This is a book review of Pitron’s “The rare metals war”. To produce the metals and minerals to make a transition to wind, solar, nuclear and so on would be incredibly destructive and polluting. A fifth of China’s arable land is laden with toxic heavy metals from mining and industry. And huge amounts of CO2 are emitted by the fossils used to mine, smelt, fabricate, and transport the metal ores and extracted metals for these short lifespan devices. They’re rebuildable, not renewable once finite fossil fuels decline.

The U.S. and other nations are frightened that China is the sole provider of many essential minerals, and demanding that rare earth and other mines be opened within our own nation so that we can control them. But so what if the Chinese have cornered the market on many essential minerals as well as vertically to make products from them? Why would we destroy our land, water, and air in doing so? No doubt because a few people will make billions of dollars for a very short while, leaving toxic mining tailings and mining pits that will pollute water tables and rivers for tens of millennia of future generations.

Related posts:

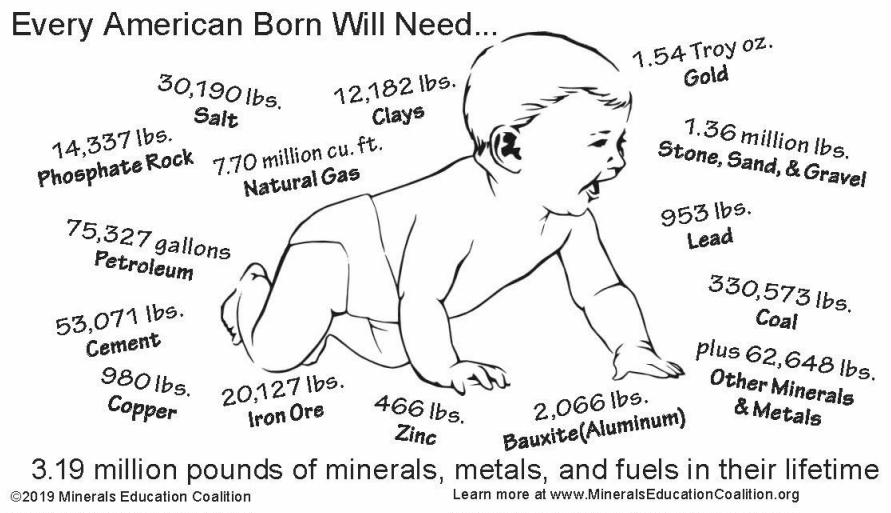

And there simply aren’t enough minerals on earth to make a transition to “renewables”:

Alice Friedemann www.energyskeptic.com Women in ecology author of 2021 Life After Fossil Fuels: A Reality Check on Alternative Energy best price here; 2015 When Trucks Stop Running: Energy and the Future of Transportation”, Barriers to Making Algal Biofuels, & “Crunch! Whole Grain Artisan Chips and Crackers”. Podcasts: Crazy Town, Collapse Chronicles, Derrick Jensen, Practical Prepping, KunstlerCast 253, KunstlerCast278, Peak Prosperity

***

Pitron G. 2020. The Rare Metals War: The Dark Side of Clean Energy and Digital Technologies. Scribe US.

The solution seems obvious: reopen rare metal production in the United States, Brazil, Russia, South Africa, Thailand, Turkey, and even in the ‘dormant mining giant’ of France. Enter the next predicament: mining these rare minerals is anything but clean! Says Pitron, ‘Green energies and resources harbor a dark secret.’ And he’s quite right: extracting and refining rare metals is highly polluting, and recycling them has proved a disappointment.

We are therefore faced with the paradox that the latest and greatest technology (and supposedly the greenest to halt the ecological countdown) relies mostly on ‘dirty’ metals. Thus, information and communication technologies actually produce 50% more greenhouse gases than air transport!

From the 1970s, we turned our sights to the superb magnetic, catalytic, and optical properties of a cluster of lesser-known rare metals found in terrestrial rocks in infinitesimal amounts. Some of the members of this large family sport the most exotic names: rare earths, vanadium, germanium, platinoids, tungsten, antimony, beryllium, fluorine, rhenium, tantalum, niobium, to name but a few. Together, these rare metals form a coherent subset of some thirty raw materials with a shared characteristic: they are often associated with nature’s most abundant metals.

Eight and a half tonnes of rock need to be purified to produce a kilogram of vanadium; sixteen tonnes for a kilogram of cerium; fifty tonnes for the equivalent in gallium; and a staggering 1,200 tonnes for one miserable kilogram of the rarest of the rare metals: lutecium. On average a kilogram of rock has 120 milligrams of vanadium, 66.5 milligrams of cerium, 19m milligrams of gallioum, & 0.8 of lutecium

a minute dose of these metals emits a magnetic field that makes it possible to generate more energy than the same quantity of coal or oil. So less pollution, and at the same time a lot more energy.

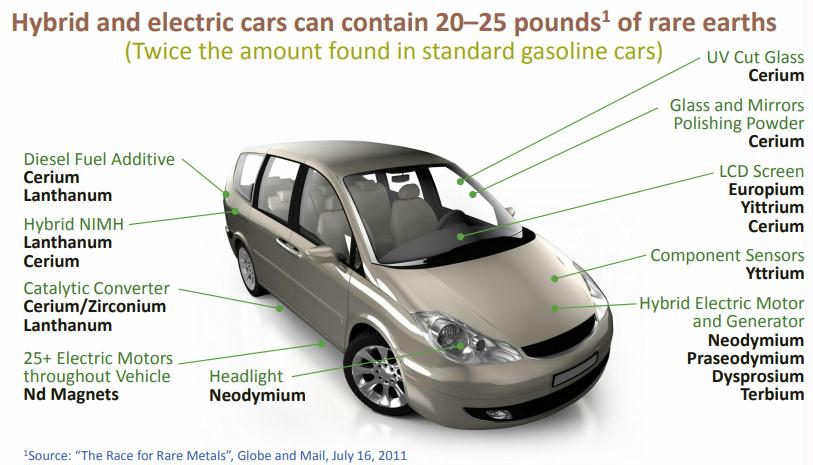

(wind turbines, solar panels, and electric cars) are packed with rare metals to produce decarbonized energy that travels through high-performance electricity grids to enable power savings. Yet these grids are also driven by digital technology that is heavily dependent on these same metals.

