Gold, Infinite Debt, and the Problem of Capital Storage: Has The Hotelling Moment Arrived?

March 9, 2011 Gregor Macdonald

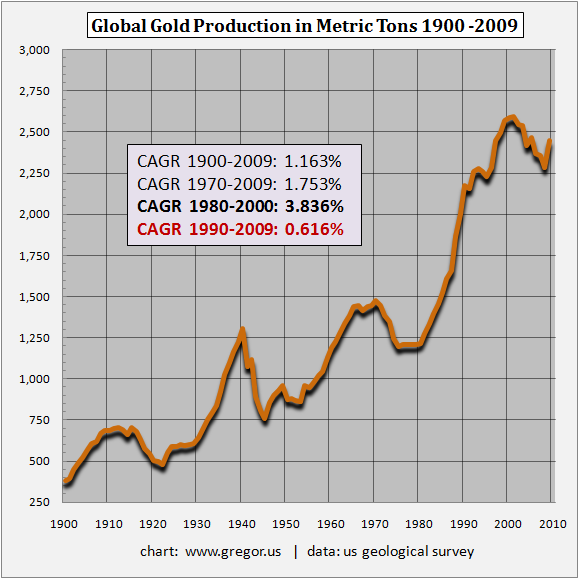

One of the reasons that gold retains its competitiveness as a capital-storage unit is the rather slow and plodding rate at which supply is brought to market. Since 1900, compound annual growth of world gold production comes in at 1.163%. That particular rate is below the growth rate for a number of other natural resources. But in particular: it’s well below the rate of credit production–the “resource” which now plagues the developed world. Indeed, the over-production of credit the past twenty-five years has once again driven capital back into hard assets such as gold. This brings up an intriguing subject: the conversion of resources into financial capital, and the conversion of financial capital back into resources. First, let’s take a look at a century of gold production. | see: World Gold Production in Metric Tons 1900 – 2009.

From 1980-2000 global gold production grew at a strong, compound annual growth rate (CAGR) of 3.836%. But that was after a very slow production rate for forty years, between 1940 and 1980. In the past decade global production of gold has not only slowed again but fallen steadily, with a notable uptick in 2009 as the decline temporarily reversed. Indeed, since the new millennium, the story of gold will be familiar to those who have watched oil: as prices steadily rose, supply growth fell.

The migration of capital, between the world of natural resources and the world of finance, has been addressed by any number of thinkers, one of the more compelling being Harold Hotelling. Writing in the Journal of Political Economy in 1931, Hotelling proposed that a rational producer of resources would only be inclined to extract and sell that resource if the investment opportunities available with the capital proceeds were greater than simply leaving that resource to appreciate in the ground. So, given Hotelling’s theory of resource extraction, what has happened to gold production since the year 2000? Does the chart reflect geological and cost limits to increasing gold production, even as the price rose from $250.00 to $1000.00 per ounce? Or, has there been some moderate yet gathering decision on the part of global gold producers to extract gold more slowly? After all, why extract gold to merely convert gold into paper currency, beyond the need to pay for the cost of production and provide, say, a dividend to shareholders? In other words, at the rate at which the price has been rising, why hurry to extract the gold?

These same questions have long been asked in the world of energy extraction as well. Why did global oil production advance so quickly into late 2003 as the oil price was rising towards the high 30′s, only to peak out for the past six years as price skyrocketed? We must assume that oil producers in the West, governed mostly by for-profit enterprises, were doing everything possible to lift production. The conclusion is rather easy: they couldn’t lift production, even with a doubling of price. But in contrast to BP, Shell, Exxon, Total, Chevron, and Conoco, what about the NOCs–the National Oil Companies? Is it possible they were inclined to apply some form of scarcity rent, holding back production slightly? Echoing statements made at least twice last decade, King Abdullah of Saudi Arabia repeated himself last Summer when he remarked about future Saudi oil production: “I told them that I have ordered a halt to all oil explorations so part of this wealth is left for our sons and successors God willing.” | see: Global Crude Oil Supply 2002 – 2010 in mbpd (updated through November 2010)

