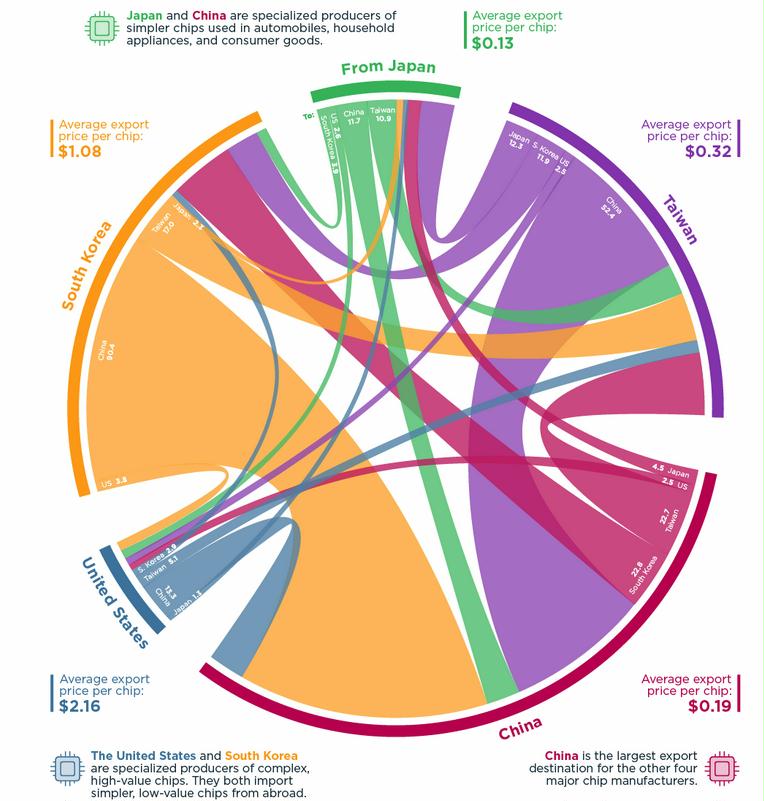

Major semiconductor producing countries rely on each other for different types of chips. Top semiconductor producers’ 2021 export values by source and destination, billions USD. Source: PIIE 2022 https://www.piie.com/research/piie-charts/major-semiconductor-producing-countries-rely-each-other-different-types-chips

Preface. We have become insanely dependent on technology that can’t possibly outlast fossil fuels, and indeed, is likely to hiccup and produce fewer chips as power outages, wars, earthquakes, financial crashes, pandemics and more disrupt the most precise, complex, and amazing technology that has ever existed, the pinnacle of human invention. Here are just a few examples of disruptions mentioned in the book:

Consider that “our production of computing power depends fundamentally on a series of choke points: tools, chemicals, and software that often are produced by a handful of companies—and sometimes only by one.

No other facet of the economy is so dependent on so few firms. Chips from Taiwan provide 37% of the world’s new computing power each year. Two Korean companies produce 44% of the world’s memory chips. The Dutch company ASML builds 100% of the world’s extreme ultraviolet lithography machines, without which cutting-edge chips are simply impossible to make,

The global network of companies that annually produces a trillion chips at nanometer scale is a triumph of efficiency. It’s also a staggering vulnerability. The disruptions of the pandemic provide just a glimpse of what a single well-placed earthquake could do to the global economy. Taiwan sits atop a fault line that as recently as 1999 produced an earthquake measuring 7.3 on the Richter scale. Thankfully, this only knocked chip production offline for a couple of days. But it’s only a matter of time before a stronger quake strikes Taiwan.

A devastating quake could also hit Japan, an earthquake-prone country that produces 17% of the world’s chips, or Silicon Valley, which today produces few chips but builds crucial chipmaking machinery in facilities sitting atop the San Andreas Fault.

Here are just a few Amazing Facts that boggle my mind:

- Apple sold over 100 million iPhone 12s, each powered by an A14 processor chip with 8 billion tiny transistors carved into its silicon. In a matter of months for just one of the dozen chips in an iPhone, TSMC’s Fab 18 fabricated well over 1 quintillion transistors—that is, a number with 18 zeros behind it.

- We know how to print single layers of atoms.

- Today, advanced chips possess tiny, three-dimensional transistors, each smaller than a coronavirus, measuring a handful of nanometers (billionths of a meter) wide.

- It was only 60 years ago that the number of transistors on a cutting-edge chip wasn’t 11.8 billion, but 4 in 1961.

All of it dependent on fossil fuels from A to Z in its life cycle. As energy declines, so will chip manufacturing and the thousands of products containing chips — what electronic vehicles or device doesn’t have them?

Alice Friedemann www.energyskeptic.com Author of Life After Fossil Fuels: A Reality Check on Alternative Energy; When Trucks Stop Running: Energy and the Future of Transportation”, Barriers to Making Algal Biofuels, & “Crunch! Whole Grain Artisan Chips and Crackers”. Women in ecology Book lists Podcasts: Financial Sense, WGBH, Jore, Planet: Critical, Crazy Town, Collapse Chronicles, Derrick Jensen, Practical Prepping, Kunstler 253 &278, Peak Prosperity, Index of best energyskeptic posts

***

Miller C (2022) Chip War: the fight for the world’s most critical technology. Scribner.

The rivalry between the United States and China may well be determined by computing power. Strategists in Beijing and Washington now realize that all advanced tech—from machine learning to missile systems, from automated vehicles to armed drones—requires cutting-edge chips, known more formally as semiconductors or integrated circuits. A tiny number of companies control their production.

Around a quarter of the chip industry’s revenue comes from phones; much of the price of a new phone pays for the semiconductors inside. For the past decade, each generation of iPhone has been powered by one of the world’s most advanced processor chips. In total, it takes over a dozen semiconductors to make a smartphone work, with different chips managing the battery, Bluetooth, Wi-Fi, cellular network connections, audio, the camera, and more.

Apple sold over 100 million iPhone 12s, each powered by an A14 processor chip with 11.8 billion tiny transistors carved into its silicon. In a matter of months for just one of the dozen chips in an iPhone, TSMC’s Fab 18 fabricated well over 1 quintillion transistors—that is, a number with 18 zeros behind it.

We know how to print single layers of atoms.

Today, advanced chips possess tiny, three-dimensional transistors, each smaller than a coronavirus, measuring a handful of nanometers (billionths of a meter) wide.

It was only 60 years ago that the number of transistors on a cutting-edge chip wasn’t 11.8 billion, but 4. In 1961, south of San Francisco, a small firm called Fairchild Semiconductor announced a new product called the Micrologic, a silicon chip with four transistors embedded in it. Soon the company devised ways to put a dozen transistors on a chip, then a hundred.

If any one of the steps in the semiconductor production process is interrupted, the world’s supply of new computing power is imperiled. In the age of AI, it’s often said that data is the new oil. Yet the real limitation we face isn’t the availability of data but of processing power. There’s a finite number of semiconductors that can store and process data. Producing them is mind-bogglingly complex and horrendously expensive. Unlike oil, which can be bought from many countries, our production of computing power depends fundamentally on a series of choke points: tools, chemicals, and software that often are produced by a handful of companies—and sometimes only by one.