Enter the military, which is pursuing its own energy transition. Or strategic transition. While generals are unlikely to lose sleep over the carbon emissions of their arsenals, as oil reserves dwindle they will nevertheless have to consider the possibility of war without oil. Back in 2010, a highly influential American think tank instructed the US army to end its reliance on fossil fuels by 2040 (Parthemore 2010 Fueling the future force). How will they do this? By using renewable energy, and by raising legions of electrically powered robots. These remote-controlled weapons, which can be recharged using renewable-energy plants, would be a formidable destructive force and solve the conundrum of getting fuel to the front line (the plan is small renewable energy plants less vulnerable to attacks see Bardi’s extracted). This form of combat is, in fact, already colonizing new virtual territories: cyber armies alone could win future conflicts by targeting the enemy’s digital infrastructure and altering its telecommunication networks.

China has used barely credible chicanery to position itself as the sole supplier of the most strategic of the rare metals. Known as ‘rare earths’, they are difficult to substitute, and the vast majority of industrial groups cannot do without them. Most rare earths cannot be substituted. See “Commission to the european parliament, the council… on the 2017 list of critical raw materials for the EU” page 4+ and Annex 1 which has substitution indexes EI/SR

An ecological observation: our quest for a more ecological growth model has resulted in intensified mining of the Earth’s crust to extract the core ingredient — rare metals — with an environmental impact that could prove far more severe than that of oil extraction. Changing our energy model already means doubling rare metal production approximately every 15 years.

At this rate, over the next thirty years we will need to mine more mineral ores than humans have extracted over the last 70,000 years.

The continued existence of the most sophisticated Western military equipment (robots, cyberweapons, and fighter planes, including the US’s supreme F-35 stealth jet) also partly depends on China’s goodwill. This has US intelligence leaders concerned, especially as one high-ranking US army officer states that ‘only war can now stop Beijing controlling the South China Sea’.

By seeking to break free from fossil fuels and turn an old order into a new world, we are in fact setting ourselves up for a new and more potent dependence.

We thought we could free ourselves from the shortages, tensions, and crises created by our appetite for oil and coal. Instead, we are replacing these with an era of new and unprecedented shortages, tensions, and crises.

From tea to black oil, nutmeg to tulips, saltpetre to coal, commodities have been a backdrop to every major exploration, empire, and war, often altering the course of history. (see Bill laws 2010 Fifty plants that changed the course of history)

They are associated with abundant metals found in the Earth’s crust, but in minute proportions. For instance, there is 1,200 times less neodymium and up to 2,650 times less gallium than there is iron.

Every year, 160,000 tonnes of rare-earth metals are produced — 15,000 times less than annual iron production of two billion tonnes. Likewise, 600 tonnes of gallium are produced annually, which is 25,000 times less than the 15 million tonnes of annual copper production.

For almost three centuries we have been working tirelessly at developing new engines with increasingly impressive power-to-weight ratios: the more compact and less resource-intensive they are, the greater their mechanical energy output. Enter rare metals.

Magnets are now — to a vast majority of electric engines — what pistons have been to steam and internal-combustion engines. Magnets have made it possible to manufacture billions of engines, both big and small, capable of executing certain repetitive movements (Note: note, not all engines have them, i.e. heating, ventilation, air-con. But electric vehicles and some wind turbines have them)

Without realizing it, our societies have become completely magnetized. To say that the world would be significantly slower without magnets containing rare metals is not an understatement. (These super magnets are produced with the rare-earth minerals neodymium and samarium alloyed with other metals, such as iron, boron, and cobalt. Magnets are usually 30% neodymium and 35% samarium. The scientific community refers to them as ‘rare-earth magnets’.

Electric engines did more than make humanity infinitely more prosperous; they made the energy transition a plausible hypothesis. Thanks to them, we have discovered our ability to maximize movement — and therefore wealth — without the use of coal and oil.

That is merely scratching the surface of rare metals, for they possess a wealth of other chemical, catalytic, and optical properties that make them indispensable to myriad green technologies. An entire book could be written on the details of their characteristics alone. They make it possible to trap car-exhaust fumes in catalytic converters, ignite energy-efficient light bulbs, and design new, lighter, and hardier industrial equipment, improving the energy efficiency of cars and planes, and the semiconducting properties regulate the flow of electricity in digital devices.

Between the ages of antiquity and the Renaissance, human beings consumed no more than seven metals; this increased to a dozen metals over the twentieth century; to twenty from the 1970s onwards; and then to almost all eighty-six metals on Mendeleev’s periodic table of elements.

The potential demand for rare metals is exponential. We are already consuming over two billion tonnes of metals every year — the equivalent of more than 500 Eiffel Towers a day.

By 2035, demand is expected to double for germanium; quadruple for tantalum; and quintuple for palladium. The scandium market could increase nine-fold, and the cobalt market by a factor of 24. (Marscheider-Wiedemann 2016 ‘raw materials for emerging technologies’. German mineral resources agency (DERA), Federal institute for geosciences and natural resources (BGR).

