilling, we have made a horrible error as a country. The rest of the world did not discontinue offshore drilling.

Every consumer in this country uses crude oil in one way or another, and we do face the political uncertainties as evidenced most recently by Egypt and the threat to the Suez Canal and the Sumed pipeline. I am reminded that while this Administration has strangled oil production in the Gulf of Mexico for an unpredictable period, China, according to Professor Wenren Jang at the University of Alberta, is going in exactly the opposite direction.

China is planning to build 1.5 million kilometers of highways over the coming decade, and in order to assure a steady crude oil supply to China has loaned the following countries the following amounts of money:

- Brazil, $10 billion

- Kazakhstan, $10 billion

- Venezuela, $20 billion

- Ghana, $16 billion

- Democratic Republican of Congo, $7 billion

- Nigeria, $23 billion

- Russia, $25 billion

China expects crude oil demand of 18 million barrels a day by the end of the decade. They are currently at about nine. Meanwhile, in the United States, today, tomorrow, Saturday, Sunday, Monday, we will consume about 20 million barrels a day, producing only seven domestically.

As long as the United States produces so limited amount of its own supply, we are vulnerable to whatever happens anywhere in the world. The United States forfeited its energy security over a sustained period of decades by prohibiting drilling on 85% of the Outer Continental Shelf, by prohibiting drilling on 97% of federal land, by standing the way of many infrastructure developments that would otherwise enable enhanced oil production in many parts of old oil fields. While people focus on transportation and the use of oil, we should not forget that within that 20-million-barrel-per-day demand, there is an entire petrochemical industry that needs crude oil as feedstock. That petrochemical industry produces the fiber which we use for clothing and other industrial purposes. It produces the pharmaceuticals, the lubricants, the food that we use to eat in this country. We have many more needs for oil than simply transportation purposes. While it is great to have a million new vehicles hybrids and battery cars on the roads by 2015, the 250 million automobiles and tens of millions of trucks, tractors, planes, boats, buses and other transportation vehicles depend upon a daily supply of crude oil.

BOBBY RUSH, ILLINOIS. Energy supply and demand are key components to the American economy. They all affect all dimensions of our lives from driving to work, feeding our families to heating and cooling our homes. Notwithstanding energy’s fundamental important, the markets and exchanges on which are energy sources are traded remains extremely volatile and unpredictable. I think I can safely say that a consistent theme we will be hearing throughout this morning is that it is in America’s best strategic and economic interests to become less and less dependent on foreign oil, gas and other fossil fuels in as short a time frame as possible.

The Obama Administration understands this perfectly well, which is why it has set the ambitious goals of, one, putting 1 million electric automobiles on America’s streets and highways and into America’s families’ garages and parking lots by 2012; 2), unleashing a clean energy revolution to double the supply of renewable energy by the end of 2012; 3), doubling America’s exports by the end of 2015; and 4), dramatically decreasing American dependence on traditional fossil fuels so that by 2035 approximately 80% of America’s electricity is sourced by renewables.

Our dependency as individuals, families and businesses on imported energy sources is still far too great.

Today’s hearing should not be used, Mr. Chairman, to criticize EPA’s permitting process to build refineries or to sanction more domestic drilling. In case you have forgotten, let me remind you that EPA’s mission, as it name indicates, is to protect the American environment and the country that we inherit. Mr. Chairman, I want to thank you

John Shimkus, Illinois. I am an Obama skeptic when it comes to energy security. We have the resources available in North American energy supplies to be energy independent when we talk about North American.

HENRY A. WAXMAN, CALIFORNIA. The recent events in Egypt have once again exposed our dependence on foreign oil. Although Egypt isn’t a major producer of oil, the Suez Canal and the Suez-Mediterranean pipeline are crucial shipping links for global oil and gas markets. Instability there has increased oil prices around the world. For decades, the Energy Information Administration projected that U.S. oil consumption would grow year after year, and it did. By 2005, nearly 60% of U.S. fuels were imported. And the future looked bleak: higher oil consumption and more imports far into the future. The solution offered by the Bush Administration was to drill out way out of the problem, and I know we are going to hear this proposed solution again today. We will hear that increased domestic production is the answer. But more U.S. production is never going to be enough to appreciably reduce global oil prices or U.S. imports of foreign oil. We use 25% of the world’s oil but we only have 2% of the world’s oil reserves. So we can double it and we could even triple it, and it is simply not going to affect global oil prices much. The key to making progress is to focus on how much oil we use. Reducing our share of global oil consumption from 25% can have a real impact both on global oil prices and on imports.

