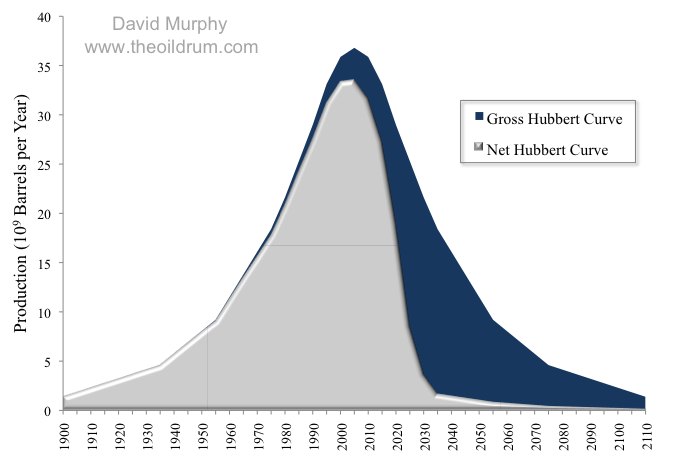

figure 1. The remaining oil is poor quality, and the energy to get this often remote oil so great that more and more energy (blue) goes into oil production itself, leaving far less — the grey area — available to fuel the rest of civilization. Source: 22 June 2009. David Murphy. The Net Hubbert Curve: What Does It Mean? theoildrum.

figure 1. The remaining oil is poor quality, and the energy to get this often remote oil so great that more and more energy (blue) goes into oil production itself, leaving far less — the grey area — available to fuel the rest of civilization. Source: 22 June 2009. David Murphy. The Net Hubbert Curve: What Does It Mean? theoildrum.

It is possible there will be a cliff, but not necessarily from the oil fields, but for non-geological reasons such as financial crashes, wars, and more that are listed in this post.

Geologically it may be a bit of a cliff and decline rapidly as the conventional oil is drained and unconventional heavy oil and deep sea oil flow at much slower rates.

Also, the harder the oil is to get, the more energy goes into obtaining the oil, leaving less energy for the rest of societies needs, throwing the social order into chaos which further reduces oil production. Climate change floods and hurricanes will be disabling or ruining refineries which are so expensive to build that none have been for 50 years now

Still though, maybe not as dramatic as figure 1. You decide. Various issues are listed below.

Related:

Stuart McMillen 2017 Diminishing returns: understanding ‘net energy’ and ‘EROEI’.

Alice Friedemann www.energyskeptic.com Author of Life After Fossil Fuels: A Reality Check on Alternative Energy; When Trucks Stop Running: Energy and the Future of Transportation”, Barriers to Making Algal Biofuels, & “Crunch! Whole Grain Artisan Chips and Crackers”. Women in ecology Podcasts: WGBH, Financial Sense, Jore, Planet: Critical, Crazy Town, Collapse Chronicles, Derrick Jensen, Practical Prepping, Kunstler 253 &278, Peak Prosperity, Index of best energyskeptic posts

Diminishing returns: understanding ‘net energy’ and ‘EROEI’

Oil is the master resource that makes all other activities and goods possible, including coal, natural, gas, transportation, agriculture, mining, manufacturing, and 500,000 products made from petroleum, using fossils to manufacture them. Such as plastics.

Before plateauing in 2006, the world production of conventional petroleum grew exponentially at 6.6% per year between 1880 and 1970. Although Hubbert drew symmetric rising and falling production curves, the declining side may be steeper than a bell curve, because the heroic measures we’re taking now to keep production high (i.e. infill drilling, horizontal wells, enhanced oil recovery methods, etc.), may arrest decline for a while, but once decline begins, it will be more precipitous because we extracted oil for NOW that would have been available LATER (Patzek 2007).

The cliff could be financial. Clearly you can’t “grow” the economy without increasing supplies of energy. GDP and oil production are almost perfectly correlated. You can print all the money or create all the credit you want, but try stuffing paper bills down your gas tank and see how far you go. Our financial system depends on endless growth to pay back debt, so when it crashes, there’s less credit available to finance new exploration and drilling, which guarantees an oil crisis further down the line.

Besides financial limits, there are political limits, such as wars over remaining resources. Now there’s the true existential threat, nuclear wars over the remaining oil. You preppers might think you have enough stuff, but a nuclear winter lasts for 10 years and knocks the ozone way back — you’ll also need 10 years of sunscreen and for crop yields to rise, since plants are damaged by UV also.

