Preface. The USGS did a survey of coal in the U.S. in 1974 and announced that America had 250 years of coal left. In 2007, the National Research Council wrote a report suggesting 100 years was more likely due to “a combination of increased rates of production…transportation issues, recoverability, and location”, and that the USGS ought to re-survey the U.S. to find out.

Not until 2015 was a new survey done on the Powder River Basin (PRB) in Wyoming and Montana, which supplies 45% of U.S. coal. The USGS found that at best, 40 years of coal were left (35 years in 2020). Here’s how the USGS calculated this in Billions of Short Tons:

- 1,156 BST original resources (mostly coal that isn’t economic or technologically obtainable).

- 1,148 BST after subtracting out previously mined coal

- 179 BST geological constraints; subtract Environmental, societal, technological restrictions

- 162 BST Subtract too deep, too thin, high stripping ratios, mining technology limitations

- 25 BST 2% of original resource estimate after subtracting coal that is more expensive than the market value of coal

You would think that this would be huge news, but the only major news media it appeared in were U.S. News and World Report and Pittsburgh Post-Gazette.

Then in 2017, the Little snake river and red desert coal fields were assessed again. Originally there were 19.37 BST in resources, but at this point in time there is only 1% of this original resource, 167 million short tons of reserves that are economically and technologically obtainable (Shaffer 2017).

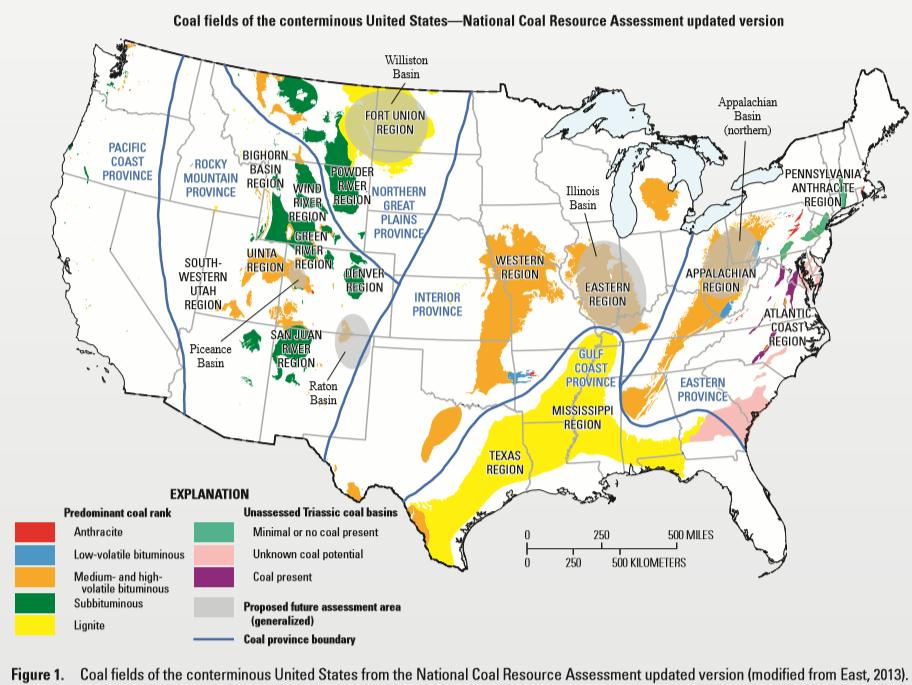

Two other basins have a lot of coal but have not been reassessed, the Appalachian and Illinois Basins. Plus the Raton and Piceance Basins in the Rocky Mountain Province.

Lignite has such low energy density that it is not worth evaluating the lignite basins of Williston in the Northern Great Plains Province and the Gulf Coast Province (USGS 2017b).

The QUALITY needs to be considered. Tad Patzek, former chairman of the Department of Petroleum and Geosystems Engineering at the University of Texas, Austin, found that energy-contentwise, global coal peak may have occurred already in 2011 (Patzek et al. 2010). Still though, a lot of coal left, though to the extent it depends on diesel trucks and other petroleum inputs, and plentiful water, production is likely to decline as oil declines. Also as overburden increases, the “stripping ratio”, the tons of earth must be removed to get at the coal to mine it will take more and more energy at a time when energy is declining. Many thick coal seams curve deeper into the earth making them more energy intense to mine.