The 10,000 or so mines spread across China have played a big role in destroying the country’s environment. Pollution damage by the coal-mining industry is well documented. But barely reported is the fact that mining rare metals also produces pollution, and to such an extent that China has stopped counting contamination events. In 2006, some 60 companies producing indium — a rare metal used in the manufacture of certain solar-panel technologies — released tonnes of chemicals into the Xiang River in Hunan, jeopardizing the meridional province’s drinking water and the health of its residents. (ft. 2006. Environmental disaster strains China’s social fabric). In 2011, journalists reported on the damage to the ecosystems of the Ting River in the seaside province of Fujian, due to the operation of a mine rich in gallium — an up-and-coming metal for the manufacture of energy-efficient light bulbs.

in Ganzhou, where I landed, the local press recently reported that the toxic waste dumps created by a mining company producing tungsten — a critical metal for wind-turbine blades — had obstructed and polluted many tributaries of the Yangtze River.

There is nothing refined about mining. It involves crushing rock, and then using a concoction of chemical reagents such as sulphuric and nitric acid. ‘It’s a long and highly repetitive process,’ explains a French specialist. ‘It takes loads of different procedures to obtain a rare-earth concentrate close to 100 per cent purity.’ That’s not all: purifying a single tonne of rare earths requires using at least 200 cubic metres of water, which then becomes saturated with acids and heavy metals. (2016 Dwindling supplies of rare earth metals hinder China’s shift from coal). Will this water go through a water-treatment plant before it is released into rivers, soils, and ground water? Very rarely.

As rare metals have become ubiquitous in green and digital technologies, the exceedingly toxic sludge they produce has been contaminating water, soil, the atmosphere, and the flames of blast furnaces

Today, China is the leading producer of 28 mineral resources that are vital to our economies, often representing over 50% of global production. It also produces at least 15% of all mineral resources, other than platinum and nickel.

Ten per cent of its arable land is contaminated by heavy metals, and 80 per cent of its ground water is unfit for consumption. Only five of the 500 biggest cities in China meet international standards for air quality,

The Pascua Lama example inspired the entire Latin American mining sector. Large-scale lithium mining

now sparks environmental activism. As with any mining activity, it requires staggering volumes of water, diminishing the resources available to local communities living on water-scarce salt flats.

Extracting minerals from the ground is an inherently dirty operation. The way it has been carried out so irresponsibly and unethically in the most active mining countries casts doubt on the virtuous vision of the energy and digital transition. A recent report by the Blacksmith Institute identifies the mining industry as the second-most-polluting industry in the world, behind lead-battery recycling, and ahead of the dye industry, industrial dumpsites, and tanneries (2016 the world’s worst pollution problems, the toxics beneath our feet). It has moved up one rung since the 2013 rankings, in which the much-maligned petrochemical industry doesn’t even crack the top ten.

We need to be far more skeptical about how green technologies are manufactured. Before they are even brought into service, the solar panel, wind turbine, electric car, or energy-efficient light bulb bear the ‘original sin’ of its deplorable energy and environmental footprint. We should be measuring the ecological cost of the entire lifecycle of green technologies.

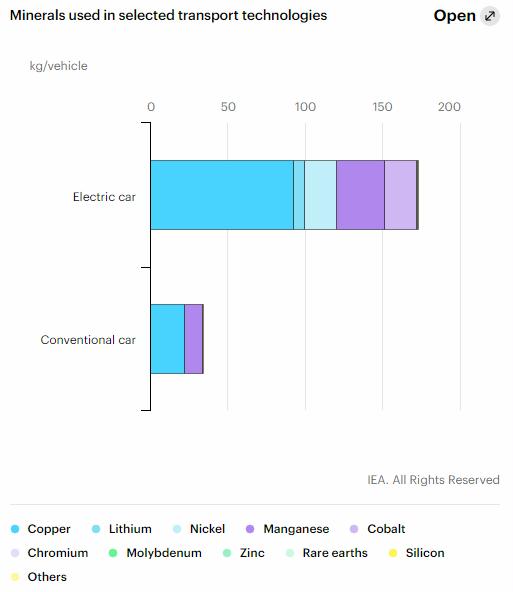

Comparing the carbon impact of a conventional fuel-driven car against that of an electric car, Aguirre (2012) found that the production of the supposedly more energy-efficient electric car requires far more energy than the production of the conventional car. This is mostly on account of the electric car’s very heavy lithium-ion battery.

Then there’s the composition of the lithium-ion battery: 80 per cent nickel, 15 per cent cobalt, 5 per cent aluminum, as well as lithium, copper, manganese, steel, and graphite. (2016 Extraordinary raw materials in a Tesla Model S’ Visual capitalist).

Industrializing electric vehicles is three to four times more energy-intensive than industrializing conventional vehicles.

The caveat of this research is that it was conducted on a medium-sized electric-vehicle battery with a 120-km range in a market that is growing so fast that none of the cars being rolled out today have a range below 300 km. According to Petersen, a battery that is powerful enough to drive a vehicle for 300 km emits twice as much carbon as production-phase emissions — a figure we can then triple for batteries with a 500-km range. Therefore, over its entire lifecycle, an electric car may produce as much as three-quarters of the carbon emissions produced by a petrol car.

John Petersen’s conclusion? Electric vehicles may be technically possible, but their production will never be environmentally sustainable. This concurs with similar research conducted along the same lines. The 2016 report by the French Environment & Energy Management Agency (ADEME) finds: ‘The energy consumption of an electric vehicle [EV] over its entire lifecycle is, on the whole, similar to that of a diesel vehicle.

Digital technology requires vast quantities of metals. Every year, the electronics industry consumes 320 tonnes of gold and 7,500 tonnes of silver; accounts for 22 per cent (514 tonnes) of global mercury consumption; and up to 2.5% of lead consumption. The manufacture of laptops and mobile phones alone swallows up 19% of the global production of rare metals such as palladium, and 23% of cobalt. This excludes the other forty or so metals, on average, contained in mobile phones.

