Preface. Here is my take on the effect this pandemic will have on oil production.

Alice Friedemann www.energyskeptic.com author of “When Trucks Stop Running: Energy and the Future of Transportation”, 2015, Springer, Barriers to Making Algal Biofuels, and “Crunch! Whole Grain Artisan Chips and Crackers”. Podcasts: Collapse Chronicles, Derrick Jensen, Practical Prepping, KunstlerCast 253, KunstlerCast278, Peak Prosperity , XX2 report

***

With global demand having fallen by about 29 million barrels per day from a year ago, it seems like this pandemic might delay peak oil production while the pandemic and consequent depression lasts, since so much less oil is being consumed. On top of that, storage is getting full, so many oil producers are being forced to shut down wells since there’s no demand or place to put it.

Shut down wells may produce less oil after being restarted

Shutting in wells can reduce oil production when restarted, but that doesn’t happen every time. Sometimes you get lucky. More often though, the sub-surface gremlins in the reservoirs are going to get you. The net effect will likely be less oil and gas than there was before.

With prices so low and storage so full, some producers are shutting down wells. But the problem with that is it can have long term consequences, damaging the reservoir so that in the future not all of the oil can be produced (Brower 2020).

In addition to reservoir problems, especially tar sands, conventional and other wells face restart issues with the pipes, valves, separators, pumps, pipelines, older wells, and so many other technical problems that at least about 10-20% plus a loss of ability to reopen marginal projects. Depending how the game is played by the industry, the damage can be twice that, easily, especially in offshore and ultra-deep offshore wells, where methane hydrates will form immediately in seafloor pipelines and plug them. These wells could be 100 times more difficult to restart than a shale well (Patzek 2020).

Operations in the Gulf of Mexico will likely shut last, since the miles of pipelines that carry the oil along the sea floor to processing facilities on shore can clog if shut off for too long.

The issue with many wells is that when they are shut down, all sorts of things can happen. You can get accumulated junk in the bore like water, waxes, and sand, up to the point that it is completely clogged up. Equipment starts to rust. It can be more trouble to start back up than it’s worth (Rapier 2020).

And wells are expensive to restart

Trying to bring a well back can cost a lot of time and money to return it to full or partial production, without remediation a well might return to just half of its previous performance.

Economically it can be cheaper to run a well at a loss rather than shut it down, since as long as the price is greater than zero, it’s bringing in some money, and legally a contract may require drilling the land, so a shut-in could cause the lease to go to a competitor (Domonoske 2020).

The Russians even talk about burning it rather than shut wells down. “Its true that demand is low but this is not a reason to put a lock on the fields: sometimes it is better to pump and (even) burn. Remember how oil production nearly halved in the USSR? It took a decade to restore it back.” (Astakhova 2020).

Wood Mackenzie Ltd estimated potential shut in costs of: $150,000 to pull the electronic submersible pump from a high-flowing well, $75,000 to pull rods from a low-flowing well, and $2,000 to $5,000 for chemical treatment to protect equipment left in the well.

Restart costs can be: $10,000 to $20,000 to repair or “swab” a well filled with too much water, $150,000 to fix a damaged electronic submersible pump, $250 – $300,000 to buy and run a new electronic submersible pump, and $50,000 worker to fix tubing or rods in a low-flow well (Wethe 2020).

North Dakota has already shut down 6,200 wells producing over 400,000 barrels per day. It is estimated that it will cost $25 to $50,000 dollars per well to restart them, or $155 to $310 million (Hampton 2020). And in Louisiana, as many as 16,800 of the 33,650 oil and gas wells could be shut in (Boone 2020, Wethe 2020).

Restart costs are $20 to $40,000 for the thousands of micro-producing wells that only produce 10 barrels a day, 11% of onshore U.S. oil production, that these aren’t likely to shut their production down (Rystad 2020).

Other technical reasons why restarting is hard water getting into the well after it is shut down. That can be the death of oil production. As more and more water is pulled up, less oil can be, so the well becomes uneconomic. Shut-ins affect the pressure below, allowing water to intrude that had been held at bay while pumping. Making matters even more complex is that oil varies in quality at different depths. This can cause emulsions of oil and water to clog up the reservoir, and may well do so in a shut-in well. There are companies who specialize in fixing this, and other technical problems (Messler 2020).

Shale “fracked” oil (Kimani 2020)

Rystad’s head of shale research, Artem Abramov, has estimated that the biggest shale fields–Permian, Eagle Ford, and Bakken–will cut a further 900,000 bpd, 250,000 bpd, and 400,000 bpd, respectively, throughout 2Q20, with shut-ins accounting for a staggering 60% in the early stages.

A well shut-in is considered a drastic action of last resort mainly because it can result in huge or even total loss of production. Today a shut-in field fetches half the price of an identical field with oil still flowing, because it’s hard to determine how much oil can be coaxed out after a lengthy layoff.

Bob Bracket of Bernstein Research pointed out that “Shut-ins are not easy decisions. When production shuts-in, problems arise. Multi-phase well flows begin to separate out, while problematic hydrates, waxes, asphaltenes form which will have serious economic implications,” citing numerous examples of fairly large wells with flows exceeding 1,000 barrels/day that could not be brought back to life after being shut-in.

