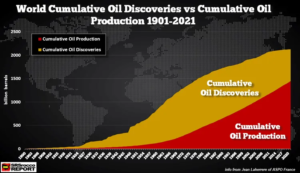

Figure 1. Conventional Oil Production vs. Conventional Oil Discoveries. NOTE: These conventional oil reserves DO NOT include Heavy oil or Oil Sands.

Figure 1. Conventional Oil Production vs. Conventional Oil Discoveries. NOTE: These conventional oil reserves DO NOT include Heavy oil or Oil Sands.

Preface. I don’t know who wrote what follows, I was on the end of a chain of many forwarded emails. It appears to be a summary of the newsletter “Steve Angelo, SRSrocco in Energy, Silver Members on November 23, 2022″. Interesting if true…

Alice Friedemann www.energyskeptic.com Author of Life After Fossil Fuels: A Reality Check on Alternative Energy; When Trucks Stop Running: Energy and the Future of Transportation”, Barriers to Making Algal Biofuels, & “Crunch! Whole Grain Artisan Chips and Crackers”. Women in ecology Podcasts: WGBH, Jore, Planet: Critical, Crazy Town, Collapse Chronicles, Derrick Jensen, Practical Prepping, Kunstler 253 & 278, Peak Prosperity, Index of best energyskeptic posts

I will show THREE CHARTS on why the Peak in Conventional Oil Production is the ENERGY CLIFF.

The Global Economy has grown on the back of high-quality, high EROI, conventional oil production. While we have added a significant amount of U.S. shale oil and Alberta oil sands, this low-quality unconventional oil supply cannot sustain our High-Tech Global Economy that needs a much higher EROI of Oil to pay for everything. Thus, there is no coincidence that world debt has doubled from $150 trillion in 2008 to over $303 trillion in 2021 to bring on this lower-quality oil.

Let’s start with Cumulative Oil Discoveries vs. Cumulative Crude Oil & Condensate Production. You will notice a troubling sign. The Graph of Cumulative Conventional Oil Discoveries has been leveling off in the past decade while production (consumption) continues higher. So, if we look at conventional oil production vs. conventional oil discoveries… We have already PAST THE POINT OF NO RETURN (figure 1). The chart above shows that conventional oil discoveries are not moving up in the same trend as cumulative oil production. Thus, the world is devouring its past conventional oil discoveries (remaining reserves) much faster than it’s replacing them. In a nutshell, the world is EATING ITS SEED CORN of oil. GOOD GRIEF…

The data from the following two charts came from Jean Laherrère. I started using data from Rystad, but Jean let me know the figures Rystad puts out are likely INFLATED. Furthermore, these charts are based upon my analysis and may differ slightly from Jean regarding remaining reserves, but not by much. Again, this analysis is to provide a Fundamental View of the Conventional Oil Energy Cliff.

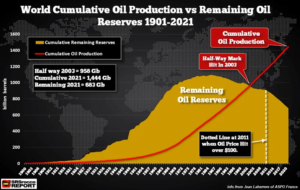

The following chart (figure 2) shows cumulative conventional oil production vs. remaining oil reserves… and this is very important to understand. If we subtract the cumulative oil production from cumulative discoveries, we get the REMAINING OIL RESERVES. This is not a pretty picture.

Of course, we will continue to discover more conventional oil reserves, but this won’t be much compared to the past. Again, that is why the cumulative oil discovery trend in the first chart, figure 1, is PLATEAUING.

Returning to figure 2, you will notice that the HALFWAY Mark for the Remaining Reserves and Cumulative Oil Production was met in 2003. Thus, it’s no coincidence that the oil price began to surge after that period as the world peaked in conventional oil production (Shown in figure 3 below).

According to Jean’s data, my analysis shows the HALFWAY mark at 958 billion barrels (Gb). With Cumulative oil production at 1,444 Gb and with only 683 Gb of Remaining Reserves, we have reached the CONVENTIONAL OIL ENERGY CLIFF. We are now really devouring conventional oil reserves at a breakneck speed.

Since 2003, the world has been consuming more of its remaining oil reserves than it has been discovering. This picked up speed, especially after 2011, shown in the WHITE DOTTED LINE… and where the oil price averaged over $100 a barrel for the next three years.

