[ Salameh explains why we will inevitably have oil wars in the future, perhaps wars over Iran’s nuclear program, between the U.S. and china, Iraq and Kurdistan, the UK and Argentina over the Falkland islands oil reserves, and/or over the disputed South China Sea’s islands. Salameh also lists 11 past oil wars from 1941 to 2014. I’ve excerpted less than half of this paper and taken out the footnotes, read the full paper here.

[ Salameh explains why we will inevitably have oil wars in the future, perhaps wars over Iran’s nuclear program, between the U.S. and china, Iraq and Kurdistan, the UK and Argentina over the Falkland islands oil reserves, and/or over the disputed South China Sea’s islands. Salameh also lists 11 past oil wars from 1941 to 2014. I’ve excerpted less than half of this paper and taken out the footnotes, read the full paper here.

Alice Friedemann www.energyskeptic.com author of “When Trucks Stop Running: Energy and the Future of Transportation”, 2015, Springer and “Crunch! Whole Grain Artisan Chips and Crackers”]

Salameh, M. G. April 2014. Oil Wars. ESCP Europe, research centre for energy management.

Dr Mamdouh G. Salameh, Director International Oil Economist, World Bank Consultant, UNIDO Technical Expert, World Bank Washington DC / Oil Market Consultancy Service

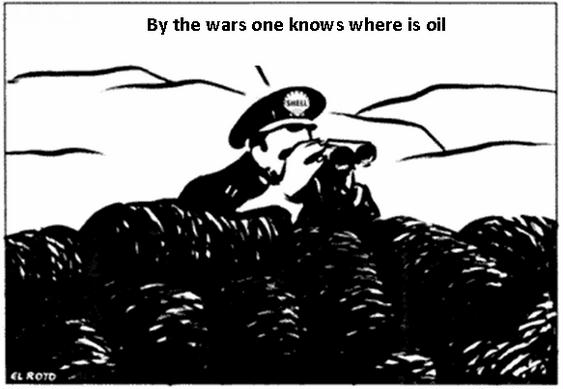

Abstract. The 20th century was truly the century of oil whilst the 21st century would be the century of peak oil and the resulting oil wars. No other commodity has been so intimately intertwined with national strategies and global politics and power as oil.

The close connection between oil and conflict derives from three essential features of oil:

- its vital importance to the economy and military power of nations

- its irregular geographic distribution

- peak oil

Conventional oil production peaked in 2006. As a result, the world could face an energy gap probably during the first two decades of the 21st century. This gap will have to be filled with unconventional and renewable energy sources. However, it is very doubtful as to whether these resources could bridge the energy gap in time as to be able to create a sustainable future energy supply.

There is no doubt that oil is a leading cause of war. Oil fuels international conflict through four distinct mechanisms:

- resource wars, in which states try to acquire oil reserves by force;

- the externalization of civil wars in oil-producing nations (Libya as an example);

- conflicts triggered by the prospect of oil-market domination such as the United States’ war with Iraq over Kuwait in 1991; and

- clashes over control of oil transit routes such as shipping lanes and pipelines (closure of the Strait of Hormuz for example).

Between 1941 and 2014, at least ten wars have been fought over oil, prominent among them the 21st century’s first oil war, the invasion of Iraq in 2003. At present, there are at least five major conflicts that could potentially flare up over oil and gas resources in the next three decades of the twenty-first century. The most dangerous among them are a war over Iran’s nuclear program and a conflict between China and the United States that has the potential to escalate to war over dwindling oil resources or over Taiwan or over the disputed Islands in the South China Sea claimed by both China and Japan with the US coming to the defense of Japan. As in the 20th century, oil will continue in the 21st century to fuel the global struggles for political and economic primacy. Much blood will continue to be spilled in its name. The fierce and sometimes violent quest for oil and for the riches and power it represents will surely continue as long as oil holds a central place in the global economy.

Introduction. Though the modern history of oil begins in the latter half of the 19th century, it is the 20th century that has been completely transformed by the advent of oil. Oil has a unique position in the global economic system. No other commodity has been so intimately intertwined with national strategies and global politics and power as oil. Oil was central to the course and outcome of World War II in both the Far East and Europe. One of the allied powers’ strategic advantages in World War II was that they controlled 86% of the world’s oil reserves. The Japanese attack on Pearl Harbor was about oil security. Among Hitler’s most cherished strategic objectives in the invasion of the Soviet Union was the capture of the oilfields in the Caucasus. In the Cold War years, the battle for the control of oil resources between international oil companies and developing countries was a major incentive and inspiration behind the great drama of de-colonization and emergent nationalism.

During the 20th century, oil emerged as an effective instrument of power. The emergence of the United States as the world’s leading power during the 20th century coincided with the discovery of oil in America and the replacement of coal by oil as the main energy source. As the age of coal gave way to oil, Great Britain, the world’s first coal superpower, gave way to the United States, the world’s first oil superpower.

