David J. Murphy and Charles A. S. Hall. 2011.

Energy return on investment, peak oil, and the end of economic growth

in “Ecological Economics Reviews.” Robert Costanza, Karin Limburg & Ida Kubiszewski, Eds. Annals of the New York Academy of Sciences 1219: 52–72.

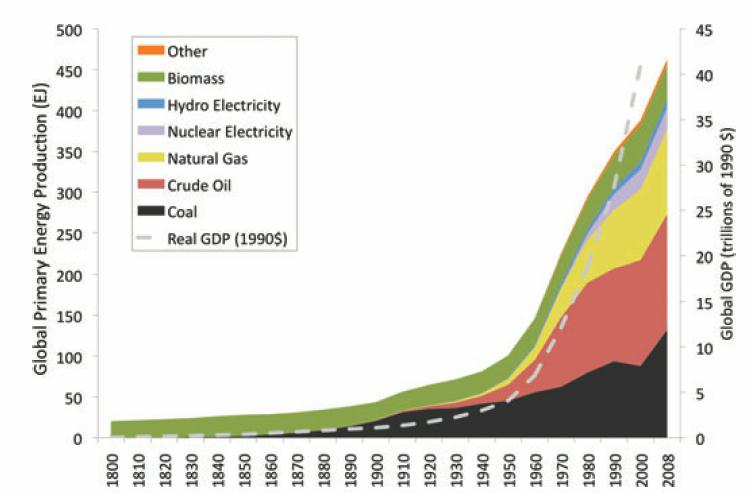

[I’ve rearranged, cut out large chunks, left out most of the charts and graphs, and sometimes paraphrased this very important paper, read the original if you have time for a complete understanding of the model presented. Notice how closely GDP (dashed line) matches energy production below in Figure 1. Energy production and GDP for the world from 1830 to 2000. Data from Kremmer and Smil. 5,6]

Economic growth over the past 40 years has used increasing quantities of fossil energy, and most importantly oil. Yet, our ability to increase the global supply of conventional crude oil much beyond current levels is doubtful, which may pose a problem for continued economic growth. Our research indicates that, due to the depletion of conventional, and hence cheap, crude oil supplies (i.e., peak oil), increasing the supply of oil in the future would require exploiting lower quality resources (i.e., expensive), and thus could occur only at high prices.

This creates feedbacks that can be described as an economic growth paradox: increasing the oil supply to support economic growth will require high oil prices that will undermine that economic growth.

From this we conclude that the economic growth of the past 40 years is unlikely to continue in the long term unless there is some remarkable change in how we manage our economy.

Historically, economic growth has been highly correlated with increases in oil consumption, and, aside from a few short supply interruptions, oil supplies have kept pace with growing demand. As a result, real gross domestic product (GDP) tripled in value while oil consumption grew by 40% from 1970 through 2008. Unfortunately, the oil world of today is much different from the oil world over the past 40 years. Numerous analyses offer evidence that we consider quite convincing that global society is entering the era of peak oil,a that is, the era in which conventional oil supply is unable to increase significantly and will eventually begin to decline.1–3

Oil, more than any other energy source, is vital to economies because of its ubiquitous application as fuels and feedstocks in manufacturing and industrial production, as well as in transportation.

The main conclusions of this paper are:

- over the past 40 years, economic growth has required increasing oil production

- the supply of high EROI oil cannot increase much beyond current levels for a prolonged period of time

- the average global EROI of oil production will almost certainly continue to decline as we search for new sources of oil in the only places we have left—deep water, arctic, and other hostile environments

- we have globally roughly 20–30 years of conventional oil remaining at current rates of consumption and current EROIs, and even less if oil consumption increases and/or EROI decreases

- increasing oil supply in the future will require a higher oil price because mostly only high-cost resources remain to be discovered

- using oil-based economic growth as a solution to recessions is untenable in the long term, as both the gross and net supplies of oil has or will begin, at some point, an irreversible decline