As the second chart shows, by requiring improvements in how efficiently we use oil, the Administration has reversed a dangerous trend. The Administration wants to build on this success with stronger standards after model year 2016. And it is also working on standards for trucks and other commercial vehicles. These standards could save even more money at the pump while further reducing our dependence on foreign oil. Incredibly, the new Republican majority in Congress is opposed to these efforts. Chairman Upton and Senator Inhofe have proposed legislation to block EPA from setting new motor vehicle standards.

We need to use oil more efficiently so that we can import less of it, but the Upton-Inhofe bill would take us in exactly the wrong direction. It would block one policy that has proven that it works. The Upton-Inhofe bill is great for oil companies like Koch Industries, which spent millions of dollars electing Republicans. But it is a public health, economic and national security disaster for all the rest of us.

RICHARD G. NEWELL, PH.D., Administrator, Energy Information Administration. Given Egypt’s small role in the global supply-demand balance for both oil and natural gas, the primary issue for global energy markets is driven by two other concerns. First, there is the concern that unrest could spread to countries with a larger role in supplying world oil markets. There is no doubt that the Middle East and North Africa are a major source of oil supply and other petroleum liquids, supplying about 28% of global liquids consumption.

The EIA has looked at a concern more directly related to Egypt involving the possibility of disruption of the Suez Canal or Sumed pipeline, which together carry about 3 million barrels a day of oil. The canal and pipeline continue to operate normally, and for reasons outlined in my written testimony, we would expect the direct effect of any closures to be manageable, although there would be undoubtedly an adjustment period.

Mr. POMPEO. Dr. Newell, in your analysis, there is the theory of peak oil.

Mr. NEWELL. We are projecting an increase in both U.S. domestic production of crude oil in the next 25 years as well as a significant increase internationally in crude oil, so we at this point in time, for the next 25 years, which is how far our projection goes out, we don’t see a peaking of world oil production capacity.

Gary Mar, Minister- Counselor, government of Alberta, Canada. For the past 5 years, Canada has and continues to be the largest supplier of imported oil to the United States. In 2009, Canada supplied 23% of America’s oil imports, more than double the imports that come from Saudi Arabia and more than four times the imported oil that comes from Iraq. The lion’s share of Canada’s exports comes from Alberta’s oil sands. If you look at Alberta in isolation, we provide 17% of your total crude oil imports, and that is in volume 1.5 million barrels of oil per day that comes to you from Alberta in a transportation system that doesn’t move called a pipeline.

I should talk about the overall size of the resource of the oil that is in place in Alberta in the oil sands. It is roughly 1.7 trillion barrels of oil of which with current technology and prices about 10% of it is accessible, so roughly 170 billion barrels. So there is certainly ample room to move up our production to the 3.3 million barrels a day. It is a very realistic target. In terms of the policies of Alberta, there are policies in place to recognize that the upfront costs of developing oil sands are very, very high. There are no exploratory costs to speak of really because we know exactly where it is, but there are enormous costs upfront in terms of capital investment that is required by private sector investment to do that. The government policy permits those who will invest to pay royalties only after payout from their original investment and so that is really the only incentive that is the strongest incentive that the government puts in place to ensure that there is purchases of land leases to develop oil sands.

Chris Busch, Policy and Program Director for the Apollo Alliance. We are a national alliance of labor, business, environmental, and community groups working towards clean energy solutions that also grow the economy and improve American competitiveness.

Every president since Nixon has sought to lessen our dependency on imported oil. Though we have started to turn the corner thanks to policies like the 2010 clean car standards, America still faces this challenge. Nearly 60% of U.S. demand is now met by imported oil. The United States accounts for 22% of the world’s oil consumption but we only possess 1.4% of the world’s proven reserves. Those numbers are slightly different than Mr. Waxman’s but those are according to the EIA’s 2009 data. These numbers tell a simple truth. No matter how deep we will, domestic oil supplies cannot solve this problem. We must put in place policies to address the demand side of the problem.