Since its discovery, it has bedeviled the Middle East and the world at large with conflicts and wars. Oil was at the very heart of the first post-Cold War crisis of the 1990s – the Gulf War. The Soviet Union – the world’s second largest oil exporter – squandered its enormous oil earnings in the 1970s and 1980s in a futile military race with the United States. And the United States, once the largest oil producer and still its largest consumer, must import 58% of its oil needs, weakening its overall strategic position and adding greatly to its huge outstanding debts – a precarious position for the only superpower in the world.

Military Significance. Oil is a vital factor in the military strength of nations in that it supplies most of the energy used to power tanks, planes, missiles, ships, armored vehicles and other instruments of war. During the 1991 Gulf war, for example, US and allied forces consumed an average 452,000 barrels of oil a day (b/d) – equivalent to the current daily consumption of Kuwait. Because oil is so vital to the conduct of warfare, its possession has been termed a “national security” issue by the United States and other countries, meaning something that may require the use of military force to protect.

Oil Geography. The global distribution of oil is another factor. Oil does not occur randomly across the globe but is highly concentrated in a few reservoirs. The largest of these, containing approximately two-thirds of the world’s proven conventional oil, are located in the Gulf region, comprised of Saudi Arabia, Iran, Iraq, Qatar and the United Arab Emirates (UAE). As a result, the center of gravity of world oil is the Gulf region. This has great economic and geopolitical implications because many of these producers are chronically unstable, harbor strong anti-Western sentiments or lie in war-torn neighborhoods.

Peak Oil. Global conventional oil production peaked in 2006 and has been in decline since then. Moreover, nine of the top oil producers in the world have already peaked: USA, Canada, Iran, Indonesia, Russia, UK, Norway, Mexico and Saudi Arabia. Also three of the world’s largest oilfields have already peaked: Kuwait’s Burgan, the world’s second largest (2005), Mexico’s giant Cantarell (2006) and Saudi Arabia’s Ghawar, the world’s largest oilfield (2006). Peak oil is not only a reality but is already impacting on oil prices, the world economy and the global energy security. Moreover, the days of inexpensive, convenient and abundant energy sources are virtually over.

We won’t “run out of oil” because, simply, we’ll never get it all, but peak oil is here, the world’s largest and best reserves are still in the Middle East, and the major powers in the world, which run on oil, know this. For all of these reasons, the risk of armed conflict over valuable oil supplies is likely to grow in the years to come.

Geopolitics in a World of Dwindling Energy Supplies. As nations compete for currency advantages, they are also eyeing the world’s diminishing resources—fossil fuels, minerals, agricultural land, and water. Resource wars have been fought since the dawn of history, but today the competition is entering a new phase. Nations need increasing amounts of energy and materials to produce economic growth, but the costs of supplying new increments of energy and materials are increasing. In many cases all that remains are lower-quality resources that have high extraction costs. Meanwhile the struggle for the control of resources is re-aligning political power balances throughout the world.

The US as the world’s superpower has the most to lose from a reshuffling of alliances and resource flows. The nation’s leaders continue to play the game of geopolitics by 20th century rules: They are still obsessed with the Carter Doctrine and focused on oil as the world’s foremost resource prize (a situation largely necessitated by the country’s continuing dependence on oil imports.

The United States maintains a globe-spanning network of over 800 military bases that formerly represented tokens of security to regimes throughout the world but that now increasingly only provoke resentment among the locals. This enormous military machine is becoming too expensive for the United States to maintain. Indeed, the nation’s budget deficit largely stems from its trillion-dollar-per-year cost. In short, the United States remains an enormously powerful nation militarily, yet it suffers from declining strategic flexibility.

The European Union, traditionally allied with the US is increasingly mapping its priorities independently, partly because of increased energy dependence on Russia, and partly because of economic rivalries and currency conflicts with America. Germany’s economy is one of the few to have emerged from the 2008 crisis relatively unscathed, but the country is faced with the problem of having to bail out more and more of its neighbors.

China is the rising power of the 21st century with a surging military and lots of cash with which to buy access to resources (oil, coal, minerals, and farmland) around the planet. Its emergence as an economic superpower and competition with the United States for dwindling oil reserves could potentially lead to an oil war in coming years.

Japan, with the world’s third-largest economy, is wary of China and increasingly uncertain of its protector, the US. The country is tentatively rebuilding its military so as to be able to defend its interests independently. Disputes with China over oil and gas deposits in the South China Sea are likely to worsen, as Japan has almost no domestic fossil fuel resources and needs secure access to supplies.

Russia is a resource powerhouse. With a residual military force at the ready, it vies with China and the US for control of Caspian and Central Asian energy and mineral wealth through alliances with former Soviet states. It tends to strike tentative deals with China to counter American interests, but ultimately Beijing may be as much of a rival as Washington. Moscow uses its gas exports as a bargaining chip for influence in Europe.