About 75% of the remaining oil is in OPEC nations, many unstable or near war-torn countries.

Most arctic oil is a RESOURCE that is not going to save us as you can see in my Arctic posts here.

Hubbert thought nuclear energy would fill in for fossil fuels

Gail Tverberg at ourfiniteworld writes “Hubbert only made his forecast of a symmetric downslope in the context of another energy source fully replacing oil or fossil fuels, even before the start of the decline. For example, looking at his 1956 paper, Nuclear Energy and the Fossil Fuels, we see nuclear taking over before the fossil fuel decline”.

The Power of Exponential Growth: Every 10 years we have burned more oil than all previous decades.

Another way of looking at this is what systems ecologists call Energy Returned on Energy Invested (EROEI). In the USA in 1930 an “investment” of the energy in 1 barrel of oil produced another 100 barrels of oil, or an EROEI of 100:1. That left 99 other barrels to use to build roads, bridges, factories, homes, libraries, schools, hospitals, movie theaters, railroads, cars, buses, trucks, computers, toys, refrigerators – any object you can think of, and 500,000 products use petroleum as a feedstock (see point #6). By 1970 EROEI was down to 30:1 and in 2000 it was 11:1 in the United States.

Charles A. S. Hall, who has studied EROEI for most of his career and published in Science and other top peer-reviewed journals, believes that society needs an EROEI of at least 12 to 14:1 to maintain our current level of civilization.

Because we got the easy oil first, we have used up 73% of the net energy that will ever be available, since the remaining half of the reserves require so much energy to extract.

Some other reasons why the cliff may even be steeper

It’s not our oil

About 80% of the good, high quality, cheap oil is in the Middle East. The U.S. has just 2% of reserves, but no worries, with thousands of nuclear weapons the Middle East will be eager to fork over their oil to America, though there are eight other nuclear nations who will also be demanding oil too. If the Sunnis and Shia nations aren’t at war with each other. The refineries and other extraction infrastructure there are easy targets for terrorists as well.

Export Land Model

Oil producing countries are using more and more of their own (declining) oil as population and industry grows within their own nation, and they too need to use more and more energy to get at their difficult oil. This results in a similar chart to the net energy cliff — suddenly there will hardly be any oil to buy on the world markets. See Jeffrey Brown’s article “The Export Capacity Index” (one of his statistics is that at the current rate of increasing imports of oil in India and China, these 2 countries alone would be importing 100% of available oil within 18 years).

Technology

As we improve our technology to get at the remaining oil, we make the cliff on the other side even steeper as we get oil now that would have been available to future generations.

Investments won’t be made because the payback times will lengthen

Since what remains is increasingly difficult and expensive to find, develop and extract, investment payback periods lengthen, eventually to impossibly long periods, or to periods that approach the useful life of the capital investment (effectively the same limit in the financial dimension as is an EROEI of 1). Which means it doesn’t matter how much might theoretically be underground, the only thing that matters is how much is actually going to be economically feasible to recover, and that is going to be considerably less than 100% of what might be theoretically and technically possible to recover.

Energy is becoming impossibly expensive, as you can see in these photos of The Tallest structure ever moved by Mankind, a Norwegian natural gas offshore platform.

Exponential growth of population

This makes whatever oil we have left last even less long.

Less oil obtained than could have been

Projects maximize a return on investment over a return of every last drop of possible oil. Making money is so important that a lot of offshore Gulf oil that could have been obtained if extracted more slowly remains in the ground to wastefully get it out as fast as possible to make a profit because that’s how our financial system operates: short-term gratification. But hey! That’s less carbon dioxide and global warming, so in a totally unintended orgy of insatiable greed the “there are no limits to growth” billionaires have ironically helped save the planet.

Flow Rate: An 8% or higher decline rate is likely

Breaking news in 2024: Exxon declared oil was declining at 15% — though less with investment (Exxon). According to the IEA, the world decline rate is 8.5% offset 4% by Enhanced Oil Recovery (which takes energy). Hook says oil will decline by 0.015 a year when all oil is decline for the giant oil fields, but at higher rates for smaller fields. Especially fracked oil at 80% over 3 years. That’s too fast for civilization to cope with.

Welcome to net zero! Great news since so many think that climate change is the ONLY problem.

Oil Chokepoints

And the problem isn’t just geological. There are several critical areas of the world where the flow of oil could be stopped by war or terrorism.