Other points made in this paper:

For the economy of the United States and almost every other nation, the prospects for future, oil-based economic growth are bleak. Maintaining the status quo of growth economics based on an oil energy base is simply not possible for more than a decade or two at most, presuming that trade lines and international politics remain amenable. For the United States, which is currently in the deepest recession since the Great Depression, it seems highly unlikely that oil production can increase enough, for a long enough period of time, to grow the economy from this recession, let alone any future recessions. Furthermore, even if oil production can increase in the near term, the price of oil needed to maintain that production will be high enough on its own to incite a recession. Taken together, it seems clear that the economic growth of the past 40 years will not continue for the next 40 years.

The model also ignores the increasingly important and intricate role that debt accumulation has in the greater energy economy [my comment: which I assume means that a financial system crash would make credit dry up and new energy production projects impossible].

Figure 17 shows a range of dates before exponential decline begins until 2020, after that, and perhaps before, decline will begin.

Energy and Business cycles

Since 1970, spikes in the price of oil have been a root cause of most recessions. For example, in 1973, precipitated by the Arab Oil Embargo, the price of oil jumped from $3 to $12 a barrel (bbl) in a matter of months, creating the largest recession thereto since the Great Depression. The price spike had at least four immediate effects within the economy: (1) oil consumption declined, (2) a large proportion of capital stocks and existing technology became too expensive to use, (3) the marginal cost of production increased for nearly every manufactured good, and (4) the cost of transportation fuels increased.4 On the other hand, expansionary periods tend to be associated with the opposite oil signature: prolonged periods of relatively low oil prices that increase aggregate demand and lower marginal production costs, all leading to, or at least associated with, economic growth.

Numerous theories attempting to explain business cycles have been posited over the past century, each offering a unique explanation for the causes of—and solutions to—recessions, including Keynesian theory, the Monetarist model, the Rational Expectations model, Real Business Cycle models, New (Neo-) Keynesian models, etc.4 Yet, for all the differences among these theories, they all share one implicit assumption: a return to a growing economy, that is, growing GDP, is in fact possible.Historically, there has been no reason to question this assumption, as GDP, incomes, and most other measures of economic growth have in fact grown steadily over the past century. But ifwe are entering an era of peak oil, then for the first time in history wemay be asked to grow the economy while simultaneously decreasing oil consumption, something that has yet to occur within the United States since the discovery of oil.

The objectives of this review are to

- examine the degree to which abundant and inexpensive oil is integral to economic growth, and how the future supply of that oil is in jeopardy;

- the discourse on peak oil and provide what we believe is both novel and compelling evidence indicating that society is indeed in the era of peak oil;

- the discourse on net energy and discuss how searching for new sources of oil may decrease the amount of net energy provided to society and also exacerbate the effects of oil depletion on the economy;

- how peak oil and net energy indicate that increasing oil supply will require high oil prices in the future.

Economic growth and business cycles from an energy perspective

Economic growth, from an energy perspective, has many of the same characteristics as the fundamental growth process that every living creature, species, and population on earth undertakes during their lifetime. Energy is captured by a system (the economy or a creature) and allocated first to the maintenance (metabolism) of the system and then, if there is energy remaining, to growth and/or reproduction. For example, each of us must ingest enough food during the growth phases of life to pay not only for our metabolism but also to convert some of the additional food into bone, connective tissue, etc., which is used to grow the body or create offspring. Likewise, the economy must acquire enough energy to pay not only for its metabolism, for example, fighting depreciation of existing capital, but also to pay for the construction of replacement or, sometimes, new capital. The important point here is that the construction of new capital, that is, economic growth, requires the input of “net” energy, which is the energy beyond that required for metabolic purposes.