Africa is an area of fast-growing U.S. investment in oil and other mineral extraction projects as evidenced by the establishment in 2009 of AFRICOM (a military strategic command intended to confront China’s deep involvement in Africa). Proxy conflicts there between and among these powers may intensify in the years ahead in most instances to the sad detriment of African peoples.

The Middle East maintains a vast oil wealth, but is characterized by extreme economic inequality, high population growth rates, political instability, and the need for importation of non-energy resources (including food and water). The revolutions and protests in Tunisia, Egypt, Libya, Bahrain, and Yemen in early 2011 were interpreted by many observers as a refusal by common people to tolerate sharply rising food, water, and energy prices. As economic conditions worsen, many more nations could become destabilized.

Oil Wars in Recent History. Prior to the 1990 Gulf War, The American energy company Halliburton’s president and later US vice president Dick Cheney revealed, “We’re there because that part of the world controls the world supply of oil, and whoever controls the supply of oil would have a stranglehold on the world economy.” So there you have it. All this bloodshed is over dwindling oil reserves. Meanwhile, war has become the largest business on Earth, worth trillions of dollars every year.

1-Nazi Germany’s Invasion of the Soviet Union (June 1941)

Desperate for fuel, Germany entered North Africa and Russia in 1941 to reach the Middle East oilfields and Baku oilfields in the Caspian. German War Production Minister, Albert Speer, conceded in his post war interrogation that oil “was a prime motive” for these invasions. Predicting victory at Baku, Hitler declared, “Now I have oil! Proceed to India!” But Hitler’s army literally ran out of gas. German supply trucks got half their normal fuel mileage in the road-less, muddy terrain. Rommel abandoned empty, fuel- gobbling tanks in the Egyptian desert west of El Alamein. “We have the bravest men,” he declared, “but they are useless without enough petrol.

Oil proved to be the primary strategic resource during World War II. During the war, the US built the world’s longest pipeline – from Texas to the Atlantic – and produced about 6. 3 billion barrels (bb) of oil. By comparison, Germany produced a mere 200 million barrels, about 3% of US production, much of it from expensive “synthetic oil” produced from coal.

2-The Attack on Pearl Harbour & US Entry into World War II (1941)

Oil has been central to Japan’s decision to attack Pearl Harbor thus bringing the United States into World War II. History might conclude that the Japanese attack on Pearl Harbor might have been provoked by the oil embargo imposed by the United States on Japan on July 25, 1941 as a result of Japanese military aggression in Asia. Increasingly worried about a cut-off of oil supplies from the United States, Tokyo instituted a policy to try to eliminate dependence on US oil supplies. In 1940-1941, it was energy security that led Japan to occupy the Dutch East Indies and take control of its oilfields. Indeed, the US oil embargo was the pivotal factor leading Japan to attack Pearl Harbor, bringing the United States into World War II.

3-The Biafra – Nigeria Oil War (1967)

Oil was a major issue in the Nigerian civil war forty-seven years ago. Nigeria is a country that was created artificially by British colonialism. It has a complex ethnic mixture of groups, with a division between the North inhabited by Muslim Fulani-Hausas with a rigid feudal system, and the South with its largely Christian population.

In 1966, a group of northern officers headed by a young British-trained officer, General Gowon, staged a coup and took control of the government. Three months after Gowon’s takeover a large scale massacre of Southerners was reported from the Northern region. Southern army officers then decided to lead the South-East to secession and war. On 30 May 1967, they proclaimed the independent Republic of Biafra and declared war on Nigeria. The actual fighting lasted for 24 months and led to the death of 2 million innocent Nigerians who did not know anything about politics nor the oil in their region. A major factor precipitating the war was oil. Biafra sits on huge oilfields. Approximately 30% of these fields lie in Nigeria with the remaining 70% in Biafra.

4-The1973 Arab-Israeli War

Although oil was not directly the cause of the 1973 Arab- Israeli War, using the oil weapon was a central part of the planning for the war. History will judge if the war could have gone ahead without the assurance of the oil weapon and the oil financial resources. On October 17, 1973, eleven days into the Arab Israeli War of the 6th of October, the Arab oil-producing countries wielded the oil weapon and imposed an oil embargo against the United States and other countries friendly to Israel. The embargo led to a quadrupling of crude oil prices and precipitated a severe recession, economies of the industrialized nations. The US gross domestic product (GDP) plunged 6% unemployment doubled to 9%. Japan’s GDP declined by 7% for the first time since the end of World War II and Europe’s by 2.5%.