No other facet of the economy is so dependent on so few firms. Chips from Taiwan provide 37% of the world’s new computing power each year. Two Korean companies produce 44% of the world’s memory chips. The Dutch company ASML builds 100% of the world’s extreme ultraviolet lithography machines, without which cutting-edge chips are simply impossible to make.

OPEC’s 40 percent share of world oil production looks unimpressive by comparison.

25.4 million nanometers per inch. We can make chips at the atomic level, there are 25 billion hydrogen atoms per inch if lined up.

The global network of companies that annually produces a trillion chips at nanometer scale is a triumph of efficiency. It’s also a staggering vulnerability. The disruptions of the pandemic provide just a glimpse of what a single well-placed earthquake could do to the global economy. Taiwan sits atop a fault line that as recently as 1999 produced an earthquake measuring 7.3 on the Richter scale. Thankfully, this only knocked chip production offline for a couple of days. But it’s only a matter of time before a stronger quake strikes Taiwan.

A devastating quake could also hit Japan, an earthquake-prone country that produces 17% of the world’s chips, or Silicon Valley, which today produces few chips but builds crucial chipmaking machinery in facilities sitting atop the San Andreas Fault.

Rather than a diffuse set of suppliers centered in advanced economies, the two main types of memory chip—DRAM and NAND—are produced by only a couple of firms. For DRAM memory chips, the type of semiconductor that defined Silicon Valley’s clash with Japan in the 1980s, an advanced fab can cost $20 billion an enormous capital investment that few firms can afford. There used to be dozens of DRAM producers, but today there are only three major producers. In the late 1990s, several of Japan’s struggling DRAM producers were consolidated into a single company, called Elpida, which sought to compete with Idaho’s Micron and with Korea’s Samsung and SK Hynix. By the end of the 2000s, these four companies controlled around 85 percent of the market. Yet Elpida struggled to survive and in 2013 was bought by Micron. Unlike Samsung and Hynix, which produce most of their DRAM in South Korea, Micron’s long string of acquisitions left it with DRAM fabs in Japan, Taiwan, and Singapore as well as in the United States. Government subsidies in countries like Singapore encouraged Micron to maintain and expand fab capacity there. So even though an American company is one of the world’s three biggest DRAM producers, most DRAM manufacturing is in East Asia.

A NAND memory chip is where data files such as photos, videos and music are stored on a microSD card, USB flash drives, smartphones, modern TVs, computers, tablets, equipment such as trffic lights, and anthing with AI. NAND chips are roughly the size of a fingernail and can retain huge amounts of data.

The market for NAND, the other main type of memory chip, is also Asia-centric. Samsung, the biggest player, supplies 35% of the market, with the rest produced by Korea’s Hynix, Japan’s Kioxia, and two American firms—Micron and Western Digital. The Korean firms produce chips almost exclusively in Korea or China, but only a portion of Micron and Western Digital’s NAND production is in the U.S., with other production in Singapore and Japan. As with DRAM, while U.S. firms play a major role in NAND production, the share of U.S.-based fabrication is substantially lower.

America’s second-rate status in memory chip output dates to the late 1980s, when Japan first overtook the U.S. in DRAM output. The big shift in recent years is the collapse in the share of logic chips produced in the United States. As with memory chips, there’s a correlation between the number of chips a firm produces and its yield—the number of chips that actually work. Given the benefits of scale, the number of firms fabricating advanced logic chips has shrunk relentlessly.

With the prominent exception of Intel, many key American logic chipmakers have given up their fabs and outsourced manufacturing. Other formerly major players, like Motorola or National Semiconductor, went bankrupt, were purchased, or saw their market share shrink. They were replaced by fabless firms, which often hired chip designers from legacy semiconductor firms but outsourced fabrication to TSMC or other foundries in Asia. This let fabless companies focus on their strength—chip design—without requiring simultaneous expertise in fabricating semiconductors.

Since the late 1980s, there’s been explosive growth in the number of fabless chip firms, which design semiconductors in-house but outsource their manufacturing, requiring only a good idea and a couple of million dollars in startup capital, a tiny fraction of the money needed to build a fab.

Around the early 2010s, it became unfeasible to pack transistors more densely by shrinking them two dimensionally. One challenge was that, as transistors were shrunk according to Moore’s Law, the narrow length of the conductor channel occasionally caused power to “leak” through the circuit even when the switch was off. On top of this, the layer of silicon dioxide atop each transistor became so thin that quantum effects like “tunneling”—jumping through barriers that classical physics said should be insurmountable—began seriously impacting transistor performance. By the mid-2000s, the layer of silicon dioxide on top of each transistor was only a couple of atoms thick, too small to keep a lid on all the electrons sitting in the silicon.

nanometer-scale 3D structures were crucial for the survival of Moore’s Law, but they were staggeringly difficult to make, requiring even more precision in deposition, etching, and lithography.

Soon Apple began hiring some of the industry’s best chip designers. Two years later, the company announced it had designed its own application processor, the A4, which it used in the new iPad and the iPhone 4. Designing chips as complex as the processors that run smartphones is expensive, which is why most low- and midrange smartphone companies buy off-the-shelf chips from companies like Qualcomm. However, Apple has invested heavily in R&D and chip design facilities in Bavaria and Israel as well as Silicon Valley, where engineers design its newest chips. Now Apple not only designs the main processors for most of its devices

Apple is well known for outsourcing assembly of its phones, tablets, and other devices to several hundred thousand assembly line workers in China, who are responsible for screwing and gluing tiny pieces together. Though the electronics assembly facilities in Chinese cities like Dongguan and Zhengzhou are the world’s most efficient, however, they aren’t irreplaceable. The world still has several hundred million subsistence farmers who’d happily fasten components into an iPhone for a dollar an hour. Foxconn assembles most of its Apple products in China, but it builds some in Vietnam and India, too.

As transistors have shrunk, they’ve become ever harder to fabricate. The number of semiconductor companies that can build leading-edge chips has dwindled. By 2010, at the time Apple launched its first chip, there were just a handful of cutting-edge foundries: Taiwan’s TSMC, South Korea’s Samsung, and—perhaps—GlobalFoundries, depending on whether it could succeed in winning market share. Intel, still the world’s leader at shrinking transistors, remained focused on building its own chips for PCs and servers rather than processors for other companies’ phones.

The smartphone supply chain looks very different from the one associated with PCs. Smartphones and PCs are both assembled largely in China with high-value components mostly designed in the U.S., Europe, Japan, or Korea. For PCs, most processors come from Intel and are produced at one of the company’s fabs in the U.S., Ireland, or Israel. Smartphones are different. They’re stuffed full of chips, not only the main processor (which Apple designs itself), but modem and radio frequency chips for connecting with cellular networks, chips for WiFi and Bluetooth connections, an image sensor for the camera, at least two memory chips, chips that sense motion (so your phone knows when you turn it horizontal), as well as semiconductors that manage the battery, the audio, and wireless charging. These chips make up most of the bill of materials needed to build a smartphone.

As semiconductor fabrication capacity migrated to Taiwan and South Korea, so too did the ability to produce many of these chips. Application processors, the electronic brain inside each smartphone, are mostly produced in Taiwan and South Korea before being sent to China for final assembly inside a phone’s plastic case and glass screen. Apple’s iPhone processors are fabricated exclusively in Taiwan. Today, no company besides TSMC has the skill or the production capacity to build the chips Apple needs.