This is just the tip of the iceberg, for the energy and digital transition will require constellations of satellites — already promised by the heavyweights of Silicon Valley — to put the entire planet online. It will take rockets to launch these satellites into space; an armada of computers to set them on the right orbit to emit on the correct frequencies and encrypt communications using sophisticated digital tools; legions of super calculators to analyze the deluge of data; and, to direct this data in real time, a planetary mesh of underwater cables, a maze of overhead and underground electricity networks, millions of computer terminals, countless data-storage centers, and billions of tablets, smartphones, and other connected devices with batteries that need to be recharged.

Feeding this digital leviathan will require coal-fired, oil-fired, and nuclear power plants, windfarms, solar farms, and smart grids — all infrastructures that rely on rare metals.

Unlike traditional metals such as iron, silver, and aluminum, rare metals are not used in their pure state in green technologies. Rather, the manufacturers in the energy and digital transition are increasingly partial to alloys, for the properties of several metals combined into composites are far more powerful than those of one metal on its own. For example, the combination of iron and carbon gives us steel, without which most skyscrapers would not be standing. The fuselage of the Airbus A380 is in part composed of GLARE (Glass Laminate Aluminum Reinforced Epoxy), a robust fiber–metal laminate with an aluminum alloy that lightens the aircraft. And the magnets contained in certain wind turbine and electric vehicle motors are a medley of iron, boron, and rare-earth metals that enhance performance.

Alloys need to be ‘dealloyed’ to be recycled. Manufacturers have to use time-consuming and costly techniques involving chemicals and electricity to separate rare-earth metals from other metals.

Metals in Japan’s waste dumps are hidden treasures that no economic model today can retrieve. It is the prohibitive cost of recovering rare metals — a cost that currently exceeds their value — that is holding industry back. The price of recycled metals could be competitive were it not for the fact that commodity prices have been structurally low since the end of 2014.

For manufacturers, there is little point in recycling large quantities of rare metals. Why rummage through e-waste dumps when it is infinitely cheaper to go straight to the source? It is not surprising, therefore, that only 18 of the 60 most used industrial metals have a recycling rate above 50% (aluminum, cobalt, chrome, copper, gold, iron, lead, manganese, niobium, nickel, palladium, platinum, rhenium, rhodium, silver, tin, titanium, zinc).

An additional three metals have a recycling rate over 25% (magnesium, molybdenum, iridium), and three more a rate of over 10% (ruthenium, cadmium, tungsten). The recycling rate of the remaining thirty-six metals is below 10 per cent (UNEP 2011 Recycling rates of metals: a status report. United nations). For rare metals such as indium, germanium, tantalum, and gallium, as well as certain rare-earth metals, the rate is between 0 and 3 per cent.

Even recycling nearly 100% of lead has not been enough to stop its mining and extraction, because of perpetually growing demand.

‘Green’ technologies require the use of rare minerals whose mining is anything but clean. Heavy metal discharges, acid rain, and contaminated water sources — it borders on being an environmental disaster. Put simply, clean energy is a dirty affair.

While Europe produced nearly 60% of the world’s heavy metals in 1850, its momentum steadily declined to produce no more than 3% today. Mining production in the US hasn’t fared any better: after peaking in the 1930s, accounting for close to 40% of global production, it now represents around 5%.

The United States, when they realized after the Second World War that their own oil reserves would not be enough to meet their growing energy needs, turned to the Kingdom of Saudi Arabia and its extraordinary crude oil reserves. The ‘Quincy Pact’, signed on 14 February 1945 between President Roosevelt and the Saudi king, Ibn Saud, gave Washington privileged access to Riyad’s petroleum in exchange for military protection.

There are many more examples of export restrictions, as observed by the Organization for Economic Co-operation and Development (OECD). Its most recent report on trade in raw materials gives an inventory of all basic product export restrictions declared around the world, and identifies 900 such cases between 2009 and 2012.

Trump took the Chinese policy of slapping quotas on rare metals exports to reignite — and amplify — resource sovereignty across five continents. ‘China galvanized the nationalism of resources,’ says an American expert, ‘not only on its own territory, but all over the world.’ From that point, it was no longer a question of if new trade crises would occur, but rather when they would occur.

We know that an electrical charge coming into contact with the magnetic field of a magnet generates a force that creates movement. Traditional magnets made out of the iron derivative ferrite needed to be massive to generate a magnetic field powerful enough for more sophisticated applications

By orchestrating the transfer of magnet factories, the Chinese accelerated the migration of the entire downstream industry — the businesses that use magnets — to the Baotou free zone. ‘Now they’ve moved onto producing electric cars, phosphors, and wind turbine components. The entire value chain has moved!’ This makes Baotou much more than just another mining area. The Chinese prefer to call it the ‘Silicon Valley of rare earths’. The city hosts over 3,000 companies, fifty of which are backed by foreign capital, manufacture high-end equipment, and employ hundreds of thousands of workers who generate revenues of up to €4.5 billion every year.

Thus, rare-metal restrictions did more than serve China’s sporadic embargos. The second stage of its offensive is far more ambitious: China is erecting a completely independent and integrated industry, starting with the foul mines in which begrimed laborers toil, to state-of-the-art factories employing high-flying engineers. And it’s perfectly legitimate. After all, the Chinese policy of moving up the value chain is not dissimilar from the viticulture strategy of winemakers in the Napa Valley in California, or the Barossa Valley in South Australia. As one Australian expert put it, ‘The French don’t sell grapes, do they? They sell wine. The Chinese feel like rare earths are to them what vineyards are to the French.’