Wars, cyber-attacks, nuclear war, social chaos

By 2024, if not sooner, the unequal distribution of the remaining oil, starvation generated riots and pillaging, and collapsing economies have triggered war(s), massive migrations, and social chaos.

Shale oil and natural gas can not prevent the cliff. Martin Payne explains: “shale oil plays give us a temporary reprieve from what Bob Hirsch called the severe consequences of not taking enough action proactively with respect to peak oil. Without unconventional oil, what we wind up with is essentially Hubbert’s cliff instead of a Hubbert’s rounded peak”. But this won’t last: “Conventional oil–which was found in huge quantities, in giant fields in the 40’s and 50’s – well those giant fields had huge reserves and high porosities and permeabilities – meaning they would flow at very high rates for decades. This is in contrast to a relative few shale oil plays which have very low porosity and perm and which must be hydraulically fractured to flow. Conventional oil is just a different animal than unconventional oil; some unconventional oil wells have high initial rates of production, but all of these wells have high decline rates. Hubbert anticipated a lot of incremental efforts by the industry to make the right-hand or decline side of his curve a more gradual curve rather than a sharp drop (Andrews)

If any of these wars involve nuclear bombs, then at least a billion people will die.

The unrest has certainly curtailed the ability of oil companies to drill.

Even farmers may stop growing crops once city residents and roaming militias harvest whatever is grown (i.e. Africa as described in Parenti’s “Tropic of Chaos: Climate change and the new geography of violence).

Cyberattacks from China, Russia, and elsewhere have brought the electric grid down in the USA to prevent US military forces for trying to grab the remaining Saudi and Iraqi oil –the armed forces will be too busy trying to maintain order in the USA to venture abroad — nor could they go even if they wanted to, because Chinese and Russian drone attacks will have destroyed all of the United State oil refineries, and we have retaliated against them, so they won’t be able to refine oil either). We’ve also cyberattacked their electric grids. Most major cities have no sewage treatment or clean water. Nuclear power plants are melting down.

There’s no substitute for oil

First of all, whatever replaced oil would need a new distribution system of hundreds of thousands of new service stations. Billions of new vehicles. Pipes if a liquid. Biomass does not scale up. Well what am I doing, my books and this website explain why.

The thing is though — China started building LNG stations for their road trucks 30 years ago, and now 25% of their truck fleet is natural gas run. BUT, not farm tractors, excavators, mining haul trucks, logging, and the myriad other types of trucks out there.

Coal — why it can’t easily subsitute for oil

“Peak is dead” and the future of oil supply:

Steve Andrews (ASPO): You mention in your paper that natural gas liquids can’t fully substitute for crude oil because they contain about a third less energy per unit volume and only one-third of that volume can be blended into transportation fuel. In terms of the dominant use of crude oil—in the transportation sector—how significant is the ongoing increase in NGLs vs. the plateau in crude oil?

Richard G. Miller: The role of NGLs is a bit curious. You can run a car on it if you want, but it’s not a drop-in substitute for liquid oil. You can convert vehicle engines in fleets to run on liquefied gas; it’s probably better thought of as a fleet fuel. But it’s not a substitute for oil for my car. By and large, raising NGL production is not a substitution to making up a loss of liquid crude.

The only way I can see this being prevented or the end of oil delayed a few years, is if a government has already developed effective bio-weapons and doesn’t care if their own population suffers as well.

I feel crazy to have just written this very dire paragraph with just a few of the potential consequences, but the “shark-fin” curve made me do it!

Even though I’ve been reading and writing about peak everything since 2001, and the rise and fall of civilizations for 40 years, it is hard for me to believe a crash could happen so fast. It is hard to believe there could ever be a time that isn’t just like now. That there could ever be a time when I can’t hop into my car and drive 10,000 miles.

I can imagine the future all too well, but it is so hard to believe it.

Believe it.

References

Andrews, Steve. 29 July 2013. Interview with Martin Payne—Is Peak Oil Dead? ASPO-USA Peak Oil Review.

Exxon (2024) ExxonMobil Global Outlook. Executive Summary. https://corporate.exxonmobil.com/sustainability-and-reports/global-outlook/executive-summary

Patzek, T. 2007 How can we outlive our way of life? 20th round table on sustainable development of fuels, OECD headquarters.

11 Responses to Net Energy Cliff & the Collapse of Civilization