Preface. This is a 3-page review of a 34-page overview Congressional Budget Office report requested by congress on establishing a single-payer health care system.

IMHO, I don’t see how this can possibly happen. How can a dysfunctional congress deal with such a complex undertaking, let alone ignore powerful insurance, hospitals, and health care provider lobbyists? Haven’t we learned anything from both Clinton & Obama’s attempts to reform health care with a public option?

Also, although Medicare is seen as a single payer system, many analysts disagree, since “private insurers play a significant role in delivering Medicare benefits outside the traditional Medicare program.”

Peak oil and health care

But the biggest stumbling block of all is that it really does look like we’re on the cusp of peak oil. The 2019 BP Statistical review of world energy showed that 98% of all new oil produced in 2018 came from U.S. Fracking, and we’re nowhere “peak demand”, consumption grew by 3.1 million barrels per day (bpd) to a new record of 99.8 million bpd (Rapier 2019). Since what really matters is peak diesel to keep trucks running, we may be past peak diesel, since fracked oil is far better for plastics than transportation fuel.

So take good care of yourself. There will be far less health care in the future, and eventually nothing but what your local community provides.

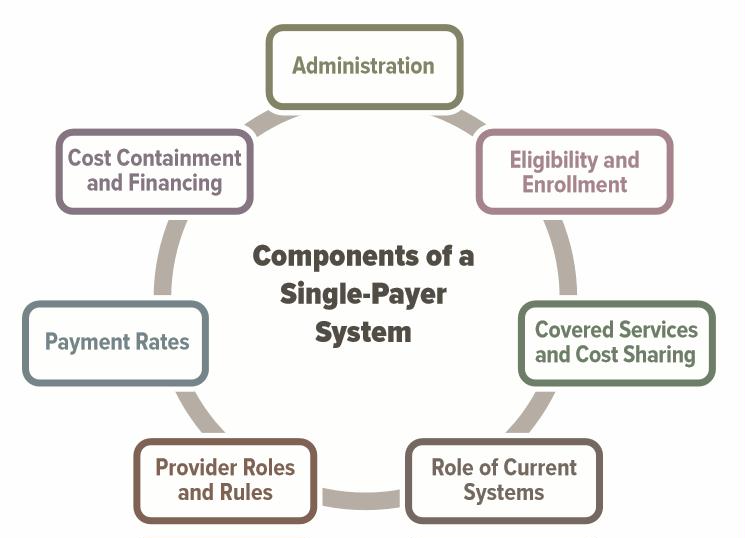

Components of single payer system.jpg

Alice Friedemann www.energyskeptic.com author of “When Trucks Stop Running: Energy and the Future of Transportation”, 2015, Springer and “Crunch! Whole Grain Artisan Chips and Crackers”. Podcasts: Practical Prepping, KunstlerCast 253, KunstlerCast278, Peak Prosperity , XX2 report

***

CBO. 2019. Key design components and considerations for establishing a single-payer health care system. United States Congressional Budget Office.

The report does not address all of the issues involved in designing, implementing, and transitioning to a single-payer system, nor does it analyze the budgetary effects of any specific proposal.

Statistics

29 million people under age 65 were uninsured, 11% of the population.

243 million people under age 65 had health insurance: 160 million people through an employer, 69 million via Medicaid the Children’s Health Insurance Program

Some of the key design considerations for policymakers interested in establishing a single-payer system include the following:

- How would the government administer a single-payer health plan?

- Who would be eligible for the plan, and what benefits would it cover?

- What cost sharing, if any, would the plan require?

- What role, if any, would private insurance and other public programs have?

- Which providers would be allowed to participate, and who would own the hospitals and employ the providers?

- How would the single-payer system set provider payment rates and purchase prescription drugs?

- How would the single-payer system contain health care costs?

- How would the system be financed?

Establishing a single-payer system would be a major undertaking that would involve substantial changes in the sources and extent of coverage, provider payment rates, and financing methods of health care in the United States.

Although a single-payer system could substantially reduce the number of people who lack insurance, the change in the number of people who are uninsured would depend on the system’s design. For example, some people (such as noncitizens who are not lawfully present in the United States) might not be eligible for coverage under a single-payer system and thus might be uninsured.