Industrial robots require terrific amounts of tungsten. China has always produced this rare metal in abundance, but there are other tungsten mines around the world, ensuring supply diversity for manufacturers.

During the 1990s, the Chinese machined their own cutting tools — ‘Some hammers, a few drills … really crumby tools,’ said an Australian consultant. But they wanted to move up the value chain in this area as well. ‘They drove down tungsten prices [from 1985 to 2004], hoping that Westerners concerned about getting their raw materials at the best price would buy exclusively from the Chinese, and that competing mines would shut down.’ We can guess what could have happened next: the Middle Kingdom — now the hegemonic power in tungsten production — would have used the same blackmail tactic to force the Germans to move their factories as close as possible to the raw materials. The Chinese would have crushed any German lead in the cutting-tools industry, and would then have made off with the machine-tools segment — a pillar of the Mittelstand.

The Germans saw the Chinese coming, and aligned instead with other tungsten producers (Russia, Austria, and Portugal, among others). ‘They preferred paying more for their resources to sustain the alternative mines and not depend on the Chinese

By now a pattern is emerging, and it is being applied to molybdenum and germanium, a journalist I met in Beijing told me. Lithium and cobalt should go the same way. ‘They’re using the same industrial policy for iron, aluminum, cement, and even petrochemical products,’ warned a German industrialist. In China, there is even talk of applying this policy to composite materials — new materials resulting from alloys of several rare minerals.

The West is starting to put words to what has happened with China: whoever has the minerals owns the industry. Our reliance on China — previously limited to raw materials — now includes the technologies of the energy and digital transition that rely on these raw materials.

Bangka is the world’s biggest producer of tin — a grey-silver metal essential to green technology and modern electronics, such as solar panels, electric batteries, mobile phones, and digital screens. Every year, over 300,000 tonnes of tin are mined around the world. Indonesia represents 34% of global production, making it the biggest exporter of this high-tech mineral, which is nevertheless not considered rare. The archipelago recognized the value of this outstanding mineral: from 2003, as a spokesperson for one of Indonesia’s biggest mining houses, PT Timah, explained: ‘Tin became the first mineral to be used in an embargo.’ It would be the first of a very long series of embargos. From 2014, all of Indonesia’s mineral resources — from sand to nickel, and diamonds to gold — were no longer exported in raw form. As explained by Indonesian authorities, ‘The minerals we don’t sell now will be sold tomorrow as finished products.’

As in China, this policy was a powerful way to generate wealth. By some calculations, preserving the added value in this way quadrupled profits on iron, increased profits on tin and copper sevenfold, bauxite profits by a factor of as much as eighteen, and nickel profits by as much as twenty.

The reality is that China’s definition of indigenous innovation is reworking and adjusting imported technologies to develop its own technologies. ‘The plan is considered by many international technology companies as a blueprint for technology theft on a scale the world has never seen,’ a US report published in 2010 asserted. It continued: ‘With these indigenous innovation industrial policies, it is very clear that China has switched from defense to offense.’ The Chinese applied this very tactic to rare-earth magnets: it enticed — or forced — foreign businesses onto its territory under the guise of joint ventures, and then launched a process of ‘co-innovation’ or ‘re-innovation’.

This is how China purloined the technologies of Japanese and US super-magnet manufacturers. Having reaped the benefits of the invention of others, Beijing built an ecosystem of endogenous creation to ‘move from factory to laboratory’, starting with a variety of research programs that began in the early 1980s.

China has many weaknesses: relative to its population size, it has far fewer researchers than France or the UK; there remain colossal challenges to education; while rural China — a massive part of the country — is sidelined from this momentum.

Some of China’s characteristics do little to aid its cause. While an interventionist regime may have allowed a strategic state to flourish, it leaves no room for any deviation. How can an administration that employs two million government agents to restrict online freedom of expression encourage creativity? A government that stymies the freedom to criticize — and therefore to think differently — nurtures a potent culture of copying, and turns the lack of inventiveness into a building block. ‘The Chinese have the technology, but they are stuck in an organizational and intellectual logic that dates back to 1929,’ concluded a former Western diplomat posted to Beijing.

No one could have imagined what happened next,’ admits a European journalist based in Beijing. China’s astounding progress in the electronics, aerospace, transport, biology, machine tools, and information technology sectors caught everyone off guard — including the upper realms of the Communist Party. In aerospace, China has already put a robot on the moon, and it plans to send an astronaut as well by 2036. In 2018 alone it launched some 37 space missions, dethroning Russia as the US’s main competitor in the new space race. Beijing wants to move beyond the demand side of new technologies by trading its status of being a skills consumer for that of a skills supplier. In 2018, China filed a staggering 1.4 million patents — more than any other country in the world.

It wants to explore the still-unknown properties of rare earths to develop the applications of the future. Some of its university research programs are advanced enough to both astonish and alarm a researcher at the US Department of Defense: ‘Losing our supply chain was tragic enough. But now China is busy getting a ten-year head start on us. We could easily find ourselves without the intellectual property rights of the applications of the future that matter the most.’

Beijing has already designed a stealth fighter jet more advanced than that of its Japanese rivals. From 2013 to 2018, the most powerful super computer on the planet came from China. This earned China the title of ‘the leading IT power globally’. It has also put into orbit the first quantum communications satellite with reputedly impregnable encryption technology.

Donald Trump succeeded in reaching the White House because he could count on the voters in the de-industrialized states of the Rust Belt. In these swing states, where votes can tip the result of a national election, the Republican candidate vigorously denounced the anti-competitive practices of the Chinese and offshoring, and emphasized the need to protect the US from the industrial war spearheaded by Beijing.