Figure 2. Conventional oil production versus remaining oil reserves

Figure 2. Conventional oil production versus remaining oil reserves

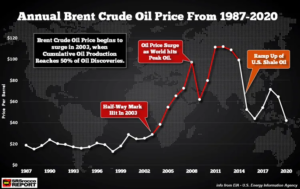

The last chart (figure 3) shows there is a relationship between the fundamental factors of Conventional Oil Production vs. Discoveries and Remaining Reserves to the Brent Crude Oil Price. Figure 3 Annual Brent Crude oil price from 1987-2020

Figure 3 Annual Brent Crude oil price from 1987-2020

We can see that the average annual Brent Crude Oil price began to surge after 2003 when the world reached the HALFWAY Mark as we reached peak conventional oil production. As the world continued to consume more of its reserves than it was being replaced, the price jumped to over $100 and stayed there for three years until U.S. shale oil production came on in a BIG WAY.

So, with the world being saved by U.S. Shale oil and Canadian Oil Sands, the Brent Crude Oil price declined to allow BUSINESS AS USUAL to continue. Unfortunately, U.S. shale oil production has likely peaked or will peak shortly, and will collapse by 2030.

This is why I continue to stick with my forecast of the ENERGY CLIFF beginning circa 2025.

PS. I wrote this in 2013, so you can’t say I didn’t warn you!

Here we are at the energy cliff, approaching the time we warned everyone about. Wiley coyote is over the edge, legs wheeling in the air.

Here we are at the energy cliff, approaching the time we warned everyone about. Wiley coyote is over the edge, legs wheeling in the air.

In California it’s warm and sunny, home prices are going up, Silicon Valley is booming again. Almost impossible to believe it won’t continue this way! Not even after having studied this more than the average person.

I don’t dare talk about peak oil and resource depletion in my social circles. At this point I’m told point blank no one wants to venture into my dark world, and I think some are hoping I’ll apologize about being wrong now that fracking has brought us energy independence (NOT).

What’s coming is so much bigger than any tragedy in history, than any war, epidemic — a 6th extinction event that may nail us as well.

So you could consider peak fossil fuels a blessing, a chance at not going extinct, since the remaining fossil fuels that are left are hard to get at, often stranded, and will take so much time and energy to extract that society will have to stop growing and start to contract, bringing on wars and social unrest, preventing us from getting every last bit of what’s left.

I often wonder how many people are watching ecological collapse approach. A wild guess, given the membership at peakoil.com of 33000, America2point0 550, energyresources 2700, runningonempty2 7400, and another 60,000 in theoildrum, ASPO, transition towns, universities, non-english speaking forums I don’t know about, and local peak oil forums, minus a large overlap in membership, and further subtracting a third of the people on these forums who don’t get that solar, wind, nuclear, biofuels and so on won’t save us from a liquid fuels crisis, gives me a rough guess of about 50,000 actively watching the cliff approach.

Since Hubbert’s curve isn’t a symmetric bell curve, but rather a cliff because of net energy loss, is there any town, ranch, or farm in the world that won’t feel the repercussions?

Since the collapse will be seen as a financial crash by most people, and blamed on the government, Wall Street, and corporations – not carrying capacity hitting the wall of oil and resource depletion — it would be a shame if no one understood what really happened.

So with the coming collapse in mind I try to travel and see friends and family more often. What my friends consider my “dark place” has its virtues. I’m keenly aware of how lucky I am to live at the peak of human civilization, to be closer to a Goddess than a Queen flying 40,000 feet above the earth in an airplane, zooming at 80 miles and hour through Utah salt flats with thousands of energy slaves at my service (Buckminster Fuller).

When I volunteer to take 4th and 5th graders on hikes at a nature preserve, I start by asking them to open their eyes and try to see everything, cup their hands around their ears to hear every sound better, to smell the aromas of flowers and the scents of the damp earth, to let all sensations flow in. I give them hardware store paint samples with many colors of green and ask them to match one of these colors exactly with a leaf so they notice how many shades of green there are, which leads them to notice the textures and shapes of leaves as well.

The bright side of Post Carbon is not such a dark place, I expect that many of us share a more vivid appreciation of the beauty around us, the freedom to travel where we please, can even be more patient in traffic jams knowing we might be nostalgic about them ten years from now.

Perhaps our role is to be among the few witnesses who weren’t fooled by Business As Usual, and watched the approaching tsunami with eyes wide open.

Alice Friedemann

Buckminster Fuller: “Energy slave unit = average output of a man doing 150,000 foot-pounds of work per day, 250 days per year. In low-energy societies, non-human energy slaves are horses, oxen, windmills, riverboats. Now, the average American has more than 8,000 energy-slaves at his or her disposal, and these slaves can work under extreme conditions: no sleep, 5,000° F, at 400,000 pounds per square inch pressure, etc”

One Response to We are over the edge of the Energy Cliff