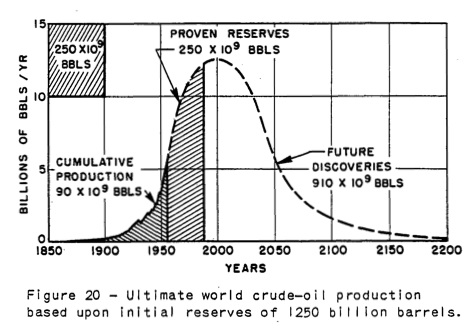

Will the decline in world oil supply be fast or slow?

April 11, 2011 by Gail Tverberg

Below are excerpts, read the link above to see all of this excellent article. Gail makes the case that the downslope of energy production is likely to steeper than Hubbert’s Curve would predict.

(1) A slow decline assumes that the only issue is geological decline in oil supply, and the economy and everything else can go on as usual. Technological advances and switches to alternatives might also be expected to help keep supply up.

(2) A fast decline can be expected if one or more adverse factors make oil supply decline faster than geological factors would suggest. These might include:

- Liebig’s Law of the Minimum – some necessary element for production, such as political stability, or adequate food for the population, or adequate financial stability, is missing or

- Declining Energy Return on Energy Invested (EROEI) interferes with the functioning of society, so the society generates too little net energy, and economic problems ensue, or

- Oil becomes so high priced that there is little demand for it. This would quite likely be related to declining EROEI.

The faster decline scenario is likely, because we will hit limits that interfere with oil production or oil demand.

Declining EROEI

EROEI means Energy Returned on Energy Invested. Wikipedia says: When the EROEI of a resource is equal to or lower than 1, that energy source becomes an “energy sink, and can no longer be used as a primary source of energy. The situation is worse than that.

An economy needs a certain level of energy just to keep its infrastructure — roads, bridges, schools, medical system, etc. — repaired and working. So energy resources need an EROEI significantly higher than 1 to maintain the system at its current level of functioning.

[MY NOTE: Charles A. S. Hall, one of the founders of EROEI, estimates you’d need an EROEI of least 12 or 13 to maintain civilization as we know it now]

If the average EROEI available to society is falling because oil is becoming more and more difficult to extract, an economy with a high standard of living, the US will be more affected than countries with a lower standard of living, like China or India. Ultimately, though, the world is one economy, so problems in one country are likely to affect the economies of other countries as well.

More issues related to declining EROEI:

1. High cost to extract. Sources of oil or natural gas or coal that are difficult (high cost) to extract tend to be lower in EROEI than sources that are low-cost to extract. So high cost of extraction tends to be a marker for low EROEI. We are increasingly running into this issue, for both oil and natural gas.

2. Declining Net Energy. EROEI is closely related to “Net Energy,” which is the amount of usable energy that is left after deducting the energy that it takes to make energy. When net energy decreases, we have less energy to run society, making it difficult to do things like maintain bridges and roads, and fund schools.

What did M. King Hubbert Say?

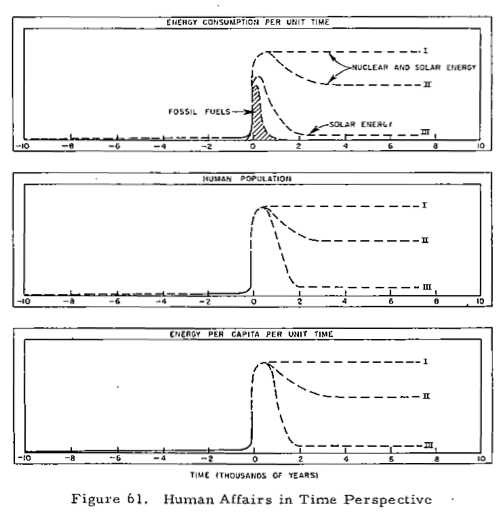

M. King Hubbert in various papers such as these (1956, 1962, 1976) talked about a world in which other fuels took over, long before fossil fuels encountered problems with short supply.