Single-Payer Health Care Systems

Although single-payer systems can have a variety of different features and have been defined in many ways, health care systems are typically considered single-payer systems if they have these four key features:

- The government entity (or government-contracted entity) operating the public health plan is responsible for most operational functions of the plan, such as defining the eligible population, specifying the covered services, collecting the resources needed for the plan, and paying providers for covered services

- The eligible population is required to contribute toward financing the system

- The receipts and expenditures associated with the plan appear in the government’s budget

- Private insurance, if allowed, generally plays a relatively small role and supplements the coverage provided under the public plan.

In the United States, the traditional Medicare program is considered an example of an existing single-payer system for elderly and disabled people, but analysts disagree about whether the entire Medicare program is a single-payer system because private insurers play a significant role in delivering Medicare benefits outside the traditional Medicare program.

Questions and complexities

- Could people opt out?

- Which services would the system cover, and would it cover long-term services and supports?

- How would the system address new treatments and technologies?

- What cost sharing, if any, would the plan require?

- How would the system purchase and determine the prices of prescription drugs?

- Would the government finance the system through premiums, cost sharing, taxes, or borrowing?

- How would the system pay providers and set provider payment rates?

- What role would private health insurance have?

- Who would own the hospitals and employ the providers?

Differences Between Single-Payer Health Care Systems and the Current U.S. System

Establishing a single-payer system in the United States would involve significant changes for all participants— individuals, providers, insurers, employers, and manufacturers of drugs and medical devices—because a single-payer system would differ from the current system in many ways, including sources and extent of coverage, provider payment rates, and methods of financing. Because health care spending in the United States currently accounts for about one-sixth of the nation’s gross domestic product, those changes could significantly affect the overall U.S. economy.

Although policymakers could design a single-payer system with an intended objective in mind, the way the system was implemented could cause substantial uncertainty for all participants. That uncertainty could arise from political and budgetary processes, for example, or from the responses of other participants in the system.

The transition toward a single-payer system could be complicated, challenging, and potentially disruptive. To smooth that transition, features of the single-payer system that would cause the largest changes from the current system could be phased in gradually to minimize their impact. Policymakers would need to consider how quickly people with private insurance would switch their coverage to the new public plan, what would happen to workers in the health insurance industry if private insurance was banned entirely or its role was limited, and how quickly provider payment rates under the single-payer system would be phased in from current levels.

Coverage. In a single-payer system that achieved universal coverage, everyone eligible would receive health insurance coverage with a specified set of benefits regardless of their health status. Under the current system, CBO estimates, an average of 29 million people per month—11% of U.S. residents under age 65—were uninsured in 2018.5 Most (or perhaps all) of those people would be covered by the public plan under a single-payer system, depending on who was eligible.

A key design choice is whether noncitizens who are not lawfully present would be eligible. An average of 11 million people per month fell into that category in 2018, and they might not have health insurance under a single-payer system if they were not eligible for the public plan. About half of those 11 million people had health insurance in 2018.

In 2018, a monthly average of about 243 million people under age 65 had health insurance. About two-thirds of them, or an estimated 160 million people, had health insurance through an employer. Roughly another quarter of that population, or about 69 million people, are estimated to have been enrolled in Medicaid or the Children’s Health Insurance Program (CHIP).

Currently, national health care spending—which totaled $3.5 trillion in 2017—is financed through a mix of public and private sources, with private sources such as businesses and households contributing just under half that amount and public sources contributing the rest (in direct spending as well as through forgone revenues from tax subsidies). Shifting such a large amount of expenditures from private to public sources would significantly increase government spending and require substantial additional government resources. The amount of those additional resources would depend on the system’s design and on the choice of whether or not to increase budget deficits. Total national health care spending under a single-payer system might be higher or lower than under the current system depending on the key features of the new system, such as the services covered, the provider payment rates, and patient cost-sharing requirements.

It would probably have lower administrative costs than the current system—following the example of Medicare and of single-payer systems in other countries—because it would consolidate administrative tasks and eliminate insurers’ profits. Moreover, unlike private insurers, which can experience substantial enrollee turnover over time, a single-payer system without that turnover would have a greater incentive to invest in measures to improve people’s health and in preventive measures that have been shown to reduce costs. Whether the single-payer plan would act on that incentive is unknown.

An expansion of insurance coverage under a single-payer system would increase the demand for care and put pressure on the available supply of care.

A single-payer system would affect other sectors of the economy that are beyond the scope of this report. For example, labor supply and employees’ compensation could change because health insurance is an important part of employees’ compensation under the current system.

References

Rapier, R. 2019. The U.S. accounted for 98% of global oil production growth in 2018. Forbes

2 Responses to Medicare for All?