By extension, for the economy to grow over time there must be an increase in the flow of net energy and materials through the economy. Quite simply, economic production is a work process, and work requires energy. This logic is an extension of the laws of thermodynamics,which state that (1) energy cannot be created nor destroyed, and (2) energy is degraded during any work process so that the initial inventory can do less work.As Daly and Farley describe, the first law places a theoretical limit on the supply of goods and services that the economy can provide, and the second law sets a limit on the practical availability of matter and energy.5 In other words, the laws of thermodynamics state that to produce goods and services, energy must be used, and once this energy is used it is degraded to a point where it can no longer be reused to power the same process again. Thus to increase production over time, that is, to grow the economy, we must either increase the energy supply or increase the efficiency with which we use our source energy.

This energy-based theory of economic growth is supported by data: the consumption of every major energy source has increased with GDP since the mid-1800s (Fig. 1). Throughout this growth period, however, there have been numerous oscillations between periods of growth and recessions. Recessions are defined by the Bureau of Economic Research as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”10 From 1970 until 2007, there have been five recessions within the United States, and examining these recessions from an energy perspective elucidates a common mechanism underlying recent business cycles: oil consumption tends to be higher during expansions and lower during recessions, and prices tend to be lower during expansions and higher during recessions.

There are a myriad of publications on the topic of whether or not energy consumption causes economic growth.11 Unfortunately, the literature is confounding, due mainly to two issues: energy quality and substitution effects. Energy quality refers to many things, but in the economic sense energy quality pertains mainly to the utility of a fuel, which is a combination of its transportability, storability, energy density, etc. Consequently, the utility of a fuel is reflected in its price, which is why the price per energy unit of coal is much lower than the price per energy unit of electricity, that is, electricity is deemed to have a higher quality. Yet despite this difference in quality, most energy-economic analyses assume that a BTU of coal has the same economic utility as a BTU of electricity. Consequently, the substitution of high-quality energy sources, such as electricity, for low-quality energy sources, such as coal, is often missed.12

Our analysis indicates that about 50% of the changes in economic growth over the past 40 years are explained by the changes in oil consumption alone. In addition, the work by Cleveland et al.12 indicates that changes in oil consumption cause changes in economic growth, or that economic growth is bound by the energy available. These two points support the idea that energy consumption, and oil consumption in particular, is of the utmost importance for economic growth.

Yet, oil consumption is rarely used by neoclassical economists as a means of explaining economic growth.

Thus, we present the hypothesis that higher oil prices and lower oil consumption are indicative of recessions. Likewise, economic growth requires maintaining lower oil prices while simultaneously increasing oil supply. The data support these hypotheses: the inflation-adjusted price of oil averaged across all expansionary years from 1970 to 2008 was $37/bbl compared to $58/bbl averaged across recessionary years, whereas oil consumption grew by 2% on average per year during expansionary years compared to decreasing by 3% per year during recessionary years.

Although this analysis of recessions and expansions may seem like simple economics, that is, high prices lead to low demand and low prices lead to high demand, the exact mechanism connecting energy, economic growth, and business cycles is a bit more complicated. Hall et al. and Murphy and Hall state that when energy prices increase, expenditures are reallocated from areas that had previously added to GDP, mainly discretionary consumption, toward paying for more expensive energy.15,16 In this way, higher energy prices lead to recessions by diverting money from the economy toward energy only. The data show that major recessions seem to occur when energy expenditures as a percentage of GDP climb above a threshold of roughly 5.5% (Fig. 5). It is worth noting, however, that this relation did not hold for the smaller recessions of the early 1990s and 2000s. This is probably a result of the fact that the cost of oil is only one of the many possible causes of—and solutions to—recessions.

What are the implications for economic growth if (1) oil supplies are unable to increase with demand, or (2) oil supplies increase but at an increased price?

Oil is a nonrenewable resource and its supply will, at some point, decline. “Peak oil” refers to the time period when global oil production reaches a maximum rate and then begins to decline–the point at which the world will transition from an expansionist industrial era, characterized by indefinitely expanding oil consumption, to an era defined by declining supplies of oil and all those things we do with oil. Peak oil represents a major problem for the U.S. (and most) economies, as it indicates that oil supplies cannot increase with economic expansion in the long term.