As lovely and reasonable a view offered by Hotelling in his The Economics of Exhaustible Resources, there is little evidence that oil producers are any more rational than individuals. The history of global oil production would appear to be governed more by geology, than any future projections of how to best invest oil revenues. North Sea oil was largely extracted in the cheap oil era, and peaked as oil prices began to take off earlier last decade. This was also true for Indonesia, and of course several decades before with the United States. Indeed, the bulk of world oil production was sold too cheaply. I discussed this phenomenon in my 2009 piece, The Fate of An Oil Exporter. By contrast, one of the few modern states that has spoken openly about husbanding scarce energy resources is Brazil. President Lula declared in 2009, as Brazil changed its resources policy that year, that the country’s new offshore discoveries were a “passport to the future.” Misunderstood by right-leaning commentary at the time as a form of resource-nationalism, Lula’s remarks were instead very much in the Hotelling vein. “We don’t have the right to take the money we’re going to get with this oil and waste it,” Lula remarked. But Brazil has been an exception.

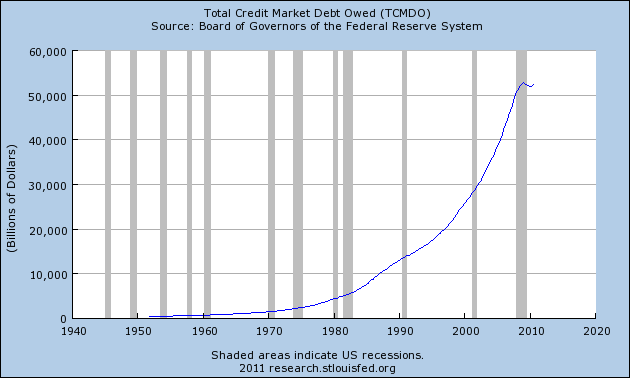

Given that both gold and oil production are now either flat or falling, what should a producer of these two commodities do with the proceeds of their sales? Let’s again consider the insurmountable problem at hand. Western economies and especially the United States have been on a credit binge for decades. When that bubble burst in 2008, punctured in large part by rising energy prices, the response from OECD governments was to create more credit. In Eric Zencey’s terrific New York Time’s essay on Frederick Soddy, which captured the views of the 1921 Nobel Laureate, the connection between debt limits and energy supply was made plain for a general readership:

Problems arise when wealth and debt are not kept in proper relation. The amount of wealth that an economy can create is limited by the amount of low-entropy energy that it can sustainably suck from its environment — and by the amount of high-entropy effluent from an economy that the environment can sustainably absorb. Debt, being imaginary, has no such natural limit. It can grow infinitely, compounding at any rate we decide.

Whenever an economy allows debt to grow faster than wealth can be created, that economy has a need for debt repudiation. Inflation can do the job, decreasing debt gradually by eroding the purchasing power, the claim on future wealth, that each of your saved dollars represents. But when there is no inflation, an economy with overgrown claims on future wealth will experience regular crises of debt repudiation — stock market crashes, bankruptcies and foreclosures, defaults on bonds or loans or pension promises, the disappearance of paper assets.

To Soddy’s point on the problem of infinitely created debt, let’s take a look at 60 years of debt growth in the United States. | see: Total Credit Market Debt Owed 1940 – 2010 (updated through December 2010).

As the United States has now (long) embarked on a massive dollar devaluation program, in part to bust the CNY-USD peg, but mostly to mitigate the next leg down in real-estate and debt deflation, we should consider how resource extractors might behave in such an environment. Two obvious possibilities are as follows. First, oil producers rather than chasing higher prices in dollar-terms might start to demand full or partial payment in gold. Meanwhile, gold producers might consider banking some of their capital not in cash, but also in gold. And yes, both oil and gold producers could simply leave more of the stuff in the ground. What may become more clear is that, beyond the need for operational cash, turning excess production of resources into paper currency will increasingly become, per Hotelling, a losing proposition.

Data Sources:

USGS Historical Statistics for Mineral and Material Commodities in the United States (includes global data).