WSJ Gets it Wrong on “Why Peak Oil Predictions Haven’t Come True”

October 6, 2014

On Monday, September 29, the Wall Street Journal (WSJ) published a story called “Why Peak Oil Predictions Haven’t Come True.” The story is written as if there are only two possible outcomes:

- The Peak Oil version of what to expect from oil limits is correct, or

- Diminishing Returns can and are being put off by technological progress–the view of the WSJ.

It seems to me, though, that a third outcome is not only possible, but is what is actually happening.

3. Diminishing returns from oil limits are already beginning to hit, but the impacts and the expected shape of the down slope are quite different from those forecast by most Peak Oilers.

Area of Confusion

In many people’s way of thinking, the economy is separate from resources and the extraction of those resources. If we believe economists, the economy can grow indefinitely, with or without the use of resources. Clearly, with this view, the price of these resources doesn’t matter very much. If one kind of resource becomes more expensive, we can substitute other resources, once the scarce resource becomes sufficiently high-priced that the alternative makes financial sense. Incomes can rise arbitrarily high–all it takes is for each of us to pay the other higher wages. And we can fix any problem with the financial system with more money printing and more debt.

This wrong version of how our economy works has been handed down through the academic world, through our system of peer review, with each academic researcher following in the tracks of previous academic researchers. As long as new researchers follow the same wrong thinking as previous researchers, their articles will be published. Economists were especially involved in putting together this wrong world-view, but politicians helped as well. They liked the outcomes of the models the economists produced, since it made it look like the politicians, with the help of economists, were all-powerful. All the politicians needed to do was tweak the financial system, and the world economy would grow forever. There was not even a need for resources!

Peak Oilers’ Involvement

The Peak Oilers walked into a situation with this wrong world view, and started trying to fix pieces of it. One piece that was clearly wrong as the relationship between resources and the economy. Resources, especially energy resources, are needed to make any of the goods and services we buy. If those resources started reaching diminishing returns, it would be harder for the economy to grow. The economy might even shrink. Dr. Charles Hall, recently retired professor from SUNY-ESF, came up with one measure of diminishing returns–falling Energy Returned on Energy Invested (EROEI).

How would shrinkage occur? For this, Peak Oilers turned to the work of M. King Hubbert, who worked in an area of geology. He wrote about how supply of a resource might be expected to decline with diminishing returns.

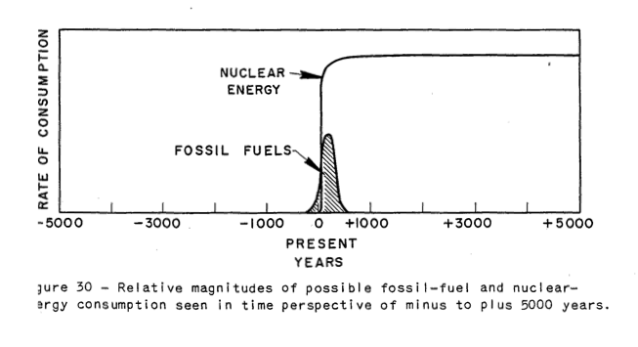

Hubbert was not concerned about what effect diminishing returns would have on the economy–presumably because that was not his area of specialization. He avoided the issue by only modeling the special case where no economic impact could be expected–the special case where a perfect substitute could be found and be put in place, in advance of the decline caused by diminishing returns.

In the example shown above, Hubbert assumes cheap nuclear would take over, before the decline in fossil fuels started. Hubbert even talked about making cheap liquid fuels using the very abundant nuclear resources, so that the system could continue as before.

In this special case, Hubbert suggested that the decline in resources might follow a symmetric curve, slowly declining in a pattern similar to its original rise in consumption, since this is the pattern that often occurs in extracting a resource in nature. Many Peak Oilers seem to believe that this pattern will happen in the more general case, where no perfect substitute is available, as well. A perfect substitute would need to be cheap, abundant, and involve essentially no cost of transition.