It is not only the quantity of oil that is important, but the cost of that oil. It is our ability to find, develop, and produce that oil for a reasonable energy and hence monetary cost that makes it so useful. Net energy is defined as the amount of energy remaining after the energy costs of getting and concentrating that energy are subtracted.19 The economy gains zero net energy if we have to use just as much energy to develop a resource as we will garner from producing that resource.

Clearly, energy resources that produce a high level of net energy are considered to be of higher value than those that produce a small amount of net energy.

[Large snip of explanation of Hubbert’s peak and evidence of declining oil production]. Most of the easy-to-find and easy-to-produce oil has already been found and produced.3 Global oil discoveries peaked during the 1960s and have declined steadily since. In addition to finding less oil, new discoveries are located increasingly in areas that are geologically harder to produce, such as deep offshore areas. Discoveries in deepwater areas increased from under 10% of total discoveries in 1990 to nearly 60% by 2005. These three lines of evidence suggest that society is entering the era of peak oil. Note, we are simply stating that the evidence indicates that oil supplies were constrained from 2004 to 2008, and that the most likely explanation is that the supply of conventional crude oil is nearing (or possibly past) its peak. Other explanations for the constraint in oil supply from 2004 to 2008 is a lack of investment in infrastructure from the oil industry, but we could not find much evidence to support his claim, especially considering the large investments made into the oil sands and deepwater exploration during this period.

Peak Oil Deniers — a Rebuttal

Technology only delays the inevitable

Even if technology enables us to extract more oil than expected, this would only delay the issue of peak oil, not change it. Bartlett calculates that for every additional billion barrels of oil we find beyond two trillion barrels delays the peak in global oil production by only 5.5 days. 24

Discovery of new oil fields has declined since 1948

But we can’t get enhanced recovery or produce more oil from fields we can’t find. Global discoveries have been in a steady decline since the peak in 1948 despite advances in technology. Others argue that as the price of oil increases, known sources of oil that were previously too expensive to develop will become economical. To some extent this is true: oil sand development in Canada, for example, is expensive and economically feasible at high oil prices only. However, the oil sands are not conventional oil sources and are not new discoveries, and are already incorporated into many models of future oil supply. 3

There is no alternative energy that can replace oil

There is no substitute for conventional oil that is of the same quantity, quality, and available for the same price.

The closest substitutes for conventional oil currently in large-scale production are the oil sands of Canada and biofuels, produced mainly from corn and sugarcane. The oil sands present a vast amount of potential energy, but it is in a less accessible form than conventional oil. The oil sands must be heated and refined just to form crude oil and then refined further to form the various crude oil derivatives. Estimates from Cambridge Energy Research Associates show that the cost of production for the oil sands is roughly $85/bbl,which is more than double the average price of oil during expansionary periods ($37/bbl).38 The usual assumption is that the oil sands will be rate limited, not resource limited, because of their large demands for water and natural gas and their large environmental impacts.3 So, even though there are large amounts of potential energy, production of oil sands cannot be increased enough to offset a large decline in conventional oil production.

Biofuels have zero net energy: as much energy to produce as they deliver

Biofuels are recent plant material that has been converted through some combination of chemical and/or thermal processes into a liquid fuel. The main fuel products from these processes are biodiesel, or more commonly ethanol. There are many reasons why alcohols do not produce as good fuel as gasoline, and we present here two. (1) the energy density of ethanol is only about two-thirds that of gasoline. (2) the energy contained within the biofuel product is nearly the same as the energy used to produce the biofuel–roughly zero net energy to society.39–43 Oil produces roughly 18 units of energy per unit invested, and gasoline roughly 10 units per unit invested.44,45 Therefore gasoline and biofuels are imperfect substitutes and place doubt on their ability to replace oil.

