Preface. Copper is essential for modern civilization and any hope of migrating to renewable energy, since solar, wind, tidal, hydro, biomass and geothermal use 5 times more copper than traditional power generation in fossil and nuclear power plants. Nothing matches copper for electric wiring, which is used in power generation, power transmission & distribution, telecommunications, vehicles, cookware,and hundreds of kinds of electrical equipment. It’s used on integrated circuits, printed circuit boards, vacuum tubes, magnetrons in microwave ovens, electric motors. Copper is used in buildings for its corrosion resistance in roofs, flashings, gutters, and so on. It’s used in ships to protect against barnacles and mussels, and aquaculture and health care due to its antimicrobial, corrosion-resistance, and prevention of biofouling. Wikipedia Copper has even more uses.

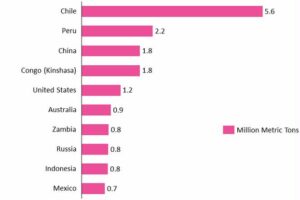

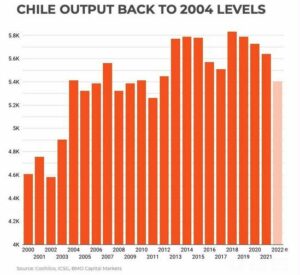

As you can see in Figure 1, Chile produced the most copper of any nation — a quarter of all copper in 2021. Figure 2 shows that in 2022, Chilean production dropped to 2004 levels due to water scarcity, declining grades of ore, depletion rates, tax increases, regulatory uncertainty and other factors.

Figure 1. Largest copper producing countries 2021 (million metric tons). Source: www.usgs.gov

Figure 2. Chile copper production 2000-2022

Elon Musk told a closed-door Washington conference of miners, regulators and lawmakers that he sees a shortage of EV minerals coming, including copper and nickel (Scheyder 2019). Other rare metals used in cars include neodymium, lanthanum, terbium, and dysprosium (Gorman 2009).

Learn more about copper and other mineral shortages here: Michaux S (2021) The Mining of minerals and the Limits to growth. Geological Survey of Finland.

Alice Friedemann www.energyskeptic.com Author of Life After Fossil Fuels: A Reality Check on Alternative Energy; When Trucks Stop Running: Energy and the Future of Transportation”, Barriers to Making Algal Biofuels, & “Crunch! Whole Grain Artisan Chips and Crackers”. Women in ecology Podcasts: WGBH, Jore, Planet: Critical, Crazy Town, Collapse Chronicles, Derrick Jensen, Practical Prepping, Kunstler 253 &278, Peak Prosperity, Index of best energyskeptic posts

***

Zaremba H (2022) The Energy Transition Could Be Derailed By A Looming Copper Shortage. Oilprice.com

“…a looming copper shortage threatens to completely derail the clean energy transition, and by extension, climate pledges across the world. According to a recent report from S&P Platts, if copper shortfalls follow projected trends, climate goals will be “short-circuited and remain out of reach.”

Copper is particularly effective in a wide range of low-carbon alternatives because of its relatively high electrical conductivity and low reactivity. It’s not that traditional energy production and transmission and gas-powered vehicles don’t use copper in their manufacturing – it’s just that renewables and electric vehicles require a whole lot more of it. “An EV requires 2.5 times as much copper as an internal combustion engine vehicle,” reports CNBC. “Meanwhile, solar and offshore wind need two times and five times, respectively, more copper per megawatt of installed capacity than power generated using natural gas or coal.”

S&P projects that current levels of demand will nearly double by the year 2035, climbing to a whopping 50 million metric tons. That figure will climb to more than 53 million metric tons by 2050, which amounts to “more than all the copper consumed in the world between 1900 and 2021.

Richard A. Kerr. February 14, 2014. The Coming Copper Peak. Science 343:722-724.

Production of the vital metal will top out and decline within decades, according to a new model that may hold lessons for other resources.

If you take social unrest and environmental factors into account, the peak could be as early as the 2020s

As a crude way of taking account of social and environmental constraints on production, Northey and colleagues reduced the amount of copper available for extraction in their model by 50%. Then the peak that came in the late 2030s falls to the early 2020s, just a decade away.

After peak Copper

Whenever it comes, the copper peak will bring change. Graedel and his Yale colleagues reported in a paper published on 2 December 2013 in the Proceedings of the National Academy of Sciences that copper is one of four metals—chromium, manganese, and lead being the others—for which “no good substitutes are presently available for their major uses.”