5-The Iran-Iraq War (1980-1988)

The Iran–Iraq War began when Iraq invaded Iran on 22 September 1980. It followed a long history of border disputes and was motivated by fears that the Iranian Revolution in 1979 would inspire insurgency among Iraq’s Shia population. However, the real factor behind the Iran-Iraq war was a simmering rivalry between these two oil-producing nations underpinned by each one’s aspiration for strategic primacy in the gulf region and supremacy inside OPEC. The war was a precursor for the invasion in Kuwait and the first Gulf War. Started by Iraq in September 1980, the war was marked by indiscriminate ballistic-missile attacks, extensive use of chemical weapons and attacks on third-country oil tankers in the Gulf. The end came in July 20, 1988 with the acceptance by Iran of UN Ceasefire Resolution 598. During the eight years between Iraq’s formal declaration of war on September 22, 1980, and Iran’s acceptance of ceasefire, thousands of troops were killed on both sides and some $500 billion of damage suffered by each of the warring countries (mostly to oil facilities). In addition, economic development stalled and oil exports were disrupted.

6- The Iraq-Kuwait War (1990)

The invasion of Kuwait, also known as the Iraq–Kuwait War, was a major conflict which resulted in the seven-month long Iraqi occupation of Kuwait and subsequently the first Gulf War. In 1990 Iraq accused Kuwait of stealing Iraqi oil through slant drilling in the Rumaila oilfield which straddles the borders between the two countries. There were several reasons for the Iraqi move, including Iraq’s inability to pay more than $80 bn that had been borrowed to finance the Iran-Iraq war and Kuwaiti overproduction of oil which kept revenues down for Iraq. The invasion started on 2 August 1990, and within two days of intense combat, most of the Kuwaiti Armed forces were either overrun by the Iraqi Republican Guard or escaped to neighboring Saudi Arabia and Bahrain. The state of Kuwait was annexed, and Saddam Hussein announced a few days later that it had become the 19th province of Iraq.

By the time the Iran–Iraq war ended, Iraq was not in a financial position to repay the US$14 billion it borrowed from Kuwait to finance its war with Iran and requested Kuwait to forgive the debt. Iraq argued that the war had thwarted the rise of Iranian influence that could have threatened the Arab Gulf regimes. However, Kuwait’s reluctance to pardon the debt created strains in the relationship between the two Arab countries. During late 1989, several official meetings were held between the Kuwaiti and Iraqi leaders but they were unable to break the deadlock between the two countries. In 1988 Iraq’s Oil Minister, Issam al-Chalabi, requested a further reduction in the crude oil production quota of the Organization of the Petroleum Exporting Countries (OPEC) members so as to end the 1980s oil glut. 12 Chalabi argued that higher oil prices would help Iraq increase its revenues and pay back its outstanding debts. Instead, Kuwait requested OPEC in 1989 to increase its oil production quota by 50% to 1.35 mbd. Throughout much of the 1980s, Kuwait’s oil production was considerably above its mandatory OPEC quota and this had prevented a further increase in crude oil prices. A lack of consensus among OPEC members undermined Iraq’s efforts to end the oil glut and consequently prevented the recovery of its war-crippled economy. According to former Iraqi Foreign Minister Tariq Aziz, “every $1 drop in the price of a barrel of oil caused a $1 billion drop in Iraq’s annual revenues triggering an acute financial crisis in Baghdad”. It was estimated that between 1985 and 1989, Iraq lost US$14 billion a year due to Kuwait’s oil price strategy. Kuwait’s refusal to decrease its oil production was viewed by Iraq as an act of aggression against it. The increasingly tense relations between Iraq and Kuwait were further aggravated when Iraq alleged that Kuwait was slant-drilling across the international border into Iraq’s Rumaila oilfield. During the Iran–Iraq War, Iraqi oil drilling operations in Rumaila declined while Kuwait’s operations increased. In 1989, Iraq accused Kuwait of using “advanced drilling techniques” to exploit oil from its share of the Rumaila field. Iraq estimated that $2.4 billion worth of Iraqi oil was “stolen” by Kuwait and demanded compensation. Kuwait dismissed the accusations as a false Iraqi ploy to justify military action against it. More than 600 Kuwaiti oil wells were set on fire by withdrawing Iraqi forces causing massive environmental and economic damage to Kuwait.

7-The War on Iraq (2003)

The war on Iraq was undoubtedly about oil. This was the 21st century’s first oil war. The prize was Iraq’s spectacular oil wealth estimated at 330 billion barrels of proven, semi-proven and probable oil reserves. Even Alan Greenspan, the former chairman of the US Federal Reserve Bank for seventeen years, agrees that the Iraq war was largely about oil. The war cost the US economy an estimated $6.65 trillion in running costs and also in oil price differences. It also cost the global economy (including the US) some $14.13 trillion and was instrumental in precipitating the recent global financial and economic crisis and the economic recession from which the global economy has not yet fully recovered. It is estimated that the Iraq war may have increased energy costs worldwide by a staggering $6 trillion. The former US vice president, Dick Cheney made Iraqi’s oil fields a national security priority before 9/11. Five months before 9/11, the United States started calling for the use of force against Iraq to secure control of its oil.