To shut down a well, a special rig is used to pump heavy “mud” fluid down the hole to stop the flow of oil and gas, penetrating the reservoir. This will make restarting more difficult by potentially causing permanent formation damage, and changing the pressure below. After the mud, a metal plug is cemented into the hole to stop the flow of fluid. Metal pipes and equipment left in the hole may corrode while the well is shut in.

When the well is restarted another rig drills out the cement and heavy mud. With luck, the well will flow again. If not, more solutions are tried, such as well treatment, re-perforation, and re-fracking at great expense, once a crew can be found that is. After the last price collapse crews weren’t available for a year or two.

This is why even heavily indebted shale companies, including bankrupt ones like Whiting Corp, insist on continuing to pump at all costs, and California Resources Corp (CRC), which despite owing $4 billion in 2022 is keeping its wells going with a continuous injection of steam to keep them alive at great cost.

Even shale wells that are pumping oil decline at a rate of 80% over 3 years, and shut-in-wells will add to a dramatic falling off of production.

Tar Sands (Slav 2020)

This is also true of Canadian oil sand production, which uses steam to melt bitumen so it can flow into a well. The temperature and pressure must be maintained for long term production. Stopping the steam can make the reservoir lock up, result in damage leading to a permanent loss of production, and it can take many months of heating to get the tar sands flowing again (Rapier 2020, Wethe 2020).

Refineries need to be at 60 to 70% capacity

U.S. oil refineries are reducing production as demand for gasoline and diesel plummets. But there are engineering limits on how much production can be reduced, at some point the refinery has to shut down entirely once it goes below the 60 to 70% range, though a few large ones along the Gulf coast can operate at less than 50%. Most at risk are small refineries and those that mainly make gasoline. Most refineries have already cut production by 30%, and are close to having to shut down. Since demand is only 5 million barrels per day (bpd) of the 18 bpd refineries produce in the U.S., the longer the pandemic continues, the more plants that will be forced to shut down. After the pandemic, it is possible that 1 to 2 million bpd will be lost permanently since some refineries will not be able to afford to restart (Cunningham 2020, Osborne 2020, Powell 2020, Seba 2020).

Alaskan pipeline freezes up when not enough oil flowing

The Alaskan pipeline requires a throughput of over 400,000 barrels a day or the crude cools down so much that it becomes too thick for pumps to push it through and turns the pipeline into an 800-mile long Popsicle (Waldman 2015). This is because lower volumes cause crude to travel more slowly, losing heat along the way. At low temperatures, ice crystals form that can damage pumping equipment. Carbon molecules combine into paraffin, a waxy residue that, if not cleared out, can gunk up the line “like a big, frozen tube of ChapStick,” said Betsy Haines, Alyeska’s oil-movements director (Nussbaum 2017).

I haven’t been able to find any articles about this being a problem yet. It helps that California refineries cut back on their international purchases but still refine Alaskan and North Dakotan oil. Also Alyeska pipeline has cut crude flow 50,000 barrels per day, down from 500,000 barrels a day, so even more could be cut. And Alaska is also looking for new storage sites, such as Adak island, and the Port of Valdez, where the pipeline ends, has enough storage for two weeks of pipeline oil.

But the slowdown is delaying Alaskan oil projects on the North Slope which will be needed to keep production up enough to prevent the pipeline from freezing in the future.

Knock-on effects

Less oil production at low prices, refinery shut-downs, the high debt of many oil drillers, bankruptcies, the high costs of restarting wells and refineries, layoffs of tens of thousands of oil workers, and lost gas tax revenue (California alone is likely to lose more than $1.3 billion), has the potential to knock back wages and state budgets by billions of dollars. Many speculate that much of the oil industry will have to be nationalized to bring oil production back.

| Year | Crude oil + lease condensate |

| 2003 | 69,460 |

| 2004 | 72,595 |

| 2005 | 73,869 |

| 2006 | 73,621 |

| 2007 | 73,331 |

| 2008 | 74,301 |

| 2009 | 73,128 |

| 2010 | 74,894 |

| 2011 | 74,921 |

| 2012 | 76,399 |

| 2013 | 76,475 |

| 2014 | 78,390 |

| 2015 | 80,762 |

| 2016 | 80,848 |

| 2017 | 81,096 |

| 2018 | 82,928 |

| 2019 | 82,253 |

Peak oil sooner rather than later?

As Table 1 above shows, global peak crude oil production may have already happened in October of 2018 (Patterson 2019), so no matter how many projects and oil wells are started after the pandemic, oil decline may be greater than production once a recovery begins because of less production from shut in wells and tar sands, and the projects that were halted in 2020 unable to keep up with the decline rate of oil. In a depression, companies will go bankrupt, leaving fewer to start new projects with what little capital is available, mainly extremely expensive offshore and deep-sea that can take ten years to produce oil.

That means global peak oil decline — the downhill side of Hubbert’s curve, may be steeper after the pandemic in a recovery, though the resulting energy shortages are likely to be blamed on covid-19 and the financial system. Even with lower demand due to covid-19, at some point the amount of oil consumed crosses the depletion rate line resulting in energy shortages.