By the late-2010s, ASML, the Dutch lithography company, had spent nearly two decades trying to make extreme-ultraviolet lithography work. Doing so required scouring the world for the most advanced components, the purest metals, the most powerful lasers, and the most precise sensors. EUV was one of the biggest technological gambles of our time. In 2012, years before ASML had produced a functional EUV tool, Intel, Samsung, and TSMC had each invested directly in ASML to ensure the company had the funding needed to continue developing EUV tools that their future chipmaking capabilities would require.

To create chips, their machine creates a pattern of light waves by using a “mask” to block some of the light, then project the light onto photoresist chemicals applied to a silicon wafer. The light reacts with photoresists, making it possible to deposit material or etch it away in perfectly formed shapes, producing a working chip.

Lathrop had used simple visible light and off-the-shelf photoresists produced by Kodak. Using more complex lenses and chemicals, it eventually became possible to print shapes as small as a couple hundred nanometers on silicon wafers. The wavelength of visible light is itself several hundred nanometers, depending on the color, so it eventually faced limits as transistors were made ever smaller. The industry later moved to different types of ultraviolet light with wavelengths of 248 and 193 nanometers. These wavelengths could carve shapes more precise than visible light, but they, too, had limits, so the industry placed its hope on extreme ultraviolet (EUV) light with a wavelength of 13.5 nanometers. Using EUV light introduced new difficulties that proved almost impossible to resolve. Where Lathrop used a microscope, visible light, and photoresists produced by Kodak, all the key EUV components had to be specially created. You can’t simply buy an EUV lightbulb. Producing enough EUV light requires pulverizing a small ball of tin with a laser. Cymer, a company founded by two laser experts from the University of California, San Diego, had been a major player in lithographic light sources since the 1980s. The company’s engineers realized the best approach was to shoot a tiny ball of tin measuring thirty-millionths of a meter wide moving through a vacuum at a speed of around two hundred miles per hour. The tin is then struck twice with a laser, the first pulse to warm it up, the second to blast it into a plasma with a temperature around half a million degrees, many times hotter than the surface of the sun. This process of blasting tin is then repeated 50,000 times per second to produce EUV light in the quantities necessary to fabricate chips.

Cymer’s light source only worked, though, thanks to a new laser that could pulverize the tin droplets with sufficient power. In 2005, two engineers at Cymer approached a German precision tooling company called Trumpf to see if it could build such a laser. Trumpf already made the world’s best carbon dioxide-based lasers for industrial uses like precision cutting. These lasers were monuments of machining in the best German industrial tradition. Because around 80% of the energy a carbon dioxide laser produces is heat and only 20% light, extracting heat from the machine is a key challenge. Trumpf had previously devised a system of blowers with fans that turned a thousand times a second, too fast to rely on physical bearings. Instead, the company learned to use magnets, so the fans floated in air, sucking heat out of the laster system without grinding against other components and imperiling reliability.

The company proposed a laser with four components: two “seed” lasers that are low power but accurately time each pulse so that the laser can hit 50 million tin drops a second; four resonators that increase the beam’s power; an ultra-accurate “beam transport system” that directs the beam over thirty meters toward the tin droplet chamber; and a final focusing device to ensure the laser scores a direct hit, millions of times per second.

Every step required new innovations. Specialized gases in the laser chamber had to be kept at constant densities. The tin droplets themselves reflected light, which threatened to shine back into the laser and interfere with the system; to prevent this, special optics were required. The company needed industrial diamonds to provide the “windows” through which the laser exited the chamber, and had to work with partners to develop new, ultra-pure diamonds. It took ten years to produce lasers with enough power and reliability. Each one required 457,329 parts.

After Cymer and Trumpf found a way to blast tin so it emits sufficient EUV light, the next step was to create mirrors that collected the light and directed it toward a silicon chip. Zeiss’s primary challenge was that EUV is difficult to reflect. The 13.5nm wavelength of EUV is closer to X-rays than to visible light, and as is the case with X-rays, many materials absorb EUV rather than reflect it.

Zeiss created mirrors that were the smoothest objects ever made, with impurities that were almost imperceptibly small. If the mirrors in an EUV system were scaled to the size of Germany, the company said, their biggest irregularities would be a tenth of a millimeter. To direct EUV light with precision, they must be held perfectly still, requiring mechanics and sensors so exact that Zeiss boasted they could be used to aim a laser to hit a golf ball as far away as the moon.

The most crucial input into an EUV lithography system wasn’t any individual component, but the company’s own skill in supply chain management. ASML engineered this network of business relationships “like a machine,” van Houts explained, producing a finely tuned system of several thousand companies capable of meeting ASML’s exacting requirements. ASML itself only produced 15% of an EUV tool’s components, he estimated, buying the rest from other firms.

The company had no choice but to rely on a single source for the key components of an EUV system.

The result was a machine with hundreds of thousands of components that took tens of billions of dollars and several decades to develop. The miracle isn’t simply that EUV lithography works, but that it does so reliably enough to produce chips cost-effectively. Extreme reliability was crucial for any component that would be put in the EUV system. ASML had set a target for each component to last on average for at least 30,000 hours—around four years—before needing repair. In practice, repairs would be needed more often, because not every part breaks at the same time. EUV machines cost over $100 million each, so every hour one is offline costs chipmakers thousands of dollars in lost production.

The atomic-level unpredictability in light waves’ reaction with photoresist chemicals created new problems with EUV that barely existed with larger-wavelength lithography. To adjust for anomalies in the way light refracts, ASML’s tools project light in a pattern that differs from what chipmakers want imprinted on a chip. Printing an “X” requires using a pattern with a very different shape but which ends up creating an “X” when the light waves hit the silicon wafer.

The final product—chips—work so reliably because they only have a single component: a block of silicon topped with other metals. There are no moving parts in a chip, unless you count the electrons zipping around inside. Producing advanced semiconductors has relied on some of the most complex machinery every made. ASML’s EUV lithography tool is the most expensive mass-produced machine tool in history, so complex it’s impossible to use without extensive training from ASML personnel, who remain on-site for the tool’s entire life span. All made possible by ASML’s ability to orchestrate a far-flung network of optics experts, software designers, laser companies, and many other experts

ASML’s EUV tools weren’t really Dutch, though they were largely assembled in the Netherlands. Crucial components came from Cymer in California and Zeiss and Trumpf in Germany. And even these German firms relied on critical pieces of U.S.-produced equipment. The point is that, rather than a single country being able to claim pride of ownership regarding these miraculous tools, they are the product of many countries. After three decades of investment, billions of dollars, a series of technological innovations, and the establishment of one of the world’s most complex supply chains, by the mid-2010s, ASML’s EUV tools were finally ready to be deployed in the world’s most advanced chip fabs.

There were only so many optical tricks that could help 193nm light carve smaller features. Each new workaround added time and cost money. By the mid-2010s, it might have been possible to eke out a couple additional improvements, but Moore’s Law needed better lithography tools to carve smaller shapes. The only hope was that the hugely delayed EUV lithography tools, which had been in development since the early 1990s, could finally be made to work at a commercial scale. What was the alternative? “There is no Plan B,” Yen knew.

Because manufacturing tools account for much of the cost of an advanced fab, keeping the equipment operating is crucial for profitability.

GlobalFoundries was by far the biggest foundry in the United States and one of the largest in the world, but it was still a minnow compared to TSMC.