8-The Sudan Oil War

On April 10th 2013 forces from the newly independent state of South Sudan occupied the oil center of Heglig, a town granted to North Sudan as part of a peace settlement that allowed the southerners to secede in 2011. North Sudan then mobilized their own forces and drove the South Sudanese out of Heglig. Fighting has then erupted all along the contested border between the two countries, accompanied by air strikes on towns in South Sudan. Although the fighting has not yet reached the level of a full-scale war, international efforts to negotiate a cease-fire and a peaceful resolution to the dispute have yet to meet with success. The conflict between South Sudan and the North is being fueled by many factors, including economic disparities between the two Sudans and an abiding animosity between the southerners (who are mostly black Africans and Christians) and the northerners (mostly Arabs and Muslims). But oil and the revenues produced by it remain at the heart of the matter.

When Sudan was divided in 2011, most of the oilfields wound up in the south, while the only pipeline capable of transporting the South’s oil to international markets (and thus generating revenue) remained in the hands of the northerners. They have been demanding exceptionally high “transit fees” — $32-$36 per barrel compared to the common rate of $1 per barrel — for the privilege of bringing the South’s oil to market. When the southerners refused to accept such rates, the northerners confiscated money they had already collected from the South’s oil exports, its only significant source of funds. In response, the southerners stopped producing oil altogether and launched their military action against the north. The situation remains explosive. Oil is the main natural resource for the North and South economies. The dispute over oil-rich boundary as well as the overlapping of oil blocks will continue to be a source of tension between both the North and South Sudan.

Sudan has been exporting crude oil since 1999 with oil production rising dramatically to 490, 000 b/d. As mentioned, oil remains crucial to economic development of both the North and South and the basic resource to mitigate the endemic problem of poverty of the whole of Sudan. Oil accounts for 60%-70% of revenue in the North and 98% in the South. Furthermore, about 75% of Sudanese oil is produced in the South. North-South tension is complicated further by the intervention of foreign powers, namely the US and China and their rivalry over African oil. North Sudan and South Sudan could become proxies to these two ‘heavyweights’ and their geopolitical maneuvering in their quest for African oil.

9- Syria’s Civil War

The civil war and the massacres of civilians in Syria since 2011 are being exploited for narrow geopolitical competition to control Mideast oil and gas pipelines. Whatever the case, few recall that US agitation against Syria began long before the civil war with the main objective of weakening Iranian influence across the Middle East. These strategic concerns, motivated by fear of expanding Iranian influence, impacted Syria primarily in relation to pipeline geopolitics. In 2009 President Bashar Assad of Syria refused to sign a proposed agreement with Qatar that would run a pipeline from the latter’s North gasfield, contiguous with Iran’s South Pars field, through Saudi Arabia, Jordan, Syria and on to Turkey, with a view to supply European markets thus competing with Russian gas exports to Europe. Assad’s rationale was to protect the interests of his Russian ally, which is Europe’s top supplier of natural gas.

Instead, the following year Assad is said to have pursued negotiations for an alternative $10-billion pipeline with Iran, across Iraq to Syria, that would also potentially allow Iran to export gas from its South Pars field shared with Qatar. The Memorandum of Understanding (MoU) for the project was signed in July 2012 – just as Syria’s civil war was spreading – and earlier in 2013 Iraq signed a framework agreement for the construction of the gas pipeline. The proposed Iran-Iraq-Syria pipeline was a “slap in the face” for Qatar’s plans.

Syria’s Assad is being targeted because he is not considered a reliable “player”. Specifically, Turkey and the US want an assured flow of Qatari gas through Syria, and don’t want a Syrian regime which is not unquestionably loyal to those two countries to stand in the way of the pipeline or to demand too big a royalty. So yes, regime change was planned against Syria (as well as Iraq, Libya, Lebanon, and Iran) 20 years ago. And yes, attacking Syria weakens its close allies Iran and Russia allies and indirectly China.

10- The War on Libya in 2011

The war on Libya was portrayed as a humanitarian effort by the US and NATO to protect civilians. Far from it, it was oil they were after. Three underpinning factors were behind the war on Libya: Libya’s future endeavor to replace the US Dollar by the Libyan Dinar for payment for Libyan oil exports, the international oil companies’ unhappiness with the terms Libya was offering them to operate in the country and the fact that Libya was instrumental in creating the African Union’s financial institutions to provide financial independence for African countries. Libya has been one of the last nations in the world that had its own state-run banking system and control over its own money supply. By having this system in place, Libya could demand payment for its oil exports in Libyan Dinar or any other currency instead of the US Dollar thus weakening the American currency.

The attack on Libya is very reminiscent of one of the reasons why the United States attacked Iraq in 2003. Six months before the US moved into Iraq, Saddam Hussein took the decision to accept Euros instead of dollars for oil, and this became a threat to the global dominance of the dollar as the world’s reserve currency and as a petrodollar. The dollar is only strong because everyone uses it. It has been America’s blank check for the past nine decades. It acted as a form of control and still does today. If many countries in the world decide to move away from the dollar as a reserve currency and petrodollar, there could be a glut of dollars in the world resulting in huge loss of its value. All wars have economic motives.