Alice Friedemann www.energyskeptic.com Author of Life After Fossil Fuels: A Reality Check on Alternative Energy; When Trucks Stop Running: Energy and the Future of Transportation”, Barriers to Making Algal Biofuels, & “Crunch! Whole Grain Artisan Chips and Crackers”. Women in ecology Podcasts: WGBH, Jore, Planet: Critical, Crazy Town, Collapse Chronicles, Derrick Jensen, Practical Prepping, Kunstler 253 &278, Peak Prosperity, Index of best energyskeptic posts

***

Matthew Brown. Feb. 23, 2016 Amid coal market struggles, less fuel worth mining in US. Associated Press.

This AP article is based on a USGS report that “presents the final results of the first assessment of both coal resources and reserves for all significant coal beds in the entire Powder River Basin, northeastern Wyoming and southeastern Montana. The basin covers about 19,500 square miles, and contains the largest resources of low-sulfur, low-ash, subbituminous coal in the United States. It is the single most important coal basin in the United States. In 2012, almost 420 million short tons were produced from this basin, which was about 42 percent of the total coal production in the United States.

BILLINGS, Mont. (AP) — Vast coal seams dozens of feet thick that lie beneath the rolling hills of the Northern Plains once appeared almost limitless, fueling boasts that domestic reserves were sufficient to power the U.S. for centuries.

But an exhaustive government analysis says that at current prices and mining rates the country’s largest coal reserves, located along the Montana-Wyoming border, will be tapped out in just a few decades.

The finding by the U.S. Geological Survey upends conventional wisdom on the lifespan for the nation’s top coal-producing region, the Powder River Basin.

“You’re looking at a forty-year life span, maximum, for Powder River coal,” said USGS geologist Jon Haacke, one of the authors of the analysis.

Claims that the U.S. had reserves sufficient to last as long as 250 years came from greatly inflated estimates of how much coal could be mined, Haacke added. They were based on data put out by the U.S. Energy Department last updated comprehensively in the 1990s.

USGS study leader James Luppens said the Energy Department estimates were in “desperate need of revision.” But there are no immediate plans to do so or to incorporate the new findings, said Lance Harris, a supervisor with the Energy Department’s coal team.

For decades, the agency has made little distinction between coal reserves that reasonably could be mined and those that could not.

The perception of coal’s abundance began to shift in 2008, when the USGS team released initial data that called into question the longevity of U.S. supplies.

Yet assertions that America was the “Saudi Arabia of coal” persisted, including in 2010 by President Barack Obama and continuing in recent months by industry supporters. The Department of Energy states on its website that based on current mining rates, “estimated recoverable coal reserves would last about 261 years.”

Leslie Glustrom, an environmental activist from Boulder, Colorado, who has urged the Energy Department to change how it tallies up the nation’s untapped resources, said she believes the end for the Powder River Basin is coming even more rapidly than the USGS study suggests. And she said it has little to do with a “war on coal” that Republicans frequently accuse the Obama administration of waging.

“This is not a political problem. It’s a geologic problem,” Glustrom said.

It’s been four decades since its low-sulfur content first made Powder River Basin coal the fuel of choice among electric utilities that needed to cut their sulfur dioxide pollution. Sprawling strip mines in the region have since removed more than 11 billion tons of coal, the equivalent of 95 million loaded rail cars.

To gauge how much coal remains, USGS researchers since 2004 have analyzed the geology from minerals removed by 30,000 holes drilled deep into the earth. The data revealed almost 1.1 trillion tons of coal buried across the 20,000-square mile Powder River Basin. Of that, only 162 billion tons is within coal seams considered thick enough and close enough to the surface to make extracting them worthwhile.

The amount drops even more drastically when the coal’s quality is factored in and compared against current prices. When the USGS data was first compiled, in 2013, Powder River Basin coal was selling for $10.90 a ton, resulting in about 23 billion tons being designated as economically-recoverable.

With coal prices down to $9.55 a ton, the reserve estimate has plummeted to just 16 billion tons, Haacke said. That’s equivalent to 40 years at the current production pace of 400 million tons annually from the basin’s 16 mines in Wyoming and Montana.

Meanwhile, mining costs have trended up. That’s been driven by an increase in the “stripping ratio” — how many tons of earth must be removed to mine a ton of coal as the region’s thick coal seams curve gradually deeper into the earth.

“It became two to one, then three to one, then three-and-a-half to one,” Haacke said of the stripping ratio. “That becomes a dirt-moving operation rather than a coal-moving operation.”