Measured by thousands of wafers per month, the industry standard, TSMC had a capacity of 1.8 million while Samsung had 2.5 million. GlobalFoundries had only 700,000. By 2018, GlobalFoundries had purchased several EUV lithography tools and was installing them in its most advanced facility, Fab 8, when the company’s executives ordered them to halt work. The EUV program was being canceled. GlobalFoundries was giving up production of new, cutting-edge nodes. It wouldn’t pursue a 7nm process based on EUV lithography, which had already cost $1.5 billion in development and would have required a comparable amount of additional spending to bring online. GlobalFoundries decided that as a medium-sized foundry, it could never make a 7nm process financially viable.

Building cutting-edge processors was too expensive for everyone except the world’s biggest chipmakers. Even the deep pockets of the Persian Gulf royals who owned GlobalFoundries weren’t deep enough. The number of companies capable of fabricating leading-edge logic chips fell from four to three.

ARTIFICIAL INTELLIGENCE

The cost of training a single AI model—the chips it uses and the electricity they consume—can stretch into the millions of dollars. (To train a computer to recognize a cat, you have to show it a lot of cats and dogs so it learns to distinguish between the two. The more animals your algorithm requires, the more transistors you need.) Chips optimized for AI can work faster, take up less data center space, and use less power than general-purpose Intel CPUs.

Where a CPU would feed an algorithm many pieces of data, one after the other, a Graphics Processing Unit (GPU) could process multiple pieces of data simultaneously. To learn to recognize images of cats, a CPU would process pixel after pixel, while a GPU could “look” at many pixels at once. So the time needed to train a computer to recognize cats decreased dramatically.

CHINA & WAR

Why was Xi Jinping so worried about digital security? The more China’s leaders studied their technological capabilities, the less important their internet companies seemed. China’s digital world runs on digits—1s and 0s—that are processed and stored mostly by imported semiconductors. China’s tech giants depend on data centers full of foreign, largely U.S.-produced, chips. The documents that Edward Snowden leaked in 2013 before fleeing to Russia demonstrated American network-tapping capabilities that surprised even the cyber sleuths in Beijing. Chinese firms had replicated Silicon Valley’s expertise in building software for e-commerce, online search, and digital payments. But all this software relies on foreign hardware. When it comes to the core technologies that undergird computing, China is staggeringly reliant on foreign products, many of which are designed in Silicon Valley and almost all of which are produced by firms based in the U.S. or one of its allies.

Which core technologies most worry Xi? One is a software product, Microsoft Windows, which is used by most PCs in China, despite repeated efforts to develop competitive Chinese operating systems. Yet even more important in Xi’s thinking are the chips that power China’s computers, smartphones, and data centers. As he noted, “Microsoft’s Windows operating system can only be paired with Intel chips.” So most computers in China needed American chips to function. During most years of the 2000s and 2010s, China spent more money importing semiconductors than oil. High-powered chips were as important as hydrocarbons in fueling China’s economic growth. Unlike oil, though, the supply of chips is monopolized by China’s geopolitical rivals.

China one of the world’s leading tech powers. When it came to artificial intelligence, the country was one of the world’s two AI Superpowers, according to a widely discussed book by Kai-Fu Lee, former head of Google China. Beijing built a 21ST century fusion of AI and authoritarianism, maximizing use of surveillance technology. But even the surveillance systems that track China’s dissidents and its ethnic minorities rely on chips from American companies like Intel and Nvidia. All of China’s most important technology rests on a fragile foundation of imported silicon.

It wasn’t just about avoiding supply chain vulnerability. Like its neighbors, China can only win more valuable business if it produces what Beijing’s leaders call “core technologies”—products the rest of the world can’t live without. Otherwise, China risks continuing the low-profit pattern of what has occurred with the iPhone. Millions of Chinese are involved in assembling the phones, but when the devices are sold to end users, Apple makes most of the money, with much of the rest accruing to the makers of the chips inside each phone.

When Japan, Taiwan, and South Korea wanted to break into the complex and high-value portions of the chip industry, they poured capital into their semiconductor companies, organizing government investment but also pressing private banks to lend. Second, they tried to lure home their scientists and engineers who’d been trained at U.S. universities and worked in Silicon Valley. Third, they forged partnerships with foreign firms but required them to transfer technology or train local workers. Fourth, they played foreigners off each other, taking advantage of competition between Silicon Valley firms—and, later, between Americans and Japanese – to get the best deal for themselves.

China’s problem isn’t only in chip fabrication. In nearly every step of the process of producing semiconductors, China is staggeringly dependent on foreign technology, almost all of which is controlled by China’s geopolitical rivals—Taiwan, Japan, South Korea, or the United States. The software tools used to design chips are dominated by U.S. firms, while China has less than 1% of the global software tool market. When it comes to core intellectual property, the building blocks of transistor patterns from which many chips are designed, China’s market share is 2%; most of the rest is American or British. China supplies 4% of the world’s silicon wafers and other chipmaking materials; 1% of the tools used to fabricate chips; 5% of the market for chip designs. It has only a 7% market share in the business of fabricating chips. None of this fabrication capacity involves high-value, leading-edge technology.

Across the entire semiconductor supply chain, aggregating the impact of chip design, intellectual property, tools, fabrication, and other steps, Chinese firms have a 6% market share, compared to America’s 39%, South Korea’s 16%, or Taiwan’s 12%.

For advanced logic, memory, and analog chips, however, China is crucially dependent on American software and designs; American, Dutch, and Japanese machinery; and South Korean and Taiwanese manufacturing. Every Chinese leader since the founding of the People’s Republic wanted a semiconductor industry, of course. Mao’s Cultural Revolution dream that every worker could produce their own transistors had been an abject failure.

One former CEO of a Chinese foundry explained that every governor wanted a chip fab in his province and offered a mix of subsidies and veiled threats to ensure a facility was built. So China’s foundries ended up with an inefficient collection of small facilities spread across the country. “When a Chinese firm said, ‘Let’s open a joint venture,’ ” one European semiconductor executive explained. “I heard, ‘Let’s lose money.’ ” The joint ventures that did emerge were generally addicted to government subsidies and rarely produced meaningful new technology.

China’s subsidy strategy of the 2000s hadn’t created a leading-edge domestic chip industry. Yet doing nothing—and tolerating continued dependence on foreign semiconductors—wasn’t politically tolerable.

Beijing was right to conclude the country’s chip industry needed more money. In 2014, when the fund was launched, advanced fabs cost well over $10 billion. Only a government could take such a gamble. The amount of money China’s put into chip subsidies and “investments” is hard to calculate, since much of the spending is done by local governments and opaque state-owned banks, but it’s widely thought to measure in the tens of billions of dollars.

ASML’s most advanced lithography tools only work thanks to specialized light sources produced at the company’s San Diego subsidiary. Despite occasional tension over trade, these countries have similar interests and worldviews, so mutual reliance on each other for chip designs, tools, and fabrication services was seen as a reasonable price to pay for the efficiency of globalized production.

If China only wanted a bigger part in this ecosystem, its ambitions could’ve been accommodated. But it was about remaking the world’s semiconductor industry, not integrating with it. Some economic policymakers and semiconductor industry executives in China would have preferred a strategy of deeper integration, yet leaders in Beijing, who thought more about security than efficiency, saw interdependence as a threat.