Another underpinning factor for the attack is that international oil companies were not happy with Libya’s terms for operating in Libya. With 48 billion barrels (bb) of proven oil reserves, Libya has the biggest reserves in Africa and the 9th biggest in the world. Interests at stake emerged from an article in the Wall Street Journal entitled: “For West’s Oil Firms, No Love Lost in Libya”. After the lifting of sanctions in 2003, Western oil companies flocked to Libya with high expectations; they have been disappointed by the results. The Libyan government, under a system known as EPSA-4, granted operating licenses to foreign companies that left the Libyan state-run National Oil Corporation of Libya (NOC) with 90% of the extracted oil. “The EPSA-4 contracts contained the toughest terms in the world,” says Bob Fryklund, former president of the U. S.-based ConocoPhillips in Libya.

It is apparent, then, the reason why with an operation decided not in Bengazi, but in Washington, London and Paris, the National Libyan Transitional Council has created the “Libyan Oil Company” to replace the NOC. Its task will be to grant licenses on terms highly favorable to US, British and French companies. On the other hand, companies that before the war were the main producers of oil in Libya: first of all the Italian firm ENI, which in 2007 paid a billion dollars to obtain concessions until 2042, and Germany’s Wintershall which came in second place, will be made to suffer. It would make Chinese and Russian companies suffer even more, those to which on March 14, 2011 Gaddafi promised he would transfer the oil concessions held by European and U.S. companies.

A third reason for the war on Libya was to sink the African Union’s financial institutions, whose birth was made possible largely by Libyan investment. These include the African Investment Bank, based in Tripoli, Libya; the African Central Bank, based in Abuja, Nigeria; the African Monetary Fund, based in Yaoundé, Cameroon. The latter, with a programmed capital of more than 40 billion dollars, could supplant the International Monetary Fund (IMF) in Africa. Up to now the IMF has dominated the African economy, paving the way for U.S. and European multinationals and investment banks. By attacking Libya, the US & NATO are trying to sink the bodies that could one day make the financial independence of Africa possible.

11- The Annexation of the Crimea

The annexation of the Crimea signals to the world that oil and natural gas are once again being used as a weapon of war. This isn’t the first time. When the Ukraine refused to pay higher prices for Russian natural gas supplies, Russia cut off gas supplies in 2009 to Ukraine thus affecting supplies to six other European countries in the middle of winter and leaving millions in the cold until they paid Russia’s ransom in the form of higher prices. It was a stark example how vulnerable Europe had become to Russia’s control over energy resources.

Russia is the world’s largest supplier of oil and gas and has thus tremendous power over the market. The European Union (EU) depends on Russian oil and gas supplies for 30% of its needs.

Russia’s intrusion into the Ukraine in February 2014 has been prompted by energy and geopolitical factors. The oil and gas factors are that 50% of Russia’s gas and oil supplies to the EU are piped through the Ukraine. Moreover, revenues from these supplies are extremely important for the Russian economy. It is in Russia’s energy interests to make sure that the gas pipelines transiting the Ukraine are well defended not only against sabotage but also against the Ukraine making use of the gas without paying for it. Ensuring that there is a pro-Russian government in the Ukraine becomes a very important Russian national interest.

There is, however, a geopolitical dimension. The Ukraine has become like a chess pawn in a grand chess game being played by the United States and the EU with Russia. At the heart of the Ukraine-Russia crisis is the EU’s attempts incited and abetted by the United States to draw the Ukraine away from Russia into the EU and eventually into NATO, thus bringing NATO to the borders of Russia. Having failed to achieve their aim, the EU supported by the US instigated internal strife in the Ukraine which ended with the ousting of the legally-elected president and eventually led to the annexation of the Crimea.

Potential Future Oil Wars

At present, there are at least five major conflicts that could potentially flare up over oil and gas resources in the next three decades of the twenty-first century.

1-Conflict over Iran’s Nuclear Program

Oil is at the heart of Iran’s nuclear program. Iran needs nuclear energy to replace the crude oil and natural gas currently being used to generate electricity, thus allowing more oil and gas to be exported. Without nuclear power, Iran could cease to remain a major crude oil exporter and could be relegated to the ranks of small exporters as early as 2015 with catastrophic implications for its economy and also the price of oil. Iran would doubtless not be averse to possessing nuclear weapons. There is an element of security and also logic involved with Iran’s quest for nuclear weapons. Even direct negotiations between the United States and Iran will not shift Iran an iota from its determination to acquire nuclear weapons. Their logic is that if Israel, India, Pakistan and North Korea can defy the world and get away with it, why not Iran.