It takes a very long time to construct the infrastructure to move from one source of primary energy to another

Marchetti analyzed the time it took global society to transition from wood to coal and subsequently from coal to oil and found that it takes about a century for society to increase its adoption of a primary energy substitute from 1% to 50% of market capacity.46 Thus, even if society adopts alternative energy quickly, it will still take decades to substitute for just half of the oil use in the world.

Hirsch et al. came to a similar conclusion when examining the specific strategies that the United States might take to mitigate its oil dependence.47 They examined numerous, large-scale methods by which the United States could substitute for conventional oil, including: (1) conservation—implementing higher efficiency energy equipment, that is, high mileage automobiles; (2) gas-to-liquids; (3) fuel switching to electricity; and (4) coal liquefaction. Their main conclusion is that “waiting until world oil production peaks before taking crash program action leaves the world with a significant liquid fuel deficit for more than two decades”(p. 59).47

The True Value of Energy to Society is the Net Energy

[snip of explanation of EROI vs net energy]

A shift from easy-to-access oil to hard-to-access oil is changing the net energy delivered to society and how this may exacerbate the effects of peak oil on economic growth.

Gagnon et al. report that the EROI for global oil extraction declined from 36:1 in the 1990s to 18:1 in 2008.44 This downward trend results from at least two factors: First, increasingly supplies of oil originate from sources that are inherently more energy intensive to produce, simply because firms develop cheaper resources before expensive ones. For example, in 1990 only 2% but by 2005 60% of discoveries were located in ultra-deepwater locations (Fig. 10).

Enhanced oil recovery techniques increase production short term, but significantly increase the energy used in production, offsetting much of the energy gain for society

Enhanced oil recovery techniques are being implemented increasingly in the world’s largest conventional oil fields. For example, nitrogen injection was initiated in the once super giant Cantarell field in Mexico in 2000, which boosted production for 4 years, but since 2004, production from the field has declined precipitously.

Summary of net energy. The EROI for global oil production is declining, so maintaining the flow of net energy to society given declining EROIs will require an increase in the extraction of gross energy, accelerating the depletion of oil. This means that it will be very difficult to offset peak oil by finding and developing new, low EROI fields because new fields must produce enough oil to not only match the depletion of the existing field stock but also to overcome the decline in EROI.

We have anywhere between 20 and 30 years of conventional oil remaining at current levels of consumption

Or less if China, India, or the 200,000 new people born every day increases consumption.

Peak oil, net energy, and oil price

Low EROI oil indicates that there will be high oil prices in the future. Forecasting the price of oil, however, is a much more difficult endeavor as oil price depends, in theory, on the supply and demand for oil at a given moment in time. What we can examine with some accuracy is the cost of production of various sources of oil, in order to calculate the price at which different types of oil resources become economical. In theory, if the price of oil is below the cost of production, then most producers will cease operation. If we examine the cost of production in the areas in which we are currently discovering oil, hence the areas that will provide the future supply of oil, we can calculate a theoretical floor price below which an increase in oil supply is unlikely.

Roughly 60% of the oil discoveries in 2005 were in deepwater locations. Based on estimates from CERA,38 and the cost of developing that oil is between $60 and $85/bbl, so oil prices must be over $60/bbl to support the development of even the best deepwater resources. The average price of oil during recessionary periods has been $57/bbl, so it seems that increasing oil production in the future will occur only at recessionary prices. All of this indicates that an expensive oil future is necessary if we are to produce the remaining oil resources, and, as a consequence, the economic growth witnessed by the United States and globe over the past 40 years will be difficult to realize in the future.

Since EROI is a measure of the efficiency with which we use energy to extract energy resources from the environment, it can be used as a rough proxy to estimate whether the cost of production of a particular resource will be high or low. For example, the oil sands have an EROI of roughly 3:1, whereas the production of conventional crude oil has an average EROI of 18:1. The production costs for oil sands are roughly $85/bbl compared to $20/bbl for Saudi Arabian conventional crude.38 Therefore, as oil production continues, we can expect the cost of oil extraction to increase.