China’s import of chips—$260 billion in 2017, the year of Xi’s Davos debut—was far larger than Saudi Arabia’s export of oil or Germany’s export of cars. No product is more central to international trade than semiconductors. Integrated circuits made up 15% of South Korea’s exports in 2017; 17% of Singapore’s; 19% of Malaysia’s; 21% of the Philippines’; and 36% of Taiwan’s.

Made in China 2025 called all this into question. At stake was the world’s most dense network of supply chains and trade flows, the electronics industries that had undergirded Asia’s economic growth and political stability over the past half century.

In its drive for semiconductor self-sufficiency, one of Beijing’s focus areas was chips for servers.China’s government set out to acquire this technology, strong-arming U.S. companies and pressuring them to transfer technology to Chinese partners.

Intel, which dominated sales of semiconductors for servers, had few incentives to cut deals with Beijing over data center processors. The American chipmakers that had lost data center market share to Intel, however, were looking for a competitive advantage. At IBM, Rometty announced a change of strategy that would appeal to Beijing. Rather than trying to sell chips and servers to Chinese customers, she announced, IBM would open its chip technology to Chinese partners. IBM’s decision to trade technology for market access made business sense. The firm’s technology was seen as second-rate, and without Beijing’s imprimatur it was unlikely to reverse its post-Snowden market shrinkage. IBM was simultaneously trying to shift its global business from selling hardware to selling services, so sharing access to its chip designs seemed logical.

As the biggest market for Qualcomm’s chips, China had enormous leverage over the company. So some industry analysts saw a connection when, shortly after settling the pricing dispute with Beijing, Qualcomm agreed to a joint venture with a Chinese company called Huaxintong to develop server chips.

The Qualcomm-Huaxintong joint venture didn’t last long. It was closed in 2019 after producing little of value. But some of the expertise developed appears to have transferred to other Chinese companies

AMD was never on the brink of bankruptcy, but it wasn’t far from it, either. The company was looking for cash to buy time as it brought new products to market. In 2013, it sold its corporate headquarters in Austin, Texas, to raise cash, for example. In 2016, it sold to a Chinese firm an 85% stake in its semiconductor assembly, testing, and packaging facilities in Penang, Malaysia, and Suzhou, China, for $371 million.

Intel reportedly warned the government about the deal, implying that it harmed U.S. interests and that it would threaten Intel’s business. Yet the government lacked a straightforward way to stop it, so the deal was ultimately waved through, sparking anger in Congress and in the Pentagon.

Zhao’s real interest was in buying the island’s crown jewels—MediaTek, the leading chip designer outside the U.S., and TSMC, the foundry on which almost all the world’s fabless chip firms rely. He floated the idea of buying a 25 percent stake in TSMC and advocated merging MediaTek with Tsinghua Unigroup’s chip design businesses. Neither transaction was legal under Taiwan’s existing foreign investment rules, but when Zhao returned from Taiwan he took the stage at a public conference in Beijing and suggested China should ban imports of Taiwanese chips if Taipei didn’t change these restrictions. This pressure campaign put TSMC and MediaTek in a bind. Both companies were crucially reliant on the Chinese market. Most of the chips TSMC produced were assembled into electronics goods in workshops across China. The idea of selling Taiwan’s technological crown jewels to a state-backed investor on the mainland made little sense. The island would end up dependent on Beijing. Besides abolishing its military or welcoming occupation by the People’s Liberation Army, it was hard to think of a step that would do more to undermine Taiwan’s autonomy.

Huawei’s smartphone unit, meanwhile, was until recently one of the world’s largest, rivaling Apple and Samsung in numbers of phones sold. The company provides other types of tech infrastructure, too, from undersea fiber-optic cables to cloud computing. In many countries it’s impossible to use a phone without using some of Huawei’s equipment—as difficult as it is to use a PC without Microsoft products or to surf the internet (outside of China) without Google. Huawei is different from the world’s other big tech companies in one major way: its two-decade-long struggle with America’s national security state.

Thanks to IBM and other Western consultants, Huawei learned to manage its supply chain, anticipate customer demand, develop top-class marketing, and sell products worldwide.

Subsidies provided by the Chinese government reached a figure of $75 billion, in the form of subsidized land, state-backed credit, and tax deductions at a scale far above what most Western companies get from their governments.

For many years, despite the warning of America’s spy agencies, Huawei spread rapidly across the world. As it grew, incumbent Western firms selling telecom equipment were forced to merge or pushed out of the market. Canada’s Nortel went bankrupt. Alcatel-Lucent, the company that inherited Bell Labs after AT&T was broken up, sold its operations to Finland’s Nokia. Huawei’s ambitions only grew. Having provided the infrastructure that makes phone calls possible, it started selling phones, too. Soon its smartphones were among the world’s best sellers. By 2019 the company lagged only Samsung measured by number of units sold.

Company insiders say the firm’s chip design ambitions accelerated in March 2011, when an earthquake off Japan’s east coast caused a tsunami that slammed into the country.

Huawei got lucky. Few of its component suppliers saw production knocked out for long. However, the company asked its consultants to determine its supply chain risk. The company identified the 250 most important semiconductors that its products required and began designing as many as possible in-house.

Huawei has mastered the latest generation of equipment to send calls and data via cell networks, called 5G. Yet 5G isn’t really about phones—it’s about the future of computing, and therefore, it’s about semiconductors.

Just as Moore’s Law has let us pack more transistors onto chips, there’s been a steady increase in the number of 1s and 0s flying to and from cell phones via radio waves. 2G phones could send picture texts; 3G phones opened websites; and 4G made it possible to stream video from almost anywhere. 5G will provide a similar leap forward.

There’s been a comparable change in the chips hidden inside a cell network and atop cell towers. Sending 1s and 0s through the air while minimizing dropped calls or delays to video streaming is staggeringly complicated. The amount of space available in the relevant part of the radio-wave spectrum is limited. There are only so many radio-wave frequencies, many of which aren’t optimal for sending lots of data or transmitting over long distances. Telecom firms have therefore relied on semiconductors to pack ever more data into existing spectrum space.

Semiconductors have therefore been fundamental to the ability to send more data wirelessly.

Partly, this will be via even more intricate methods of sharing spectrum space, which require more complex algorithms and more computing power on phones and in cell towers so that 1s and 0s can be slotted in even the tiniest free space in the wireless spectrum. Partly, 5G networks will send more data by using a new, empty radio frequency spectrum that was previously considered impractical to fill. Advanced semiconductors make it possible not only to pack more 1s and 0s into a given frequency of radio waves, but also to send radio waves farther and target them with unprecedented accuracy. Cell networks will identify a phone’s location and send radio waves directly toward a phone, using a technique called beamforming.

A typical radio wave, like one that sends music to your car radio, sends signals out in every direction because it doesn’t know where your car is. This wastes power and creates more waves and more interference. With beamforming, a cell tower identifies a device’s location and sends the signal it needs only in that direction. Result: less interference and stronger signals for everyone.

There are innumerable ways in business and industry that more data and more connectivity will produce better service and lower cost, from optimizing how tractors drive across fields to coordinating robots on assembly lines. Medical devices and sensors will track and diagnose more conditions. The world has far more sensory information than our current ability to digitize, communicate, and process.

