Notes from: Hirsch, R.L., 2008. Mitigation of maximum world oil production: Shortage scenarios. Energy Policy, 36(2): 881–889.

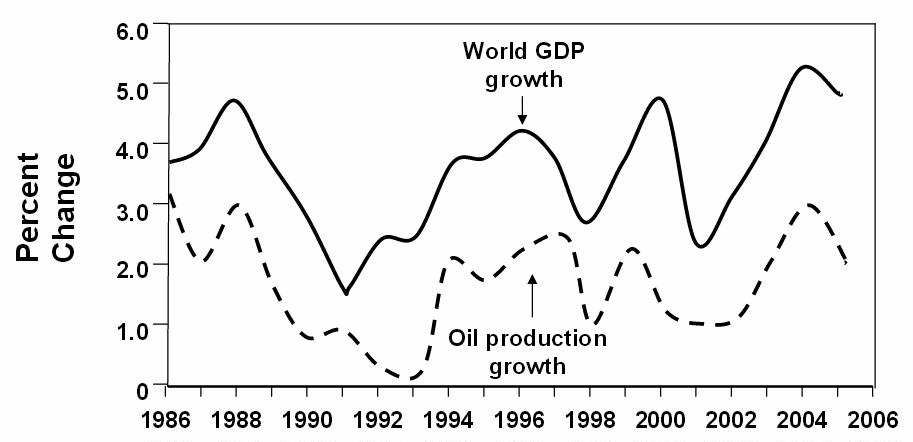

World GDP Growth & World Oil Production Growth Have Tracked For Decades:

A 1% change in current world oil production equates to over 800,000 barrels per day (bpd).

To save that level of consumption through increases in the efficiency of the world’s light duty vehicle fleet (automobiles and light trucks) would require more than a decade, assuming crash program implementation.

Production of 800,000 bpd of substitute liquid fuels would require coal-to-liquids (CTL) plants costing $100 billion and over a decade under the best of conditions.

Thus, small percentages of world oil production and demand represent large economic impacts and very large levels of mitigation hardware and investment.