Read the full article here:

Energy return on investment, peak oil, and the end of economic growth

References

1. Deffeyes, K.S. 2001. Hubbert’s Peak: The Impending World Oil Shortage. Princeton University Press. New Jersey.

2. Campbell, C.J. 1997. The Coming Oil Crisis. Multi-Science Publishing Company and Petroconsultants. Essex, UK.

3. Campbell, C.J. & J.H. Laherrere. 1998. The end of cheap oil. Sci. Am. 278: 78–83.

4. Knoop, T.A. 2010. Recessions andDepressions:Understanding Business Cycles. Praeger. Santa Barbara, CA.

5. Kremmer. 2010. Historic population and GDP data. http://www.historicalstatistics.org/ (accessed November 24, 2010).

6. Smil, V. 2010. Energy Transitions: History, Requirements, Prospects. Praeger. Santa Barbara, CA.

7. Federal, R. 2009. St. Louis Federal Reserve. http:// research.stlouisfed.org/fred2/series/CPIAUCNS (accessed March 15, 2009).

8. Hayward, T. 2010. BP Statistical Review of World Energy. British Petroleum. London, UK.

9. Daly, H.E. & J. Farley. 2003. Ecological Economics: Principles and Applications. Island Press.Washington, DC.

10. NBER. 2010. US Business Cycle Expansions and Contractions. National Bureau of Economic Research. http://www.nber.org/cycles/cyclesmain.html (accessed July 10, 2010).

11. Karanfil, F. 2009. How many times again will we examine the energy-income nexus using a limited range of traditional econometric tools? Energy Policy 37: 1191–1194.

12. Cleveland, C.J., R.K. Kaufmann & D.I. Stern. 2000. Aggregation and the role of energy in the economy. Ecol. Econ. 32:301–317.

13. Stern, D.I. 2000. Amultivariate cointegration analysis of the role of energy in the US macroeconomy. Energy Econ. 22: 267–283.

14. Stern, D.I. 1993. Energy use and economic growth in the USA, a multivariate approach. Energy Econ. 15: 137–150.

15. Hall, C.A.S., R. Powers & W. Schoenberg. 2008. Peak oil, EROI, investments, and the economy in an uncertain future. In Biofuels, Solar and Wind as Renewable Energy Systems:

Benefits and Risks. D. Pimentel, Ed.: 109–132. Springer. The Netherlands.

16. Murphy, D.J. & C.A.S. Hall. 2010. Year in review—EROI or energy return on (energy) invested. Ann. N.Y. Acad. Sci. 1185: 102–118.

17. EIA. 2009. Energy Information Administration. http:// tonto.eia.doe.gov/dnav/pet/petÿconsÿtop.asp (accessed October 21, 2009).

18. BEA. 2009. Bureau of economic analysis. http://www. bea.gov/industry/gpotables/gpo action.cfm?anon=865 (accessed July 12, 2009).

19. Odum, H.T. 1973. Energy, ecology, and economics. Ambio 2: 220–227.

20. Hubbert, M.K. 1956. Nuclear energy and the fossil fuels. Spring Meeting of the Southern District Division of Production, San Antonio, Texas.

21. Edwards, J.D. 1997. Crude oil and alternate energy production forecasts for the twenty-first century: the end of the hydrocarbon era. Bull. Am. Assoc. Pet. Geol. 81: 1292–1305.

22. Ivanhoe, L.F. 1997. King Hubbert—updated. Colo. Sch. Mines 97: 1–8.

23. MacKenzie, J.J. 1996. Oil as a finite resource: when is global production likely to peak?World Resources Institute.Washington, DC.

24. Bartlett, A.A. 2000. An analysis of U.S. and world oil production patterns usingHubbert-style curves.Math.Geol. 32:1–17.