Around the twelfth century BC, in the south of modern-day Turkey, the Hittites melted an even lighter and more widely available metal — iron — to forge weapons that were more powerful and easier to wield. This, say some historians, led ultimately to the European conquest of the Americas. Then came steel, which in 1914 tipped Europe into an industrial war. The iron and carbon alloy was used to make shell casings, the first modern fragmentation grenades, hardier helmets for soldiers, and armored tanks — all of which contributed to the bloodbath that was the First World War.

Every time a people, civilization, or state masters a new metal, it leads to exponential technical and military progress — and deadlier conflicts. Now it is rare metals, and in particular rare earths, that are changing the face of modern warfare.

The premise of the Sixteen-Character Policy was pragmatic: given the difficulty in procuring war technologies due to the US arms embargo, China would buy foreign companies whose know-how in civil applications could be repurposed for more hostile ends. In the years that followed, this strategy would lead to an extraordinary proliferation of Chinese espionage against the US. According to a former US counterintelligence agent, ‘China’s intelligence services are among the most aggressive [in the world] at spying on the US.’ A European researcher explained that Beijing’s interest was in two technologies in particular: those used in network-centric warfare, allowing armies to use information systems to their advantage; and smart bombs, containing the very magnets produced by Magnequench.

Nicknamed the ‘aircraft carrier killer’ and operational since 2010, the DF-21D has been central to Beijing’s policy of prohibiting access to the South China Sea these past few years. Having control over this strip of ocean running from its coasts to the south of Vietnam would increase China’s strategic leverage, and give it access to prodigious quantities of offshore hydrocarbon resources, as well as an eye on the comings and goings of half the world’s oil. This scenario is unacceptable to Japan, South Korea, Vietnam, and the Philippines, but especially to the US, which several years ago planned to position 60% of its warships in the Pacific by 2020. Barely a week goes by without a naval incident of some sort, making the territory the powder keg that could ignite a Sino-American conflict. Beijing’s capability in advanced ballistic technologies has already shifted the balance of power in the South China Sea.

Wouldn’t the US be vulnerable against an adversary that is also the source of its most critical defense components? And would China not take timely advantage of this dependence, either by playing the rare-earths card during trade negotiations, or by hampering America’s military efforts?

The US Department of the Interior has identified no less than 35 minerals considered critical to the country’s national security and economy.

Another broader question of national security that the US has asked itself time and again: how does it prevent the infiltration of Trojan horses in the microchips and other semi-finished goods containing rare metals sold by the Chinese around the world, including to Western armies? A 2005 report by the Pentagon even raised the possibility of electronic systems that are used extensively in US weapons being infected by malware that could disrupt combat equipment mid-operation.

Digital technologies, the knowledge economy, green energies, electricity logistics and storage, and the new industries of space and defense are diversifying and expanding our need for rare metals exponentially. Not a day goes by that we don’t discover a new miracle property of a rare metal, or unprecedented ways of applying it.

By 2050, keeping up with market growth will take ‘3,200 million tonnes of steel, 310 million tonnes of aluminium, and 40 million tons of copper’.

Indeed, wind turbines guzzle more raw materials than previous technologies: ‘For an equivalent installed capacity, solar and wind facilities require up to 15 times more concrete, 90 times more aluminum, and 50 times more iron, copper, and glass than fossil fuels or nuclear energy.’ According to the World Bank, which carried out its own study in 2017, the same applies to solar and hydrogen electricity systems, which ‘are in fact significantly more material intensive in their composition than current traditional fossil-fuel-based energy supply systems’.

We will consume more minerals than in the last 70,000 years, or five hundred generations before us. Our 7.5 billion contemporaries will absorb more mineral resources than the 108 billion humans who have walked the Earth to date.

Just as we have a list of threatened animal and plant species, we may soon have a red list of metals nearing depletion. At the current rate of production, we run the risk of exhausting the viable reserves of 15 or so base and rare metals in under 50 years (antimony, tin, lead, gold, zinc, strontium, silver, nickel, tungsten, bismuth, copper, boron, fluorite, manganese, selenium); we can expect the same for five additional metals (including currently abundant iron, rhenium, cobalt, molybdenum, rutile) before the end of the century. Surprising critical materials 2017 (in French probably)

In the short to medium term, we are also looking at potential shortages in vanadium, dysprosium, terbium, europium, and neodymium (2013. Critical metals in the path towards the decarbonization of the EU energy sector. Joint research centre of the European commission).

What if climate change drastically reduces the water reserves needed to extract and refine minerals?

China is ready to stockpile what it produces — for itself. It already consumes three-quarters of the rare earths it extracts — despite being the sole supplier — and, given its appetite, it may well use up all of its rare earths by 2025 to 2030. The output of any of China’s future rare metals mines inside or outside its borders will not go to the highest bidder, but will be taken off the market and channeled to Chinese clients only.

A lack of mining infrastructure. ‘It takes 15 to 25 years to get a mine up and running, from the moment we say “Let’s do it” to the time we start extracting minerals,’ explained an expert. But according to some projections, a new rare-earths mine will need to be opened every year from now until 2025 to accommodate growth needs. Any delay will cost us dearly in the next two decades. ‘We do not produce enough metals today to meet our future needs,’ stated an American specialist. ‘The numbers just don’t add up.

Lastly, the energy return on investment (EROI) — the ratio of the energy needed to produce metals to the energy generated using the same metals — is against us. Extracting one to five grams of gold requires crushing one tonne of rocks — up to 10,000 (times?) more rocks than the metal itself,

Rare metals require increasing amounts of energy to be unearthed and refined. Producing these metals takes 7 to 8 per cent of global energy (UNEP 2013 Environmental risks and challenges of Anthropogenic metals flows and cycles: a report of the working group on the global metal flows)

Ugo Bardi (extracted) writes that, in Chile, ‘The energy required to mine copper rose by 50% from 2001 and 2010, but the total copper output increased just 13% … The US copper mining industry has also been energy hungry. The limits to mineral extraction are not limits of quantity; they are limits of energy.