In the special case Hubbert modeled, Hubbert indicated that production would start to decline when approximately 50% of reserves had been exhausted. Peak Oilers often used this approach to forecast future production, and the date oil production would “peak.” As technology improved, additional oil became accessible, raising reserves. Also, as prices rose, resources that had never been economically extractible became extractible. Production continued beyond forecast peak dates, again and again.

Peak Oilers got at least part of the story right–the fact that we are in fact reaching diminishing returns with respect to oil. For this they should be commended. What they didn’t figure out is, however, is (1) how the energy-economy system really works, and (2) which pieces of the system can be expected to break first. This issue is not really the Peak Oilers fault–it is the result of starting with a very bad model of the economy and not understanding which pieces of that model needed to be fixed.

How the Economic System Really Works

We are dealing with a networked economy, one that is self-organized over time. I would represent it as a hollow network, built up of businesses, consumers, and governments.

This economic system uses energy of various kinds plus resources of many kinds to make goods and services. There are many parts to the system, including laws, taxes, and international trade. The system gradually changes and expands, with new laws replacing old ones, new customers replacing old ones, and new products replacing old ones. Growth in the number of consumers tends to lead to a need for more goods and services of all kinds.

An important part of the economy is the financial system. It connects one part of the system with another and almost magically signals when shortages are occurring, so that more of a missing product can be made, or substitutes can be developed.

Debt is part of the system as well. With increasing debt, it is possible to make use of profits that will be earned in the future, or income that will be earned in the future, to fund current investments (such as factories) and current purchases (such as cars, homes, and advanced education). This approach works fine if an economy is growing sufficiently. The additional demand created through the use of debt tends to raise the prices of commodities like oil, metals, and water, giving an economic incentive for companies to extract these items and use them in products they make.

The economy really can’t shrink to any significant extent, for several reasons:

- With rising population, there is a need for more goods and services. There is also a need for more jobs. A growing networked economy provides increasing numbers of both jobs and goods and services. A shrinking economy leads to lay-offs and fewer goods and services produced. It looks like recession.

- The networked economy automatically deletes obsolete products and re-optimizes to produce the goods needed now. For example, buggy whip manufacturers are pretty rare today. Thus, we can’t quickly go back to using horse and buggy, even if should we want to, if oil becomes scarce. There aren’t enough horses and buggies, and there aren’t enough services for cleaning up horse manure.

- The use of debt for financing depends on ever-rising future output. If the economy does shrink, or even stops growing as quickly as in the past, there tends to be a problem with debt defaults.

- If debt does start shrinking, prices of commodities like oil, gold, and even food tend to drop (similar to the situation we are seeing now). These lower prices discourage investment in creating these commodities. Ultimately, they lead to lower production and job layoffs. If deflation occurs, debt can become very difficult to repay.

Under what conditions can the economy grow? Clearly adding more people to the economy adds to growth. This can be done by adding more babies who live to maturity. It can also be done by globalization–adding groups of people who had previously only made goods and services for each other in limited quantity. As these groups get connected to the wider economy, their older, simpler ways of doing things tend to be replaced by more productive activities (involving more technology and more use of energy) and greater international trade. Of course, at some point, the number of new people who can be connected to the global economy gets to be pretty small. Growth in the world economy lessens, simply because of lessened ability to add “underdeveloped” countries to the networked economy.

Besides adding more people, it is also possible to make individual citizens “better off” by making workers more efficient at producing goods and services. Most people think of greater productivity as happening through technological changes, but to me, it really represents a combination of technological changes, plus a combination of inexpensive resources of various kinds. This combination often includes low-cost fossil fuels; abundant, cheap water supply; fertile soil; and easy to extract metal ores. Having these available makes possible the development of new tools (like new agricultural equipment, sewing machines, and vehicles), so that workers can become more productive.