Neither sanctions nor threat of war against Iran will force it to relinquish its nuclear program and its pursuit of nuclear weapons. If attacked, Iran could plunge the world in the biggest oil crisis in its history. Iran is determined to acquire nuclear weapons and will face down the United States, the European Union, Israel and the world community and will get away with acquiring nuclear weapons. The US and its allies can do nothing militarily, economically or with sanctions.

The US and its allies including Israel will eventually end up acquiescing to a nuclear Iran and who knows, they might end up forming an unholy alliance made up of the US, Israel and Iran to siphon off the oil and energy resources of the Arab gulf countries, something reminiscent of the US invasion of Iraq.

There is an element of security and also logic involved with Iran’s quest for nuclear weapons. Even direct negotiations between the United States and Iran will not shift Iran an iota from its determination to acquire nuclear weapons. Their logic is that if Israel, India, Pakistan and North Korea can defy the world and get away with it, why not Iran. Neither sanctions nor threat of war against Iran will force it to relinquish its nuclear program and its pursuit of nuclear weapons. If attacked, Iran could plunge the world in the biggest oil crisis in its history. Iran is determined to acquire nuclear weapons and will face down the United States, the European Union, Israel and the world community and will get away with acquiring nuclear weapons. The US and its allies can do nothing militarily, economically or with sanctions. The US and its allies including Israel will eventually end up acquiescing to a nuclear Iran and who knows, they might end up forming an unholy alliance made up of the US, Israel and Iran to siphon off the oil and energy resources of the Arab gulf countries, something reminiscent of the US invasion of Iraq. In

When the Shah started Iran’s nuclear energy program in 1974, nuclear power could not be justified economically as Iran’s population was less than half its present 70 million, oil production was 6 mbd, far more than the present production of 3.20 mbd and energy consumption was less than a quarter of consumption today, and unlike now, Iran’s oil reservoirs were not in decline. The question is: since the United States strongly encouraged the Shah to build nuclear power plants in 1974, why is it objecting now to Iran pursuing a nuclear program? The answer is that in 1974 the Shah of Iran was a great friend of Israel while in the first decade of the twenty-first century, Iran is no longer friendly with Israel. Nuclear power may have an important role in restricting the consumption of hydrocarbons in Iran and allowing more oil and gas to be exported. In 2012, Iran used the equivalent of 610,000 b/d of oil and natural gas to generate electricity. By 2015, Iran will need to use some 770,000 b/d of oil and gas for electricity generation.

Generating nuclear electricity will enable Iran to replace at least 93% of the oil and gas used in electricity generation in 2020, thus adding some 1.00 mbd to its oil and gas exports and earning an extra $46 bn. Based on these figures, Iran’s quest for nuclear energy seems justifiable.

Although the threat of War between the United States and Israel on the one hand and Iran on the other has recently abated, there is nothing to stop a reckless Israeli government from ordering an attack on Iran’s nuclear installations thus precipitating a war between Israel and Iran and bringing the United States into it.

2-Oil War between the United States & China?

The great rivalry between the United States and China will shape the 21st century. It is a truth universally acknowledged that a great power will never voluntarily surrender pride of place to a challenger. The United States is the pre-eminent great power. China is now its potential challenger.

Though a terrifying possibility, a war between the oil titans could be triggered by a race to secure a share of dwindling reserves of oil or over Taiwan or over the disputed Islands in the South China Sea claimed by both China and Japan with the US coming to the defense of Japan. In such conflicts, the United States would try to starve China of oil by blocking any oil supplies from the Middle East passing through the Strait of Hormuz or the Strait of Malacca.

China’s robust economic growth and its emergence as an economic superpower would falter without oil, particularly from the Middle East. China’s global oil diplomacy is, therefore, geared towards ensuring that this never happens.

As Chinese state-owned companies scour the globe for oil and gas to fuel their country’s rapid economic growth, criticism of China for supporting despotic, oil-rich regimes, for driving up U.S. oil prices, and for worsening global warming has grown more strident. Some Washington hard-liners say the United States should prepare for future energy conflict with China by strengthening alliances with key oil producers while denying China access to strategic oil supplies. Such policies would increase Chinese concern about the security of oil supplies, encourage China to lock in oil resources from unsavory regimes, and undermine moderates in Beijing. Hard-line policies on oil could even become a self-fulfilling prophecy, fostering a new Cold War between the United States and China and possibly a hot one.

China’s economic boom, fueled by its massive supply of coal, has begun to overwhelm its domestic energy resources. While coal still meets 68% of China’s primary energy needs, the percentage filled by imported oil is growing. A net oil exporter in 1993, China today is the world’s largest importer and the second-largest consumer of oil. Over the next 15 years, its demand is expected to roughly double. By 2020, China will likely import 70% of the oil it consumes, compared to 65% today. 29 China’s leaders worry that this dependence on imported oil leaves them vulnerable, since long-term global energy “scarcity” that undermines economic growth and increases unemployment could bring social instability.