For the same amount of energy, mining companies today extract up to 10 times less uranium than they did 30 years ago — and this is true for just about all mining resources.

Countries are therefore striking up new alliances for rare metals exploration: Tokyo and Delhi have concluded an export agreement for rare earths mined in India; Japan has deployed its rare-earth diplomacy offensive in Australia, Kazakhstan, and Vietnam; Chancellor Angela Merkel has made numerous trips to Mongolia to sign mining partnerships; South Korean geologists have made official their discussions with Pyongyang on the joint exploration of a deposit in North Korea; France is carrying out prospecting activities in Kazakhstan; Brussels has engaged in economic diplomacy to encourage mining investment with partner states; and in the US, Donald Trump has expressed his interest in buying Greenland — rich in iron, rare earths, and uranium (Cilizza. 2019. 5 questions about Donald Trump’s interest in buying Greenland, answered. CNN)

It is a new world that China wants to fashion to its liking, as corroborated by Vivian Wu: ‘Given the growth of our domestic demand, we will not be able to meet our own needs within the next five years.’ Beijing has therefore begun its own hunt for rare metals, starting in Canada, Australia, Kyrgyzstan, Peru, and Vietnam.

Many observers believe that Beijing was manipulating prices. ‘The Chinese do absolutely whatever they want on the rare-earths market,’ deplored Christopher Ecclestone. They can decide to stockpile just as they can decide to slash prices by flooding the market. It has become a headache for non-Chinese mining companies to design long-term economic models with a behemoth like China intentionally destabilizing the market. How can they escape bankruptcy when mineral prices are five to ten times lower than forecasted?

The vast majority of alternative projects that emerged after the embargo have been scuppered. The Californian mine Molycorp went bankrupt and reopened, but then had to export its minerals to China for processing due to a lack of adequate refinery facilities. The Lynas mine in Australia has long been running at a reduced speed, and is being kept afloat by Japan out of its refusal to eat from the hand of its sworn enemy. In Canada, entire battalions of mining companies have shut their doors. Mining licenses — once worth their weight in gold — now go for no more than a few hundred dollars.

When Beijing doesn’t manage to hamper operations, it deploys a strategy of acquiring competing mines. Despite the Chinalco group expressing interest in buying the Mountain Pass mine in California, it was acquired in 2017 by MP Mine Operations LLC — a consortium whose investors include a Chinese mining group, Shenge Resources Shareholding Co. Ltd. China also barges its way into the partial ownership of competing companies: in Greenland, the same group acquired a sizeable stake in the operations of the Kvanefjeld site, rich in rare earths and uranium. What better way to build up economic intelligence and possibly undermine the emergence of a serious rival? It’s as if Saudi Arabia, which holds the largest proven reserves of oil worldwide, took it upon itself to control the oil reserves of the now thirteen members of OPEC.

When China is not undermining the capitalistic foundations of alternative mines, it takes diplomatic action to torpedo them. Such is the case of Kyrgyzstan: the chairman of Stans Energy accused China of putting pressure on the Kyrgyz president to withdraw the Canadian mining house’s operating licence without any valid reason.

An environmental nonprofit organization in the US has listed a staggering 500,000 abandoned mines (NYT 2015 When a river runs orange). According to the Environmental Protection Agency, ‘Mining pollutes approximately 40% of the headwaters of Western watersheds and … cleaning up these mines may cost American taxpayers more than $50 billion.

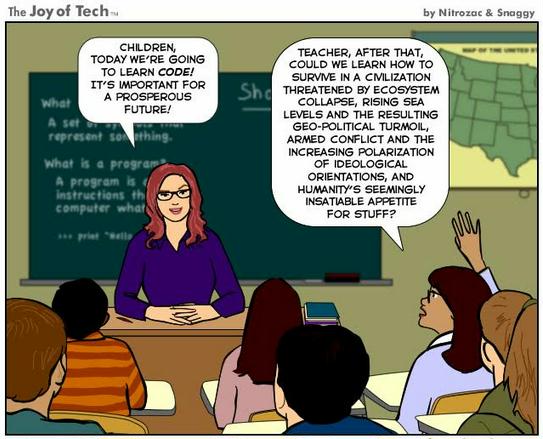

They condemn the effects of the very world they wish for. They do not admit that the energy and digital transition also means trading oilfields for rare metals deposits, and that the role of mining in the fight against global warming is a reality we have to come to terms with.

As for the entire rare metals industry, the Government Accountability Office in the US believes it would take at least 15 years to rebuild the industry. (US GAO warns it may take 15 years to rebuild U.S. Rare Earths Supply Chain. Mineweb. 2010). While Western countries wait …, their mining culture is wasting away. Training is insufficient, and young people are no longer drawn to careers in geology. As the last of the talents disappear, there is a real risk that the sector’s revival may be decades in the making.

Relocating our dirty industries has helped keep Western consumers in the dark about the true environmental cost of our lifestyles, while giving other nation-states free rein to extract and process minerals in even worse conditions than would have applied had they still been mined in the West, without the slightest regard for the environment.

The effects of returning mining operations to the West would be positive. We would instantly realize — to our horror — the true cost of our self-declared modern, connected, and green world. We can well imagine how having quarries ‘in our backyard’ would put an end to our indifference and denial, and drive our efforts to contain the resulting pollution. Because we would not want to live like the Chinese, we would pile pressure onto our governments to ban even the smallest release of cyanide, and to boycott companies operating without the full array of environmental accreditations.