Diminishing returns are what tend to “mess up” this per capita growth. With diminishing returns, fossil fuels become more expensive to extract. Water often needs to be obtained by desalination, or by much deeper wells. Soil needs more amendments, to be as fertile as in the past. Metal ores contain less and less ore, so more extraneous material needs to be extracted with the metal, and separated out. If population grows as well, there is a need for more agricultural output per acre, leading to a need for more technologically advanced techniques. Working around diminishing returns tends to make many kinds of goods and services more expensive, relative to wages.

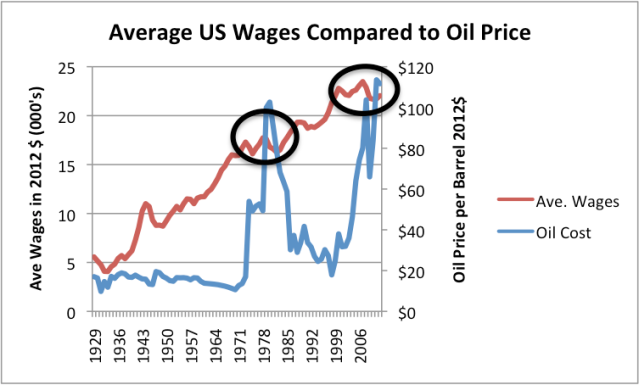

Rising commodity prices would not be a problem, if wages would rise at the same time as the price of goods and services. The problem, though, is that in some sense diminishing returns makes workers less efficient. This happens because of the need to work around problems (such as digging deeper wells and removing more extraneous material from ores). For many years, technological changes may offset the effects of diminishing returns, but at some point, technological gains can no longer keep up. When this happens, instead of wages rising, they tend to stagnate, or even decline. Figure 3 shows that per capita wages have tended to grow in the United States when oil was below about $40 or $50 barrel, but have tended to stagnate when prices are above that level.

What Effects Should We Be Expecting from Diminishing Returns With Respect to Oil Supply?

There are several expected effects of diminishing returns:

- Rising cost of extraction for oil and for other commodities subject to diminishing returns.

- Stagnating or falling wages of all except the most elite workers.

- Ultra low interest rates to try to make goods more affordable for workers stressed by stagnating wages and high prices.

- Rising governmental debt, in an attempt to stimulate the economy and in order to provide programs for the many workers without good-paying jobs.

- Increasing concern about debt defaults, as the amount of debt outstanding becomes increasingly absurd relative to wages of workers, and as all of the stimulus debt runs its course, in countries such as China.

- A two-way problem with the price of oil. On one side is recession, when oil prices rise to unaffordable levels. Economist James Hamilton has shown that 10 out of 11 post-World War II recession were associated with oil price spikes. He has also shown that there is good reason to expect that the Great Recession was related to the run-up in oil prices prior to 2007. I have written a related paper–Oil Supply Limits and the Continuing Financial Crisis.

- The second problem with the price of oil is the reverse–price of oil too low relative to the cost of extraction, because wages are not high enough to permit workers to afford the full cost of goods made with high-priced oil. This is really a problem with inadequate affordability (called inadequate demand by economists).

- Eventual collapse of whole system.

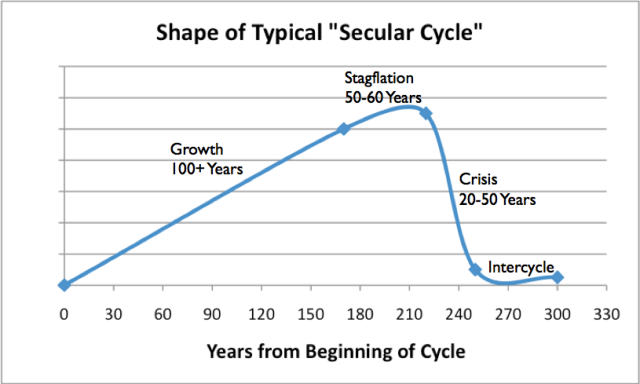

There have been many studies of collapses of past economies. These collapses tended to occur when the economies hit diminishing returns after a long period of growth. The problems were often similar to ones we are seeing today: stagnating wages of common workers and growing debt. There were more and more demands on governments to fix the problems of workers, but governments found it increasingly difficult to collect enough taxes for all the needed programs.