Tesla is also a leading chip designer. The company hired star semiconductor designers like Jim Keller to build a chip specialized for its automated driving needs, which is fabricated using leading-edge technology. As early as 2014, some analysts were noting that Tesla cars “resemble a smartphone.” The company has been often compared to Apple, which also designs its own semiconductors. Like Apple’s products, Tesla’s finely tuned user experience and its seemingly effortless integration of advanced computing into a twentieth-century product—a car—are only possible because of custom-designed chips.

From swarms of autonomous drones to invisible battles in cyberspace and across the electromagnetic spectrum, the future of war will be defined by computing power.

The idea of military AI evokes images of killer robots, but there are many spheres where applying machine learning can make military systems better. Predictive maintenance—learning when machines need to be fixed—is already helping keep planes in the sky and ships at sea. AI-enabled submarine sonars or satellite imagery can identify threats more accurately. New weapons systems can be designed more quickly.

China is still staggeringly dependent on foreign semiconductor technology—in particular, U.S.-designed, Taiwan-fabricated processors—to undertake complex computation. It isn’t only Chinese smartphones and PCs that rely on foreign chips. So, too, do most Chinese data centers—which explains why the country has tried so hard to acquire technology from companies like IBM and AMD. One Chinese study has estimated that as many as 95 percent of GPUs in Chinese servers running artificial intelligence workloads are designed by Nvidia,

It will be half a decade before China can design competitive chips and the software ecosystem around them, and far longer before it can manufacture these chips domestically.

The Chinese military has had little difficulty simply buying cutting-edge U.S. chips off-the-shelf and plugging them into military systems.

The warfare of the future will be more reliant than ever on chips—powerful processors to run AI algorithms, big memory chips to crunch data, perfectly tuned analog chips to sense and produce radio waves.

Making semiconductors is so expensive that even the Pentagon can’t afford to do it in-house. The National Security Agency used to have a chip fab at its headquarters in Maryland’s Fort Meade. In the 2000s, however, the government decided it was too expensive to keep upgrading per the cadence dictated by Moore’s Law. Today even designing a leading-edge chip—which can cost several hundred million dollars—is too expensive for all but the most important projects.

Both the U.S. military and the government’s spy agencies outsource the production of their chips to “trusted foundries.” This is relatively straightforward for many types of analog or radio frequency chips, where the U.S. has world-class capabilities. When it comes to logic chips, though, this poses a dilemma.

China’s leaders have identified their reliance on foreign chipmakers as a critical vulnerability. They’ve set out a plan to rework the world’s chip industry by buying foreign chipmakers, stealing their technology, and providing billions of dollars of subsidies to Chinese chip firms. The People’s Liberation Army is now counting on these efforts to help it evade U.S. restrictions, though it can still buy legally many U.S. chips in its pursuit of “military intelligentization.” For its part, the Pentagon has launched its own offset, after admitting that China’s military modernization has closed the gap between the two superpowers’ militaries, especially in the contested waters off China’s coast. Taiwan isn’t simply the source of the advanced chips that both countries’ militaries are betting on. It’s also the most likely future battleground.

PART VIII THE CHIP CHOKE

DRAM requires specialized know-how, advanced equipment, and large quantities of capital investment. Advanced equipment can generally be purchased off-the-shelf from the big American, Japanese, and Dutch toolmakers. The know-how is the hard part. Another, faster, method for acquiring know-how is to poach employees and steal files.

The big three DRAM firms had spent decades investing in ultra-specialized technology processes, which not only created the most advanced memory chips on earth, but also had produced a regular cadence of improvements and cost reductions. Their expertise was defended by patents, but even more important was the know-how that only their engineers had.

U.S. companies like Applied Materials, Lam Research, and KLA are part of a small oligopoly of companies that produce irreplaceable machinery, like the tools that deposit microscopically thin layers of materials on silicon wafers or recognize nanometer-scale defects. Without this machinery—much of it still built in the U.S.—it’s impossible to produce advanced semiconductors. Only Japan has companies producing some comparable machinery, so if Tokyo and Washington agreed, they could make it impossible for any firm, in any country, to make advanced chips.

One might have expected the offshoring of chipmaking to have reduced the U.S. government’s ability to restrict access to advanced chip fabrication. It would certainly have been easier to cut off Huawei if all the world’s advanced chipmaking was still based on U.S. soil. However, the U.S. still had cards to play. For example, the process of offshoring chip fabrication had coincided with a growing monopolization of chip industry choke points. Nearly every chip in the world uses software from at least one of three U.S.-based companies, Cadence, Synopsys, and Mentor (the latter of which is owned by Germany’s Siemens but based in Oregon).

Excluding the chips Intel builds in-house, all the most advanced logic chips are fabricated by just two companies, Samsung and TSMC, both located in countries that rely on the U.S. military for their security. Moreover, making advanced processors requires EUV lithography machines produced by just one company, the Netherlands’ ASML, which in turn relies on its San Diego subsidiary, Cymer (which it purchased in 2013), to supply the irreplaceable light sources in its EUV lithography tools.

It’s far easier to control choke points in the chipmaking process when so many essential steps require tools, materials, or software produced by just a handful of firms. Many of these choke points remained in American hands.

TSMC can’t fabricate advanced chips for Huawei without using U.S. manufacturing equipment. Huawei can’t design chips without U.S.-produced software. Even China’s most advanced foundry, SMIC, relies extensively on U.S. tools.

Huawei was simply cut off from the world’s entire chipmaking infrastructure, except for chips that the U.S. Commerce Department deigned to give it a special license to buy. Since then, Huawei’s been forced to divest part of its smartphone business and its server business, since it can’t get the necessary chips.

China’s rollout of its own 5G telecoms network, which was once a high-profile government priority, has been delayed due to chip shortages. After the U.S. restrictions took place, other countries, notably Britain, decided to ban Huawei, reasoning that in the absence of U.S. chips the company would struggle to service its products.

The Netherlands decided not to approve the sale of ASML’s EUV machines to Chinese firms.

Yangzte Memory Technologies Corporation (YMTC), based in Wuhan, is China’s leading producer of NAND memory, a type of chip that’s ubiquitous in consumer devices from smartphones to USB memory sticks.

There are five companies that make competitive NAND chips today; none are headquartered in China. Many industry experts, however, think that of all types of chips, China’s best chance at achieving world-class manufacturing capabilities is in NAND production.

Thanks to U.S. pressure, China’s government may provide Chinese chipmakers more support than they’d otherwise have received.

In an industry with such a multinational supply chain, technological independence was always a pipe dream, even for the United States, which remains the world’s biggest semiconductor player. For China, which lacks competitive firms in many parts of the supply chain, from machinery to software, technological independence is even more difficult.

Consider, for example, what it would take to replicate one of ASML’s EUV machines, which have taken nearly three decades to develop and commercialize. EUV machines have multiple components that, on their own, constitute epically complex engineering challenges. Replicating just the laser in an EUV system requires perfectly identifying and assembling 457,329 parts. A single defect could cause debilitating delays or reliability problems.

Even if they’ve already hacked into the relevant systems and downloaded design specs, machinery this complex can’t simply be copied and pasted like a stolen file. Even if a spy were to gain access to specialized information, they’d need a PhD in optics or lasers to understand the science—and even still, they’d lack the three decades of experience accumulated by the engineers who’ve developed EUV.