If electrons are the lifeblood of a modern economy, copper makes up its blood vessels. In cables, wires, and contacts, copper is at the core of the electrical distribution system, from power stations to the internet. A small car has 20 kilograms (44 lbs) of copper in everything from its starter motor to the radiator; hybrid cars have twice that. But even in the face of exponentially rising consumption—reaching 17 million metric tons in 2012—miners have for 10,000 years met the world’s demand for copper.

But perhaps not for much longer. A group of resource specialists has taken the first shot at projecting how much more copper miners will wring from the planet. In their model runs, described this month in the journal Resources, Conservation and Recycling, production peaks by about mid-century even if copper is more abundant than most geologists believe.

Predicting when production of any natural resource will peak is fraught with uncertainty. Witness the running debate over when world oil production will peak (Science, 3 February 2012, p. 522).

The team is applying its depletion model to other mineral resources, from oil to lithium, that also face exponentially escalating demands on a depleting resource.

The world’s copper future is not as rosy as a minimum “125-year supply” might suggest, however. For one thing, any future world will have more people in it, perhaps a third more by 2050. And the hope, at least, is that a larger proportion of those people will enjoy a higher standard of living, which today means a higher consumption of copper per person. Sooner or later, world copper production will increase until demand cannot be met from much-depleted deposits. At that point, production will peak and eventually go into decline—a pattern seen in the early 1970s with U.S. oil production.

For any resource, the timing of the peak depends on a dynamic interplay of geology, economics, and technology. But resource modeler Steve Mohr of the University of Technology, Sydney (UTS), in Australia, waded in anyway. For his 2010 dissertation, he developed a mathematical model for projecting production of mineral resources, taking account of expected demand and the amount thought to be still in the ground. In concept, it is much like the Hubbert curves drawn for peak oil production, but Mohr’s model is the first to be applied to other mineral resources without the assumption that supplies are unlimited.

Exponential growth

Increasing the amount of accessible copper by 50% to account for what might yet be discovered moves the production peak back only a few years, to about 2045 — even doubling the copper pushes peak production back only to about 2050. Quadrupling only delays peak until 2075.

Copper trouble spots

The world has been so thoroughly explored for copper that most of the big deposits have probably already been found. Although there will be plenty of discoveries, they will likely be on the small side.

“The critical issues constraining the copper industry are social, environmental, and economic,” Mudd writes in an e-mail. Any process intended to extract a kilogram of metal locked in a ton of rock buried hundreds of meters down inevitably raises issues of energy and water consumption, pollution, and local community concerns.

Civil war and instability make many large copper deposits unavailable

Mudd has a long list of copper mining trouble spots. The Reko Diq deposit in northwestern Pakistan close to both Iran and Afghanistan holds $232 billion of copper, but it is tantalizingly out of reach, with security problems and conflicts between local government and mining companies continuing to prevent development. The big Panguna mine in Bougainville, Papua New Guinea, has been closed for 25 years, ever since its social and environmental effects sparked a 10-year civil war that left about 20,000 dead.

Are we about to destroy the largest salmon fishery in the world for copper?

On 15 January the U.S. Environmental Protection Agency issued a study of the potential effects of the yet-to-be-proposed Pebble Mine on Bristol Bay in southwestern Alaska. Environmental groups had already targeted the project, and the study gives them plenty of new ammunition, finding that it would destroy as much as 150 kilometers of salmon-supporting streams and wipe out more than 2000 hectares of wetlands, ponds, and lakes.

Gold and Oil have already peaked

Copper is far from the only mineral resource in a race between depletion—which pushes up costs—and new technology, which can increase supply and push costs down. Gold production has been flat for the past decade despite a soaring price (Science, 2 March 2012, p. 1038). Much crystal ball–gazing has considered the fate of world oil production. “Peakists” think the world may be at or near the peak now, pointing to the long run of $100-a-barrel oil as evidence that the squeeze is already on.

Coal likely to peak in 2034, all fossil fuels by 2030, according to Mohr’s model

Fridley, Heinberg, Patzek, and other scientists believe Peak Coal is already here or likely by 2020.

Coal will begin to falter soon after, his model suggests, with production most likely peaking in 2034. The production of all fossil fuels, the bottom line of his dissertation, will peak by 2030, according to Mohr’s best estimate. Only lithium, the essential element of electric and hybrid vehicle batteries, looks to offer a sufficient supply through this century. So keep an eye on oil and gold the next few years; copper may peak close behind.

References

Gorman, S. August 30, 2009. As hybrid cars gobble rare metals, shortage looms. Reuters.

Scheyder, E. 2019. Exclusive: Tesla expects global shortage of electric vehicle battery minerals. Reuters.

3 Responses to Peak Copper