We have experienced six significant price shocks in the past 40 years. We all remember oil nearing $150 per barrel in 2008. Oil price shocks have been a reality of world oil markets, and surging demand from China and other countries suggests they will become more common, not less.

CHRIS JOHN, Chairman of Louisiana Mid-Continent Oil and Gas Association. I represent all of the companies that explore, produce, market, transfer from the ground to the tank, and the fact of the matter is, when we look at energy policy in this country, it cannot be an either/or. The fact of the matter is, we need all drops and all kinds of energy to make America more energy secure. But I think the real factor, the factor that we must keep in focus like a rifle shot as we debate some of these is the energy reality that we have in this country. I think it is very important not to deviate from it because we can talk about assumptions and we can talk about politics and we can look at it from a geographical standpoint. The fact of the matter is that you must be grounded in our conversations about the energy reality in this country, and that is what I would like to spend a little bit of my time on.

The fact of the matter is that 78%—the energy reality today, not tomorrow, not yesterday, but today is that 78% of our fuel needs, our energy needs is going to come from fossil fuels, 78% from fossil fuels. You will have 12% from nuclear, you will have 3% from hybrid, 1% from wind, a half a percent from solar and then it goes down from there. I think that is an important point as we discuss the future of energy policy in this country because even DOE says that 60% of our energy needs over the next 25 years is going to come from fossil fuels. There have been experts that obviously have said higher than that, and I believe it is closer to 80% for the next 50 years that fossil fuels are going to play a very important part in providing energy security for America.

With respect to the choke points, the 3 most serious are the Suez Canal, the Hormuz Straits, which is separating Iran from Oman and Iran, and the Straits of Malacca, which is between Malaysia and Indonesia. These choke points carry enormous amounts of crude oil. Matt Simmons, who passed away this past summer, used to speak of the Straits of Hormuz as, we live one day away from an oil Pearl Harbor. In other words, those Straits of Hormuz transport between 20 and 25% of daily consumption of global oil, and were they to be shut in, the world would be in a panic overnight if it were not possible to pass oil.

The production curve of what is in the Gulf and what can be produced in the Gulf shows somewhat of a decline. However, it is important to understand that you just don’t turn the switch on and off. In a deep water project where you have a billion-dollar piece of equipment in a floating drill ship from start to finish, by the time you actually lease the property until you explore, then produce, pipeline and it gets into the market is somewhere in the 2- to 5-year range. In fact, the deep water Macondo well, the lease sale of that piece of property was in 2008, so that was a 2-year span and they weren’t in production.

The bottom line is, we can’t afford to not improve the fuel economy standards of the vehicles which we drive. That is our number one weapon against the Middle East. That is where we are teaching them a lesson. That is President Kennedy telling Khrushchev we are putting a man on the moon in 10 years and bringing him back, you are not controlling outer space, we are using our technology to dominate you. That is our message to the Middle East. They have 70% of the oil reserves in the world, the Middle East. We cannot beat them at that game with only 3% of the oil reserves. It is irresponsible to talk about basically tying the hands of the EPA to improve our ability to make ourselves efficient to back out this oil from the Middle East, and next week’s vote if we have it will be a historical one.

There are 33 drill ships. There are 240 people per drill ship that work, full-time equivalent. If you multiply that out, that is about 38,000 people whose job is at risk today. Now, 6 drilling ships are gone, and those drill ships, as I mentioned earlier, a billion-dollar piece of equipment, you don’t just move them one day in an area of the world and move them back 6 months later. They are gone for 3 years to 5 years because that is the contractual obligations that they are insisting on having. Those drill ships are $400,000 a day, a day rate. That is how much they were getting. Some of the companies now negotiated a day rate below 100. How long can they stay? I think we are getting towards the end of that. I think that you see that we have got 27 drill ships that are idled right now kind of waiting to see, but at some point in time, two of which are already in the middle of negotiations, that are going to leave, and when they leave, it is 5 years, and it is about 2,000 jobs per drill ship when you multiply the factor of 4.1 to each job that is created.