ASML will have introduced a new generation tool, called high-aperture EUV, which is scheduled to be ready in the mid-2020s and cost $300 million per machine, twice the cost of the first generation EUV machine.

EUV machines are just one of many tools that are produced via multinational supply chains. Domesticating every part of the supply chain would be impossibly expensive. The global chip industry spends over $100 billion annually on capital expenditures.

Smartphones and data centers require the most cutting-edge chips, but cars and other consumer devices often use older process technology, which is sufficiently powerful and far cheaper.

China’s also investing heavily in emerging semiconductor materials like silicon carbide and gallium nitride, which are unlikely to displace pure silicon in most chips but will likely play a bigger role in managing the power systems in electric vehicles.

In 2020, just as the United States began to impose a chip choke on China, cutting off some of the country’s leading tech companies from accessing U.S. chip technology, a second chip choke began asphyxiating parts of the world economy. Certain types of chips became difficult to acquire, especially the types of basic logic chips that are widely used in automobiles. The two chip chokes were partially interrelated. Chinese firms like Huawei had been stockpiling chips since at least 2019, in preparation for potential future U.S. sanctions, while Chinese fabs were buying as much manufacturing equipment as possible in case the U.S. decided to tighten export restrictions on chipmaking tools.

However, Chinese stockpiling explains only part of the COVID-era chip choke. The bigger cause is vast swings in orders for chips after the pandemic began, as companies and consumers adjusted their demand for different goods. PC demand spiked in 2020, as millions of people upgraded their computers to work from home. Data centers’ demand for servers grew, too, as more of life shifted online.

Car companies at first cut chip orders, expecting car sales to slump. When demand quickly recovered, they found that chipmakers had already reallocated capacity to other customers. According to the American Automotive Policy Council, an industry group, the world’s biggest auto companies can use over a thousand chips in each car. If even one chip is missing, the car can’t be shipped. Carmakers spent much of 2021 struggling and often failing to acquire semiconductors. These firms are estimated to have produced 7.7 million fewer cars in 2021 than would have been possible.

The semiconductor shortage wasn’t primarily caused by issues in the chip supply chain. There were some supply disruptions, like COVID lockdowns in Malaysia, which impacted semiconductor packaging operations there. But the world produced more chips in 2021 than ever before—over 1.1 trillion semiconductor devices, according to research firm IC Insights. This was a 13 percent increase compared to 2020.

The semiconductor shortage is mostly a story of demand growth rather than supply issues. It’s driven by new PCs, 5G phones, AI-enabled data centers—and, ultimately, our insatiable demand for computing power. Politicians around the world have therefore misdiagnosed the semiconductor supply chain dilemma. The problem isn’t that the chip industry’s far-flung production processes dealt poorly with COVID and the resulting lockdowns.

There are few industries that sailed through the pandemic with so little disruption. Such problems that emerged, notably the shortage of auto chips, are mostly the fault of carmakers’ frantic and ill-advised cancelation of chip orders in the early days of the pandemic coupled with their just-in-time manufacturing practices that provide little margin of error.

Besides a massive earthquake—a low but non-zero probability risk—it’s hard to imagine a more severe peacetime shock to supply chains than what the industry has survived since early 2020. The substantial increase in chip production during both 2020 and 2021 is not a sign that multinational supply chains are broken. It’s a sign that they’ve worked.

The Pentagon’s public reports on Chinese military power have identified multiple ways China could use force against Taiwan. China would have little difficulty in knocking out Taiwan’s airfields and naval facilities as well as electricity and other critical infrastructure before any assault, but even still, it would be a tough fight.

Other options would be easier for the PLA to implement, in the Pentagon’s judgment. A partial air and maritime blockade would be impossible for Taiwan to defeat on its own. Even if the U.S. and Japanese militaries joined Taiwan to try and break the blockade, it would be difficult to do. China has powerful weapons systems arrayed along its shores. A blockade wouldn’t need to be perfectly effective to strangle the island’s trade. Ending a blockade would require Taiwan and its friends—mainly, the U.S.—to disable hundreds of Chinese military systems sitting on Chinese territory. A blockade-busting operation could easily spiral into a bloody great power war.

Even without a blockade, a Chinese air and missile campaign alone could defang Taiwan’s military and shut down the country’s economy without placing a single pair of Chinese boots on the ground. In a couple days, absent immediate U.S. and Japanese aid, Chinese air and missile forces could probably disarm key Taiwanese military assets—airfields, radar facilities, communications hubs, and the like—without severely impacting the island’s productive capacity.

TSMC’s chairman is certainly right that no one wants to “disrupt” the semiconductor supply chains that crisscross the Taiwan Strait. But both Washington and Beijing would like more control over them. The idea that China would simply destroy TSMC’s fabs out of spite doesn’t make sense, because China would suffer as much as anyone, especially since the U.S. and its friends would still have access to Intel’s and Samsung’s chip fabs. Nor has it ever been realistic that Chinese forces could invade and straightforwardly seize TSMC’s facilities. They’d soon discover that crucial materials and software updates for irreplaceable tools must be acquired from the U.S., Japan, and other countries. Moreover, if China were to invade, it’s unlikely to capture all TSMC employees. If China did, it would only take a handful of angry engineers to sabotage the entire operation. The PLA’s proven it can seize Himalayan peaks From India on the two countries’ dispute border, but grabbing the world’s most complex factories, full of explosive gases, dangerous chemicals, and the world’s most precise machinery—that’s a different matter entirely.

Beijing knows that Taiwan’s defense strategy is to fight long enough for the U.S. and Japan to arrive and help. Imagine if Beijing were to use its navy to impose customs checks on a fraction of the ships sailing in and out of Taipei. How would the U.S. respond? A blockade is an act of war, but no one would want to shoot first. If the U.S. did nothing, the impact on Taiwan’s will to fight could be devastating. If China then demanded that TSMC restart chip fabrication for Huawei and other Chinese companies, or even to transfer critical personnel and know-how to the mainland, would Taiwan be able to say no?

Such a series of moves would be risky for Beijing, but they wouldn’t be unthinkable. China’s ruling party has no higher goal than asserting control over Taiwan. Its leaders constantly promise to do so.

Long gone are the days, as during the 1996 Taiwan Strait crisis, that the U.S. could simply sail an entire aircraft carrier battlegroup through the Strait to force Beijing to stand down.

The stronger the PLA gets, the less likely the U.S. is to risk war to defend Taiwan. If China were to try a campaign of limited military pressure on Taiwan, it’s more likely than ever that the U.S. might look at the correlation of forces and conclude that pushing back isn’t worth the risk.

If China were to succeed in pressuring Taiwan into giving Beijing equal access—or even preferential access—to TSMC’s fabs, the U.S. and Japan would surely respond by placing new limits on the export of advanced machinery and materials, which largely come from these two countries and their European allies. But it would take years to replicate Taiwan’s chipmaking capacity in other countries, and in the meantime we’d still depend on Taiwan. If so, we’d find ourselves not only reliant on China to assemble our iPhones. Beijing could conceivably gain influence or control over the only fabs with the technological capability to churn out the chips we depend on.