We would protest en masse against the disgraceful practice of the planned obsolescence of products, which results in more rare metals having to be mined, and we would demand that billions be spent on research into making rare metals fully recyclable.

Perhaps we would also use our buying power more responsibly, and spend more on eco-friendlier mobile phones, for instance. In short, we would be so determined to contain pollution that we would make astounding environmental progress and wind back our rampant consumption. Nothing will change so long as we do not experience, in our own backyards, the full cost of attaining our standard of happiness.

Some countries have even resorted to subterfuge: China has gone as far as building artificial islands in the South China Sea so that it can claim exclusive use of the surrounding marine territory.

The exponential growth of our need for rare metals will increasingly commoditize the world’s backwaters, which have long been spared from humanity’s greed. But it will be decades before mining in the ocean becomes technically and ecologically possible.

References

Aguirre K, et al. 2012. Lifecycle analysis comparison of a battery electric vehicle and a conventional gasoline vehicle. UCLA institute of the Environment & Sustainability.

PEBI. 2016. World’s worst pollution problems. The toxins beneath our feet. Pure Earth Blacksmith Institute.

RealClearEnergy. 2017. Cost of Elon Musk’s dream much higher than he and others imagine.

FURTHER READING

‘The Asia-Pacific Maritime Security Strategy: achieving US national security objectives in a changing environment’, US Department of Defense, 2015

Grasso, Valerie Bailey. 2013. Rare earth elements in national defense: background, oversight issues, and options for congress. Congressional research service.

USGS. 2018. Interior releases 2018’s final list of 35 minerals deemed critical to U.S. national security and the economy.

Manchin, Capito. 2019. Reintroduce rare earth element advanced coal technologies act. U.S. Senate committee on Energy & natural resources.

UNEP. 2013. Environmental risks and challenges of anthropgenic metals flows and cycles. United Nations environment program.

IEA. 2014. World energy outlook 2014 factsheet: power and renewables.

Petersen. 2016. How large lithium-ion batteries slash EV benefits.

VIDEO: Guillaume, Pitron “Rare earths: the dirty war” 2012

Miodownik, BBC 2017 “secrets of the super elements”

Rare Earth & Platinum-group metals are used in many products:

- Magnets (Neodymium, Praseodymium, Terbium, Dysprosium, Samarium): Motors, disc drives, MRI, power generation, microphones and speakers, magnetic refrigeration

- Metallurgical alloys (Lanthanum, Cerium, Praseodymium, Neodymium, Yttrium): NimH batteries, fuel cells, steel, lighter flints, super alloys, aluminum/magnesium

- Phosphors (Europium, Yttrium, Terbium, Neodymium, Erbium, Gadolinium, Cerium, Praseodymium): display phosphors CRT, LPD, LCD; fluorescent lighting, medical imaging, lasers, fiber optics

- Glass and Polishing (Cerium, Lanthanum, Praseodymium, Neodymium, Gadolinium, Erbium, Holmium, Baryte): polishing compounds, decolorizers, UV resistant glass, X-ray imaging

- Catalysts (Lanthanum, Cerium, Praseodymium, Neodymium, ruthenium, rhodium, palladium, osmium, iridium, platinum): petroleum refining, catalytic converter, diesel additives, chemical processing, industrial pollution scrubbing

- Other applications:

- Aerospace: Beryllium

- Aluminum production (fluorspar), alloys (Magnesium, Scandium)

- Catalytic converters (Cerium)

- Cathode-ray tubes (Gadolinium, Terbium, Yttrium)

- Ceramics (Fluorspar)

- Computer chips (Indium)

- Defense (Neodymium, Praseodymium, Dysprosium, Terbium, Europium, Yttrium, Lanthanum, Lutetium, Scandium, Samarium)

- Drilling oil and gas (Baryte)

- Electric vehicles (Niobium) electric motors (Samarium)

- Electronics and electricity (Tungsten)

- Fertilizers

- Fire retardants (Antimony)

- Fiber optics (Germanium, Erbium)

- Fuel cells (SOFC use lanthaneum, cerium, prasedymium)

- Healthcare (Baryte, Erbium)

- Hybrid engines (Dysprosium)

- Integrated circuits (silicon metal)

- Lasers (Europium, Holmium, Ytterbium)

- LCD screens (Indium)

- Lenses (Lanthanum)

- Light-emitting diodes (LEDs) (Gallium)

- Lighting (Lanthanum, Samarium, Europium, Scandium)

- Luminescent compounds (Promethium)

- Metallurgy and alloys (Baryte, Cerium)

- Nuclear power (Europium, Gadolinium, Cerium, Yttrium, Sm, Erbium, Beryllium, Niobiumm /sanaruyn)

- Oil refinery (Cerium)

- Optics (fluorspar)

- Phones, computers, hybrid vehicles, magnets (Cobalt)

- Photovoltaic cells (Germanium, silicon metal)

- Pigments

- Satellites (Niobium)

- Semi-conductors (gallium, Holmium)

- Solar panels: copper, indium, gallium, selenide (CIGS) solar cells

- Steel production (coking coal, fluorspar, vanadium, Ytterbium)

- Superconductors (high-temperature) Bismuth, Thulium, Yttrium

- Superconductive compounds (Lanthanum)

- Telecommunications and electronics (Beryllium)

- Thermoelectric auto generators (Bismuth)

- Water Treatment

- Wind turbines (7 of 10 most powerful: V164 by Vestas, AD-180 & ADS-135 by Adwen, SWT 8.0 Siemens, 6 MW Haliade General Electric, SCD 6.0 Ming Yang, & Dong Fang/Hyundai 5.5 MW)