In such a world, there would be plenty of net energy from alternative fuels to run society. Because of this, even if fossil fuels ran low, it would be easy to maintain the economy’s infrastructure, without disruption. In Hubbert’s 1962 paper, Energy Resources – A Report to the Committee on Natural Resources, Hubbert writes about the possibility of having so much cheap energy that it would be possible to essentially reverse combustion–combine lots of energy, plus carbon dioxide and water, to produce new types of fuel plus water. If we could do this, we could solve many of the world’s problems–fix our high CO2 levels, produce lots of fuel for our current vehicles, and even desalinate water, without fossil fuels.

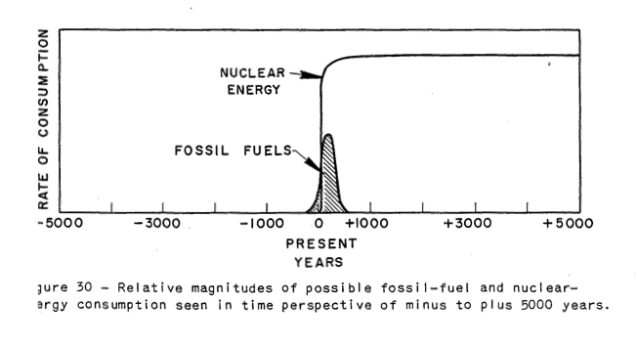

He also showed this figure in his 1956 paper:

In this figure, most of the additional energy comes from nuclear energy, while a smaller amount comes from “solar” energy. By solar energy, Hubbert would seem to mean solar, wind, tidal, wood, biofuels, and other energy we get on a day-to-day basis, indirectly from the sun. His figure seems to suggest that solar energy would basically act as a fossil fuel extender, and would not last beyond the time fossil fuels last. The primary long-term source of energy would be nuclear.

In such a world, applying Hubbert’s Curve to world oil supply would make perfect sense, because there would be plenty of other energy, to provide the energy needed to keep up the infrastructure needed to main extraction of oil, gas, and other fuels as long as they were available. Even liquid fuels and pollution wouldn’t be a problem, if they could be manufactured synthetically.

Another Approach to Forecasting Future Oil Supply: Limits to Growth Type Modeling

Another approach estimating the shape of the decline curve is applying modeling techniques, such as used in the 1972 book Limits to Growth by Donella Meadows et al. The factors in this model were population, food per capita, industrial output, pollution, and resources. Resources were modeled in total — oil wasn’t separated from other types of resources. 24 scenarios were run. The base scenario suggested that the world would start hitting resource limits about now (plus or minus 10 or 20 years). There have been several analyses regarding how this model is faring, and the conclusion seems to be that it is more or less on track. This is a link to such an analysis by Charles Hall and John Day.

With this type of model, according to Limits to Growth (p. 142), “The basic mode of the world system is exponential growth of population and capital, followed by collapse.” This type of decline would seem to be substantially faster than the decline predicted by the Hubbert Curve.

The Limits to Growth model leaves out our debt-based financial system. Since so much capital is borrowed in today’s world, it seems like including such a variable would tend to make the system even more “brittle”, and perhaps move up the date when collapse occurs.

Demand for Oil (or other Fossil Fuels)

Even if there is plenty of high-priced oil extracted from the ground, if potential buyers cannot afford it, there can be a problem, leading to a decline in oil production. Demand can be thought of as the willingness and ability to purchase oil products. Many people would like to have gasoline for their cars, but if they are unemployed, or have a part-time minimum wage job, they are likely not to have enough money to buy very much.

US energy consumption in general, and oil consumption in particular, has been relatively flat in the 2000-2009 period, and declining at the end of that period, indicating low demand. Prior to this period, it was rising. More or less the reverse has happened in China and India. Growth in oil use and energy products in general was moderate prior to 2000, but increased rapidly after 2000.

When we look at the percentage of the US population that is employed (Figure 9), it has been decreasing since 2000, so there are fewer people earning wages, and thus able to buy oil and other products. Prior to 2000, the percentage of the US population working was increasing.

In fact, over time, in the US, there is a high correlation between number of people employed and amount of oil consumed.

This high correlation is not surprising for two reasons: (1) jobs very often involve often use oil in producing or shipping goods, and because (2) people who are earning a salary can afford to buy goods and services that use oil.