25. Lynch, M.C. 2002. Forecasting oil supply: theory and practice. Q. Rev. Econ. Finance 42: 373–389.

26. Lomborg,B. 2001.Running on empty. TheGuardian, August 16.

27. Heinberg, R. 2003. The Party’sOver.New Society Publishers. Gabriola Island, BC, Canada.

28. Downey, M. 2009. Oil 101.Wooden Table Press. New York.

29. Hirsch, R.L. 2008. Mitigation of maximum world oil production: shortage scenarios. Energy Policy 36: 881–889.

30. Dargay, J.M. & D. Gately. 2010. World oil demand’s shift toward faster growing and less price-responsive products and regions. Energy Policy 38: 6261–6277. 31 Harper, F. 2004. Oil Peak—A Geologist’s View. Energy Institute. London, UK.

32. Jackson, P.M. 2009. The Future of Global Oil Supply. Cambridge Energy Research Associates. Cambridge, MA.

33. Intenational Energy Agency 2009. World Energy Outlook 2009.

34. McKinsey. 2009.AvertingtheNextEnergyCrisis:TheDemand Challenge. McKinsey Global Institution. New York.

35. Barnett, H. & C. Morse. 1963. Scarcity and Growth: The Economics of Natural Resource Availability. Johns Hopkins University Press. Baltimore.

36. Nordhaus, W.D. & J. Tobin. 1973. Is growth obsolete. In TheMeasurement of Economic and Social Performance, Studies in Income and Wealth. M. Moss, Ed.: 509–532. NEBR. Cambridge, MA.

37. Solow, R.M. 1974. The economics of resources or the resources of economics. Am. Econ. Rev. 64: 1–14.

38. CERA. 2008. Ratcheting Down: Oil and the Global Credit Crisis. Cambridge Energy Research Associates. Cambridge, MA.

39. Murphy, D.J., C.A.S. Hall & B. Powers. 2011. New perspectives on the energy return on (energy) investment (EROI) of corn ethanol. Environment, Development and Sustainability 12: 179–202.

40. Farrell, A.E., R.J. Plevin, B.T. Turner, et al. 2006. Ethanol can contribute to energy and environmental goals. Science 311:506–508.

41. Hammerschlag, R. 2006. Ethanol’s energy return on investment:

a survey of the literature 1990—present. Environ. Sci. Technol. 40: 1744–1750.

42. Patzek, T. 2004. Thermodynamics of the corn-ethanol biofuel cycle. Crit. Rev. Plant Sci. 23: 519–567.

43. Pimentel, D. & T.W. Patzek. 2005. Ethanol production using corn, switchgrass, and wood; biodiesel production using soybean and sunflower. Nat. Resour. Res. 14: 65–76.

44. Gagnon, N., C.A.S. Hall & L. Brinker. 2009. A preliminary investigation of the energy return on energy invested for global oil and gas extraction. Energies 2: 490–

503.

45. Cleveland, C. 2005. Net energy from the extraction of oil and gas in the United States. Energy 30: 769–782.

46. Marchetti, C. 1977. Primary energy substitution models: on the interaction between energy and society.Technol. Forecast. Soc. Change 10: 345–356.

47. Hirsch, R.L., R. Bezdek & R. Wendling. 2005. Peaking of World Oil Production: Impacts, Mitigation, and Risk Management. SAIC.McLean, VA. pp. 1–91.

48. Giampietro, M. & K. Mayumi. 2010. Assessing the quality of alternative energy sources: energy return on investment and the metabolic pattern of societies and energy statistics. ICTA Technical Report.

49. Giampietro,M.&K.Mayumi. 2008.Complex systemsthinking and renewable energy systems. In Biofuels, Solar and Wind as Renewable Energy Systems: Benefits and Risks. D. Pimentel, Ed.: 173–214. Springer. New York.

50. Giampietro, M. & K. Mayumi. 2009. The Biofuel Delusion:

The Fallacy Behind Large-Scale Agro-Biofuels Production. Earthscan Research. London, UK.

51. Campbell, C. 2005. The dawn of the second half of the age of oil.ASPONews Letter. http://www.peakoil.ie/newsletter/479 (accessed July 7, 2010).