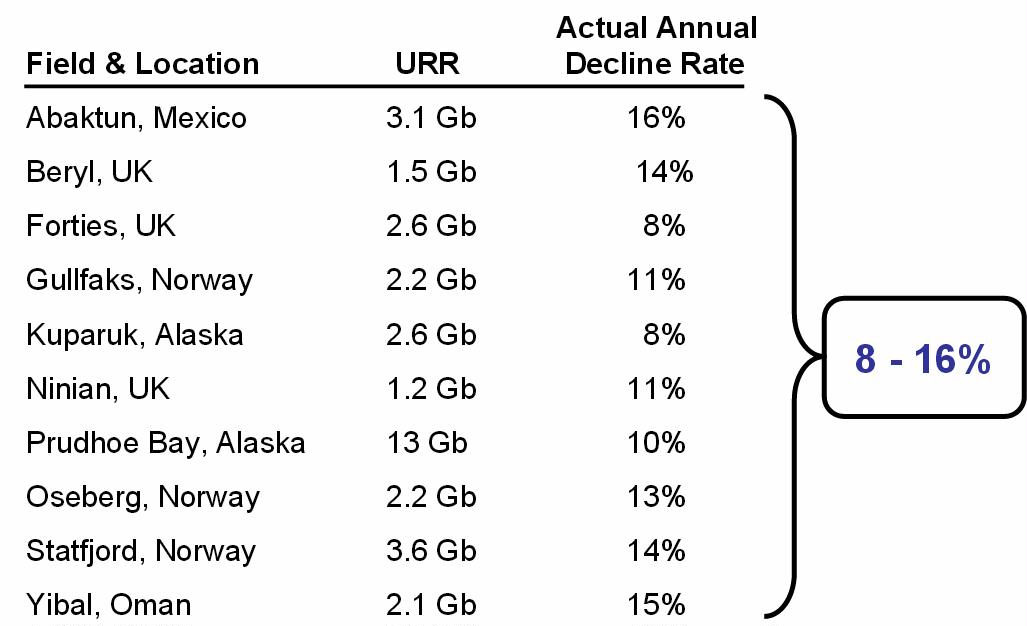

As a limiting case for decline rates, giant fields were examined, and decline rates of 8-16% were evident after plateaus in well-managed cases. Actual oil production from Europe and North America demonstrated significant periods of relatively flat oil production (plateaus). However, before entering its plateau period, North American oil production went through a sharp peak and steep decline. Examination of a number of future world oil production forecasts showed multi-year rollover / roll-down periods, which represent pseudo plateaus.

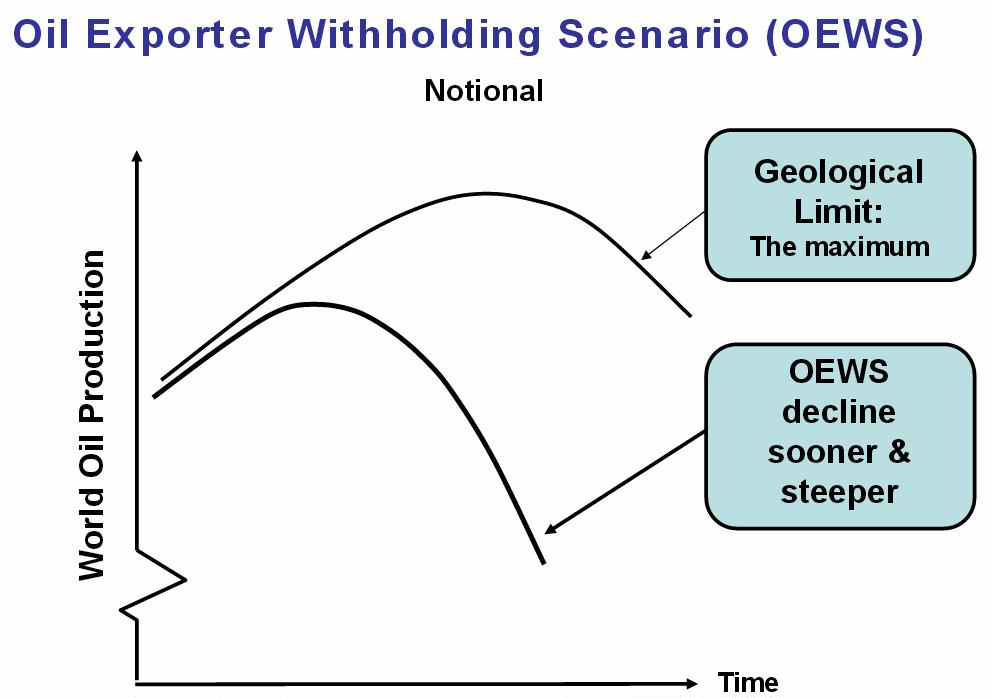

Potentially overwhelming all else, considerations of resource nationalism posits an Oil Exporter Withholding Scenario, hastening the onset of decline and exaggerating world supply decline rates.

Oil Exporter Withholding Scenario

Peak Oil & Exporter Strategies

Peak oil is not yet real to most people & countries

When realized (likely sudden), panic could cause shortages & oil prices to rise rapidly (1973 & 1979)

For oil exporters: Another large windfall

Some exporters will likely reduce exports

Less need for income due to their new windfall

Internal oil consumption rising

Realization that national oil resources are finite

Conserving for the future makes good sense

Oil Shockwave: A scenario analysis of multiyear oil supply disruptions on the U.S. economy.

- 4% global oil shortfall lead to an oil price to ~$160 / bbl.

- U.S. economy goes into recession / millions of jobs lost.

Participants: Carol Browner, Robert Gates , Richard Haass, General P.X. Kelley, Franklin Kramer , Don Nichols, Gene Sperling, Linda Stuntz & James Woolsey