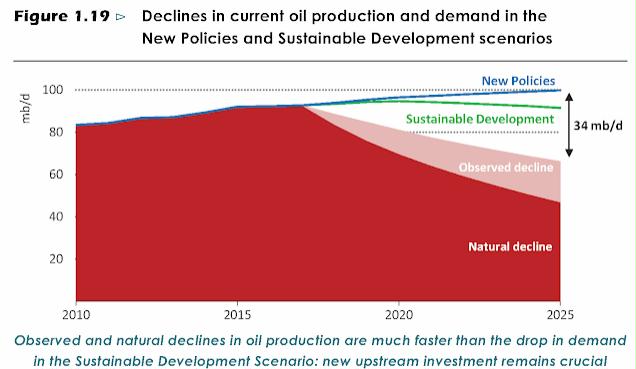

This could be soon, as shown in Figure 1.19 since the natural decline rate of oil goes from 85 mbp/d to about 45 mbp/d by 2025, and the observed decline to roughly 65 mbp/d with a 34 mb/d gap. The drop in demand from covid-19 will soon intersect with the depletion rate due to permanent loss from oil shut-ins, delayed projects, and a crippled financial system that can’t lend billions to oil and gas companies.

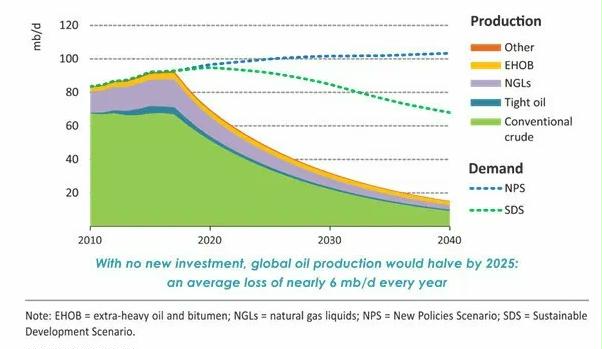

Here’s another chart from IEA 2018 illustrating the same problem. Without new investment, global oil production will be just half of what it is today by 2025 due to an average loss of 6 mb/d a year from oil decline. The IEA estimates a drop of 9 mb/d in 2020 due to covid, others just 6 mb/d, so within one to two years oil shortages may strike.

Since oil is the life-blood of civilization, that may result in nationalization of energy companies, and I hope, fair rationing of oil to agriculture and other essential needs rather than by price (i.e. “A summary of the U.S. standby 1980 oil rationing plan“).

Clearly it is past time for gaining skills for when the Great Simplification begins, such as consuming far less and starting victory gardens. At a national level, we should have already started a Manhattan project to return to organic farming, educating children in schools with farming skills, and hundreds of other actions proposed by postcarbon.org, transition towns, and other peak oil groups.

Ah well, the good thing is that fears of a climate changed hot house earth are not likely, indeed, CO2 ppm is likely to drop soon as fossils decline and what remains is absorbed by land and oceans. Too bad we wasted so much time and energy on “renewables”, which are rebuildable at best, with every single step of their life cycle dependent on finite fossil fuels.

References

Astakhova, A. 2020. Repair, abandon, burn: Russia explores options for historic oil cut. Reuters.

Boone, T. 2020. Half of Louisiana oil, gas wells could be shut in, 70% of industry jobs lost within 90 days, trade group survey shows. The Advocate.

Brower, D., et al. 2020. Oil industry facing historic production shutdown. Financial Times.

Cunningham, N. 2020. Oil refineries face shutdowns as demand collapses. EcoWatch.

Domonoske, C. 2020. Why the world is still pumping so much oil even as demand drops away. National Public Radio.

Hampton, L., et al. 2020. North Dakota regulators weigh financial help for state’s oil producers. Reuters.

Kimani, A. 2020. The Wave Of Shale Well Closures Has Finally Begun. oilprice.com

Messler, D. 2020. The oil wells that will never recover. oilprice.com

Nussbaum, A. 2017. Pipeline built to survive extremes can’t bear slow oil flow. Bloomberg news.

Osborne, J. 2020. Refineries face shutdowns as fuel demand drops. Houston Chronicle.

Patterson, R. 2020. Was 2018 the peak for crude oil production? Oilprice.com

Patzek, T. 2020. Private communication May 1, 2020.

Powell, B. J. 2020. Some of America’s oil refineries may be on brink of shutting. Bloomberg.

Rapier, R. 2020. Private communication May 1, 2020.

Rystad. 2020. American ‘Backyard’ Wells, The Flexible 11% Of The Us Onshore Oil Output, Now Face An Inflexible Choice. Rystad Energy.

Seba, E., et al. 2020. Oil refiners face reckoning as demand plummets. Reuters.

Slav, I. 2020. $0 Oil forces Canada to shut down crude production. Oilprice.com

Waldman, J. 2015. Rust. The longest war. Simon & Schuster.

Wethe, D. 2020. In historic oil shutdown, hard part is picking which well closes. Bloomberg.

3 Responses to Will covid-19 delay peak oil?