Luppens, James A., et al. 2015. Coal Geology and Assessment of Coal Resources and Reserves in the Powder River Basin, Wyoming and Montana. USGS.

This report presents the final results of the first assessment of both coal resources and reserves for all significant coal beds in the entire Powder River Basin, northeastern Wyoming and southeastern Montana. The basin covers about 19,500 square miles, exclusive of the part of the basin within the Crow and Northern Cheyenne Indian Reservations in Montana. The Powder River Basin, which contains the largest resources of low-sulfur, low-ash, subbituminous coal in the United States, is the single most important coal basin in the United States. The U.S. Geological Survey used a geology-based assessment methodology to estimate an original coal resource of about 1.16 trillion short tons for 47 coal beds in the Powder River Basin; in-place (remaining) resources are about 1.15 trillion short tons. This is the first time that all beds were mapped individually over the entire basin. A total of 162 billion short tons of recoverable coal resources (coal reserve base) are estimated at a 10:1 stripping ratio or less. An estimated 25 billion short tons of that coal reserve base met the definition of reserves, which are resources that can be economically produced at or below the current sales price at the time of the evaluation. The total underground coal resource in coal beds 10–20 feet thick is estimated at 304 billion short tons.

This report is groundbreaking as it provides the first published maps of the individual coal beds for the entire PRB.

Prior resource assessments relied on net coal thickness maps for only selected beds. Although net thickness maps are sufficient for estimating in-place (remaining) resources, the mapping of all individual beds is necessary for conducting economic studies to determine the coal reserve base for the Powder River Basin. The coal reserve base includes those resources that are currently (October 2014) economic (reserves), but also may encompass those parts of a resource that have a reasonable potential for becoming economically available. Thus, the coal reserve base provides a more realistic estimate of the portion of in-place resources that are potentially recoverable, which is important from a national energy standpoint. A key to the success of this current assessment was incorporating as much data as practical from the recent, extensive coal bed methane development in the basin. The interpretation of these new data proved critical to the development of a comprehensive geologic model needed for estimating coal resources and reserves in the Powder River Basin. A total of 29,928 drill holes were used for this assessment.

There is often confusion regarding the use of the terms coal resources and coal reserves as they relate to assessments. Although the two terms have been used interchangeably, there are significant differences between the definitions. Coal resources include those in-place tonnage estimates determined by summing the volumes for identified resources and hypothetical resources, using coal zones of a minimum thickness and within certain depth limits (commonly 0–2,000 feet [ft] deep) (Pierce and Dennen, 2009). Coal reserves are a subset of coal resources and are considered economically minable at the time of classification (Wood and others, 1983).

The cumulative results from the four PRB assessment areas are 24.5 BST of coal reserves and a total recoverable coal resource (coal reserve base) of 162 BST in coal beds greater than 5 ft in thickness and less than a 10:1 stripping ratio

So far 11 billion tons of coal filling 95 million rail cars have been removed. Yes, there’s a lot of coal down there: 1.1 trillion tons, but only 162 billion tons are thick and close enough to the surface to justify mining them. Remember, money is an abstract concept that can’t move your car even an inch if stuffed into the gas tank. No matter what the price of coal, if it takes more energy to mine and transport than the energy contained within the coal, it’s an energy sink and the mine will be shut down.

References

NRC. 2007. Coal. Research and Development to support national energy policy National Research Council.

Patzek, T., et al. 2010. A global coal production forecast with multi-Hubbert cycle analysis.

Energy 35: 3109–3122

Shaffer, B. N., et al. 2017. Assessment of coal resources and reserves in the Little Snake River Coal Field and Red Desert Assessment Area, Greater Green River Basin, Wyoming. Fact Sheet 2019-3053. United States Geological Survey.

Singh S (2021) China power crunch spreads, shutting factories and dimming growth outlook. Reuters. https://www.reuters.com/world/china/chinas-power-crunch-begins-weigh-economic-outlook-2021-09-27/

USGS. 2017b. Assessing U.S. coal resources and reserves. Fact sheet 2017-3067. United States Geological Survey.

Xu M (2022) Analysis: Quantity over quality – China faces power supply risk despite coal output surge. Reuters

https://www.reuters.com/markets/commodities/quantity-over-quality-china-faces-power-supply-risk-despite-coal-output-surge-2022-06-21/