The growing dependence on oil imports particularly from the Middle East has created an increasing sense of ‘energy insecurity’ among Chinese leaders. Some Chinese analysts even refer to the possibility that the US is practicing an ‘energy containment’ policy toward China, or could implement one in the future. Chinese leaders tend to believe that dependence on imported oil leads to great ‘strategic vulnerability’. The war on Iraq and growing US hegemony in the Middle East have made it even more urgent for China to reduce its dependence on the Arab Gulf. 30 Much of China’s imported oil from the Middle East must pass through a major chokepoint: the Strait of Hormuz which is guarded by the US navy

Another chokepoint is the Strait of Malacca between Malaysia and Indonesia, through which 80% of China’s imported oil pass. The channel is 625 miles long, and less than two miles wide at its narrowest point (see Figure 2). With the Indian navy guarding the northern end of the Strait, and the US navy the southern end, China feels sandwiched in and strategically vulnerable. The former president of China, Hu Jintao, has referred a number of times to what he describes as the ‘Malacca dilemma’. 31

3-Conflict between Iraq and Kurdistan

Like in many conflicts around the world, the presence of oil is raising the stakes and the tensions between Iraq and the Kurdistan Regional government (KRG) in Iraqi Kurdistan. Long before the toppling of Saddam Hussein’s regime, the Kurds have been angling for independence. Baghdad currently disputes KRG control over Iraq’s northern oil fields. The Kurdish security forces are patrolling the loosely defined border, with strict orders from the KRG to block the entrance of Iraqi military forces. The KRG relies heavily on revenue from these oil fields to support its growing autonomy from Baghdad. Earlier this year, a Kurdish truck delivered crude oil to the Turkish port of Mursin, marking the first time the KRG has exported oil directly to world markets. This dispute was exacerbated by the US administration during the Iraq War, which pushed for an independent Kurdish State for the benefit of multinational oil companies.

Iraq considers a Kurdish declaration of independence as part of a plan to dismember Iraq with the support of the United States. Any conflict over Kurdistan could involve Iran, the United States and Turkey. It will amount to creating a new Israel in the Arab Gulf region. Turkey hopes that by expanding its oil transactions with Iraqi Kurdistan, it will eventually be able to settle its own Kurdish question.

War Between the UK & Argentina over Falkland Islands Oil Reserves The next war between the UK and Argentina could be over the Falklands Islands potential oil Reserves If the reserves were significant and proven.

On November 28, 2013, Argentina’s Congress passed a law imposing criminal sanctions on what it described as any “illegal exploration around the Falklands Islands (or as Argentina calls them the Las Malvinas)”. The move by Buenos Aeries is a major ratcheting of the tension in the region and has triggered a furious response by Britain reminding Argentina that the Falklands are British sovereign territory. The UK government unequivocally supports the right of the Falkland Islanders to develop their natural resources for their own economic benefit. While Argentina and the UK have already warred over the Falklands, in 2010 they fell out when the British began drilling for oil off the coast of the island. And tensions are continuing to rise. Argentina which is already burdened by debt and is facing an energy crisis might be raising opposition now not just because it wants to regain sovereignty of the islands, but because it wants access to its oil reserves.

Tensions over the Disputed South China Sea’s Islands

The recent rise in tensions over the disputed South China Sea islands has drawn attention to the possibility that the conflict is really about natural resources. The ongoing territorial disputes in the South China Sea are really about oil. China has been involved in territorial disputes with Japan and Taiwan over the Senkaku islands, and with Vietnam over the Spratly islands off the coast of Vietnam. China has even ramped up its naval presence in the South China Sea making its neighbors agitated. China’s claims of the islands are based on maps drawn out centuries ago when the Chinese empire laid claim to most of the South China Sea. Growing tensions between Japan and China over the Senkaku islands could escalate into armed conflict and could potentially bring the United States into it. The commander of US Marine Corps Forces in Japan claimed that if the Chinese invaded the Senkaku Islands, the US Navy and Marines could recapture them. China recently attempted to prevent the resupply of Philippines’ armed forces stationed on a disputed shoal in the South China Sea. It is but one example of creeping Chinese coerciveness that so unnerves the region. The Chinese defense minister also stridently asserted that Beijing will never compromise on disputed territory, raising fears that words will increasingly become assertive action.

The United States remains an energy glutton, a country where energy-efficiency and conservation measures result from private-sector reactions to the market rather than from comprehensive public policy.

Dr Mamdouh G. Salameh is an international oil economist, a consultant to the World Bank in Washington DC on oil & energy and a technical expert of the United Nations Industrial Development Organization (UNIDO) in Vienna. He is director of the Oil Market Consultancy Service in the UK and a member of both the International Institute for Strategic Studies in London and the Royal Institute of International Affairs. He is also a member of the Energy Institute in London.