Mr. Jay Inslee, Washington. I wanted to explore with Dr. Newell whether or not substantially increased opening of federal lands would have an impact on the price of fuel at the pump, and I want to read your agency’s evaluation of this issue. It is a study called Impact of Limitations on Access to Oil and Natural Gas Resources in the Federal Outer Continental Shelf. It is a study in 2009. Now, a lot of folks would think if we just open up the spigot off the Outer Continental Shelf and other places, problem solved on prices. I want to read what your agency concluded after looking at it. You concluded: ‘‘The average price of imported low-sulfur crude oil in 2030 in 2007 dollars is $1.34 per barrel higher and the average U.S. price of motor gasoline price is 3 cents per gallon higher than in the reference case.’’ Now, as I understand what you are saying, when you looked at this issue and really looked at the economics of this issue, your agency concluded that if we essentially removed all federal restrictions on Outer Continental Shelf drilling. In 2030, after everything had been exploited to the extent the human mind can consider, the price would be 3 cents different in 2030. Now, that is pretty stunning because a lot of people, particularly on the other side of the aisle, figure we will just solve this cost problem by just opening up the spigot everywhere in the United States including Yellowstone National Park and the Mall. But your conclusion seems to suggest that there is a negligible, almost infinitesimal difference of we do that in price. Now, my understanding would be the reason for your conclusion is essentially it is a world market for oil, and since we have such a small amount of the world market at 3% top of the world market, we are not to affect the cost very much no matter where we drill in the United States, Outer Continental Shelf, Arctic, you name it. Secondly, there is a phenomenon that every time we increase our drilling OPEC can decrease theirs to maintain the price that they desire because that is where the oil is in the world. Now, are those the primary reasons that you concluded there would be a negligible, if almost infinitesimal, difference of price or are there others that I have not alluded to?

Mr. NEWELL. I think you have captured some of the main factors that would come into play in analyzing that kind of question. In the previous analyses that EIA has done, the magnitude of increased production that tends to be associated with some of these actions is measured in the hundreds of thousands of barrels per day, which is a significant magnitude, but in the global scheme of things, it tends to be significantly less than 1% of global oil supply and so therefore in terms of global impacts on price, it tends to be small.

Mr. Edward J. Markey, Massachusetts. Yesterday, this subcommittee held a hearing on Republican legislation that will bar EPA from doing anything further to reduce oil use from cars, trucks, planes, boats or any other source. The legislation might even nullify the progress that has already been made at the EPA in reducing demand for oil from cars and trucks and through the development of homegrown renewable fuels. The Republican bill could result in an increase in our oil dependence of more than 5 million barrels a day by the year 2030, more than we currently import from OPEC [yet] … here we are holding a hearing on the effect of Middle East unrest on the oil market as though the Republican legislation that will dramatically increase our dependence on Middle Eastern oil didn’t even exist. It reminds me a lot of when Monsignor O’Malley used to go up into the pulpit on Sunday and lecture to the congregation that on Wednesday in the church hall, Father Ganney will lecture on the evils of gambling; on Thursday night in the church hall, bingo. Well, yesterday we are lectured on the evils of the EPA. Today, bingo, Egypt, bingo, Iraq, Iran, Tunisia, bingo, bingo, bingo, bingo. So let me ask each of you. Let us go down the list and I would like a yes or no on whether or not you feel it is important for us to stop $162 billion a year going to OPEC, going to Middle Eastern countries that are paid for by American consumers at $90 a barrel so that we are not subsidizing religious fanaticism in Saudi Arabia, we are not subsidizing rockets being constructed in Iran that are then used by Hezbollah and Hamas against Israel and against our country.