Such a scenario would be disastrous for America’s economic and geopolitical position. It would be even worse if a war knocked out TSMC’s fabs. The world economy and the supply chains that crisscross Asia and the Taiwan Strait are predicated on this precarious peace. Every company that’s invested on either side of the Taiwan Strait, from Apple to Huawei to TSMC, is implicitly betting on peace. Trillions of dollars are invested in firms and facilities within easy missile shot of the Taiwan Strait, from Hong Kong to Hsinchu. The world’s chip industry, as well as the assembly of all the electronic goods chips enable, depends more on the Taiwan Strait and the South China coast than on any other chunk of the world’s territory except Silicon valley.

If TSMC’s fabs were to slip into the Chelungpu Fault, whose movement caused Taiwan’s last big earthquake in 1999, the reverberations would shake the global economy. It would only take a handful of explosions, deliberate or accidental, to cause comparable damage. Some back-of-the-envelope calculations illustrate what’s at stake. Taiwan produces 11% of the world’s memory chips. More important, it fabricates 37% of the world’s logic chips. Computers, phones, data centers, and most other electronic devices simply can’t work without them, so if Taiwan’s fabs were knocked offline, we’d produce 37% less computing power during the following year.

Airplanes and autos, microwaves and manufacturing equipment—products of all types would face devastating delays. Around one-third of PC processor production, including chips designed by Apple and AMD, would be knocked offline until new fabs could be built elsewhere. Growth in data center capacity would slow dramatically, especially for servers focused on AI algorithms, which are more reliant on Taiwan-manufactured chips from companies like Nvidia and AMD.

New 5G radio units, for example, require chips from several different firms, many of which are made in Taiwan. There’d be an almost complete halt to the rollout of 5G networks.

It would make sense to halt cell phone network upgrades because it would be extremely difficult to buy a new phone, too. Most smartphone processors are fabricated in Taiwan, as are many of the ten or more chips that go into a typical phone. Autos often need hundreds of chips to work, so we’d face delays far more severe than the shortages of 2021. Of course, if a war broke out, we’d need to think about a lot more than chips. China’s vast electronics assembly infrastructure could be cut off. We’d have to find other people to screw together whatever phones and computers e had components for.

The challenge wouldn’t simply be building new fabs. Those facilities would need trained personnel, unless somehow many TSMC staff could be exfiltrated from Taiwan. Even still, new fabs must be stocked with machinery, like tools from ASML and Applied Materials. During the 2021–2022 chip shortage, ASML and Applied Materials both announced they were facing delays in producing machinery because they couldn’t acquire enough semiconductors. In case of a Taiwan crisis, they’d face delays in acquiring the chips their machinery requires.

After a disaster in Taiwan, in other words, the total costs would be measured in the trillions. Losing 37 percent of our production of computing power each year could well be more costly than the COVID pandemic and its economically disastrous lockdowns. It would take at least half a decade to rebuild the lost chipmaking capacity. These days, when we look five years out we hope to be building 5G networks and metaverses, but if Taiwan were taken offline we might find ourselves struggling to acquire dishwashers.

The Russian invasion of Ukraine, however, is a reminder that just because the Taiwan Strait has been mostly peaceful for the past few decades, a war of conquest is far from unthinkable. The Russia-Ukraine War also illustrates the extent to which any large conflict will be determined in part by a country’s position in the semiconductor supply chain, which will shape its ability to wield military and economic power.

Most Russian customers chose to stop buying from domestic chipmakers and outsourced production to TSMC. The only remaining customers were Russia’s defense and space industries, which were not big enough buyers of chips to fund advanced chipmaking at home. As a result, even high priority defense projects in Russia struggled to acquire the chips they needed. Russia’s equivalent of GPS satellites, for example, have faced wrenching delays due to problems sourcing semiconductors.

Russia’s ongoing difficulties with fabricating and acquiring chips explains why the country’s drones shot down over Ukraine are full of foreign microelectronics. It also explains why Russia’s military continues to rely extensively on non-precision-guided munitions. A recent analysis of Russia’s war in Syria found that up to 95% of munitions dropped were unguided.

The fact that Russia faced shortages of guided cruise missiles within several weeks of attacking Ukraine is also partly due to the sorry state of its semiconductor industry. Meanwhile, Ukraine has received huge stockpiles of guided munitions from the West, such as Javelin anti-tank missiles that rely on over 200 semiconductors each as they home in on enemy tanks.

Russia’s dependence on foreign semiconductor technology has given the United States and its allies a powerful point of leverage. After Russia invaded, the U.S. rolled out sweeping restrictions on the sale of certain types of chips across Russia’s tech, defense, and telecoms sectors, which was coordinated with partners in Europe, Japan, South Korea, and Taiwan. Key chipmakers from America’s Intel to Taiwan’s TSMC have now cut off the Kremlin. Russia’s manufacturing sector has faced wrenching disruptions, with a substantial portion of Russian auto production knocked offline.

Even in sensitive sectors like defense, Russian factories are taking evasive maneuvers such as deploying chips intended for dishwashers into missile systems, according to U.S. intelligence. Russia has little recourse other than to cut its consumption of chips, because its chipmaking capabilities today are even weaker than during the heyday of the space race.

The emerging Cold War between the U.S. and China, however, will be a less lopsided match when it comes to semiconductors, given Beijing’s investment in the industry and given that much of the chipmaking capacity America relies on is within easy range of PLA missiles. It would be naïve to assume that what happened in Ukraine couldn’t happen in East Asia. Looking at the role of semiconductors in the Russia-Ukraine War, Chinese government analysts have publicly argued that if tensions between the U.S. and China intensify, “we must seize TSMC.”

Cold War I had its own standoffs over Taiwan, in 1954 and again in 1958, after Mao Zedong’s military barraged Taiwanese-held islands with artillery. Today Taiwan is within range of far more destructive Chinese forces—not only an array of short- and medium-range missiles but also aircraft from the Longtian and Huian airbases on the Chinese side of the Strait, from which it’s only a seven-minute flight to Taiwan. Not coincidentally, in 2021, these airbases were upgraded with new bunkers, runway extensions, and missile defenses. A new Taiwan Strait crisis would be far more dangerous than the crises of the 1950s. There’d still be the risk of nuclear war, especially given China’s growing atomic arsenal. But rather than a standoff over an impoverished island, this time the battleground would be the beating hart of the digital world. What’s worse is that unlike in the 1950s, it’s not clear the People’s Liberation Army would eventually back down. This time, Beijing might water that it could well win.

The idea that the semiconductor industry would eventually produce more transistors each day than there are cells in the human body was something the founders of Silicon Valley would have found inconceivable.

The Defense Department has dedicated shipyards for billion-dollar submarines and ten-billion-dollar aircraft carriers, but it buys many of the chips it uses from commercial suppliers, often in Taiwan. Even the cost of designing a leading-edge chip, which can exceed $100 million, is getting too expensive for the Pentagon. The tools needed to make ever-smaller chips are staggeringly expensive, none more so than the EUV lithography machines that cost more than $100 million each.

Today’s computers and smartphones run on chips containing billions of microscopic transistors, the tiny electric switches that flip on and off to represent information. As such, they are unfathomably more capable than the U.S. Army’s ENIAC computer, which was state of the art for 1945. That device contained a mere 18,000 “switches.”

The most advanced lithography machines, which are used to pattern millions of microscopic transistors, each far smaller than a human cell, are made by ASML in the Netherlands. Each machine costs well over $100 million dollars and is built from hundreds of thousands of components.