Eventually, the economic systems have tended to collapse, over a period of years. The shape of resource use in collapses was definitely not symmetric. Figure 4 shows my view of the typical shape of the collapses in non-fossil fuel economies, based on the work of Peter Turchin and Surgey Nefedof.

In my view, the date of the drop in oil supply will be determined by what appear to on-lookers to be financial problems. One possible cause is that the oil price will be too low for producers (a condition that is occurring now). Governments will find it unpopular to raise oil prices, but at the same time, will be powerless to stop the adverse impacts the fall in price has on world oil supply.

Falling oil prices have especially adverse effects on oil exporters, because they depend on revenues from oil to fund their programs. We are already seeing this now, with the increased warfare in the Middle East, Russia’s increased belligerence, and the problems of Venezuela. These issues will tend to reduce globalization, leading to less world growth, and a greater tendency for the world economy to shrink.

Unfortunately, there are no obvious ways of fixing our problems. High-priced substitutes for oil (that is, substitutes costing more than $40 or $50 barrel) are likely to have as adverse an impact on the economy as high-priced oil. The idea that energy prices can rise and the economy can adapt to them is based on wishful thinking.

Our networked economy cannot shrink; it tends to break instead.

Even well-intentioned attempts to reduce oil usage are likely to backfire because they tend to reduce oil prices and have other unintended effects. Furthermore, a use of oil that one person would consider frivolous (such as a vacation in Greece) represents a needed job to another person.

Should Peak Oilers Be Blamed for Missing the “Real” Oil Limits Story?

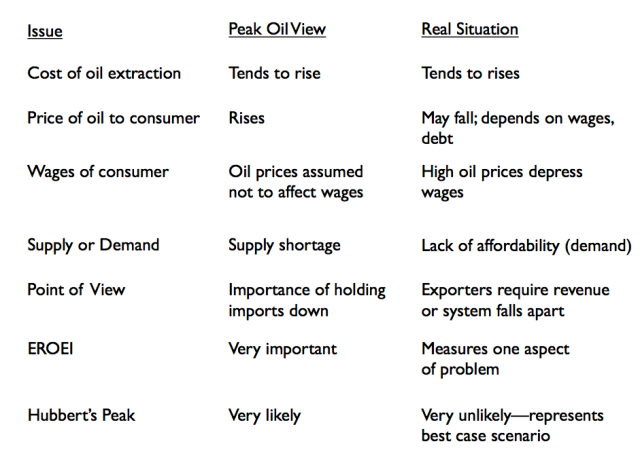

No! Peak oilers have made an important contribution, in calling the general problem of diminishing returns in oil supply to our attention. One of their big difficulties was that they started out working with a story of the economy that was very distorted. They understood how to fix parts of the story, but fixing the whole story was beyond their ability. The following chart shows a summary of some ways their views and my views differ:

One of the areas that Peak Oilers tended to miss was the fact that an oil substitute needs to be a perfect substitute–that is, be available in huge quantity, cheaply, without major substitution costs–in order not to adversely affect the economy and in order to permit the slow decline rate suggested by Hubbert’s models. Otherwise, the problems with diminishing returns remain, leading to declining wages and rising costs of making goods and services.

One temptation for Peak Oilers has been to jump on the academic bandwagon, looking for substitutes for oil. As long as Peak Oilers don’t make too many demands on substitutes–only EROEI comparisons–wind and solar PV look like they have promise.

But once a person realizes that our true need is to keep a networked economy growing, it becomes clear that such “solutions” are woefully inadequate.

We need a way of overcoming diminishing returns to keep the whole system operating. In other words, we need a way to make wages rise and the price of finished goods fall relative to wages; there is no chance that wind and solar PV are going to do this for us.