Mrs. Lois Capps. California, where do have a strong labor movement, rejected the Koch Brothers’ attempt to remove all the clean air regulations that we have in California by voting down Proposition 23 in the last election. We hear from the majority today that the way to reduce our dependence on foreign oil is to drill our way out of the problem. … I think we know in our country that that is not true by a long shot. We use so much oil in this country. I think it is actually too precious to waste on energy because of the other products that oil can offer us, lifesaving products. There is no way we could produce enough to meet our needs domestically. If we had adopted what many of us on this side on the dais and some on the other side as well had called for in the 1990s like efficiency standards for our vehicles, homes and appliances, we may not have found ourselves in the situation we are in today. Dr. Busch, the Republican Majority also claims that taking action to reduce carbon pollution would be too expensive, but that is not what you found when you looked at the demand side, and that is what I want to ask you about today. You and your colleagues examined the effects of California’s clean energy law, which will lead to the adoption of more-efficient vehicles and lower carbon fuels. California’s standards will reduce the amount of oil used by cars. Dr. Busch, what impact on oil demand in imports did California’s measures have?

Mr. Busch. Well, we actually built on the analysis of the California Air Resources Board, and so using their numbers, we found that AB 32 policies would lead to a reduction of 75 million barrels per year. About an 18% reduction is the forecasted reduction.

Mrs. Capps. And that is going to save California a little money? About how much?

Mr. Busch. At $114.50 per barrel, that is about $11 billion reduction in the import bill.

Mr. Pete Olson, Texas. I want to talk about national security and the Middle East. I think you believe as I do that we have to develop all the oil and gas resources that God has given our country. That means the East Coast, the Gulf Coast, the West Coast, Alaska, the public lands, wherever it is, we need to develop that oil. We are very vulnerable geographically particularly with these Straits of Hormuz and with the Suez Canal where most of the oil that our country depends upon flows through, and I was in the Navy for 10 years, flew P-3s and did many, many patrols through the Straits of Hormuz, and it is a very, very, very narrow choke point, about 10, 15 miles wide at its widest, and when we flew through there, we had devices on our aircraft that we were being tracked by fire control radar from the Iranians, and I can guarantee you that they are doing that with the tankers that are coming through. I mean, if they want to cause big, big trouble for the world, take out a tanker right there in the middle of the straits and cut off the whole Persian Gulf to traffic. And so, my point here, we are depending right now—we have got two very unstable nations, Egypt with what is going on there internally and Iran with a leadership who doesn’t live on this planet.

FRED UPTON, Michigan, Chairman.

- Oil and turmoil coexist in several regions, most significantly the Middle East. The unfolding events in Egypt, coming on the heels of similar unrest in Tunisia and other Middle Eastern and North African nations, is of great importance to us for a number of reasons, but today’s hearing will focus on the implications for the global oil market.

- Events in that part of the world can disrupt oil production, or in the case of Egypt, jeopardize the transport of that oil to end users. The stronger the global demand for oil, and the smaller the cushion provided by spare capacity, the more likely any actual or threatened disruption of supplies will destabilize markets and elevate prices.

- It’s simply a reality that the Middle East will remain volatile. Today it is Egypt, tomorrow it may be Iran or Saudi Arabia. Every few months will bring incidents of minor and sometimes major concern. How to deal with this instability is an ongoing challenge.

JOHN SULLIVAN, Oklahoma. I am concerned with the political unrest in North Africa and the Middle East. From Friday January 28th to Monday January 31st the price of crude oil futures suddenly jumped 6% on the security fears of the Suez Canal which is considered a world oil chokepoint due to the volume of oil traveling through such a narrow route and the Sumed pipeline in Egypt. These events prove once again that our nation’s dependence on OPEC oil is a national and economic security issue. We import 5 million barrels of oil per day from OPEC but yet we continue to restrict domestic oil resources in our country, yet the simple fact is we live in a hydrocarbon economy and we will be one for long into the future. We have the resources to drill at home and the American people deserve an affordable national energy policy that takes advantage of the fact that we have more energy within our borders than our nation will ever need or want.

My concern today is that the U.S. does not have a backup for our demand. We are at the mercy of unstable countries like Yemen, and now, potentially Egypt. If their economies fail, or worse, fail and fall into the hands of terrorists, our energy supply fails as well. The US imports over half of what it consumes, so if Egypt collapses and terrorist forces take hold, they may very well decide to restrict access to the Suez Canal, for example. We are then talking about a severe disruption in the oil supply. Rising prices, which we are experiencing today due to the crisis in Egypt, will be the least of our concerns when the wrong people control the energy supply. Demand for oil and gas is not going away.