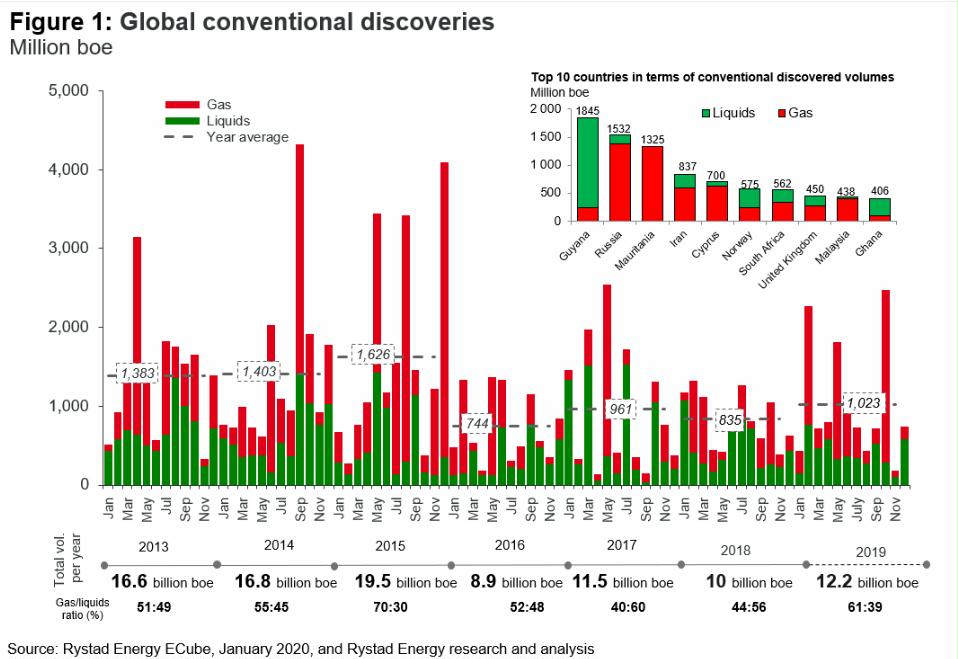

Source: Rystad Energy (2020) in “Global oil and gas discoveries reach four-year high in 2019, boosted by ExxonMobil’s Guyana success“.

Preface. The global conventional discovery chart above lists natural gas and oil discoveries since 2013. The fossil fuel that really matters is oil, since it’s the master resource that makes all others available, including natural gas, coal, transportation, and manufacturing.

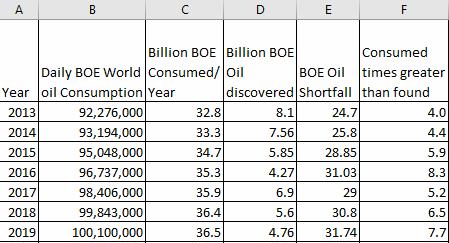

Source: discoveries Rystad (2020), consumption BP statistical review of world energy (2020

As you can see, in 2019 the world burned 7.7 times more oil than was discovered, with a shortfall of 31.74 billion barrels of oil to be discovered to break even in the future. This can’t end well, as anyone whose covid-19 pantry is emptying can easily grasp.

FYI from Peak Oil Review Feb 10, 2020: worldwide production of oil was 60.27% sourced from conventional on-shore oil, 21.59% conventional offshore shallow-water oil, 8.1% conventional offshore deep water, 6.93% U.S. Tight Oil (Fracking), and 3.10% Canadian Oil Sands oil extraction 3.10%.

And an editorial in oilprice.com notes that: “US oil production has peaked, and it will be difficult to climb back to these levels ever again, given how much capital markets have soured on the industry. The EIA said that the US will once again become a net petroleum importer later this year, ending a brief spell during which the US was a net exporter”.

Alice Friedemann www.energyskeptic.com author of “When Trucks Stop Running: Energy and the Future of Transportation”, 2015, Springer, Barriers to Making Algal Biofuels, and “Crunch! Whole Grain Artisan Chips and Crackers”. Podcasts: Collapse Chronicles, Derrick Jensen, Practical Prepping, KunstlerCast 253, KunstlerCast278, Peak Prosperity , XX2 report

***

Mikael, H. August 29, 2016. Oil Discoveries at 70-Year Low Signal Supply Shortfall Ahead. Bloomberg.

2016 figure only shows exploration results to August. Discoveries were just 230 million barrels in 1947 but skyrocketed the next year when Ghawar was discovered in Saudi Arabia, and it is still the world's largest oil field, though recently it was learned that Ghawar is in decline at 3.5% a year. Source: Wood Mackenzie

Explorers in 2015 discovered only about a tenth as much oil as they have annually on average since 1960. This year, they’ll probably find even less, spurring new fears about their ability to meet future demand.

With oil prices down by more than half since the price collapse two years ago, drillers have cut their exploration budgets to the bone. The result: Just 2.7 billion barrels of new supply was discovered in 2015, the smallest amount since 1947, according to figures from Edinburgh-based consulting firm Wood Mackenzie Ltd. This year, drillers found just 736 million barrels of conventional crude as of the end of last month.

That’s a concern for the industry at a time when the U.S. Energy Information Administration estimates that global oil demand will grow from 94.8 million barrels a day this year to 105.3 million barrels in 2026. While the U.S. shale boom could potentially make up the difference, prices locked in below $50 a barrel have undercut any substantial growth there. Ten years down from now this will have a “significant potential to push oil prices up. Given current levels of investment across the industry and decline rates at existing fields, a “significant” supply gap may open up by 2040″.

Oil companies will need to invest about $1 trillion a year to continue to meet demand, said Ben Van Beurden, the CEO of Royal Dutch Shell Plc, during a panel discussion at the Norway meeting. He sees demand rising by 1 million to 1.5 million barrels a day, with about 5 percent of supply lost to natural declines every year.

New discoveries from conventional drilling, meanwhile, are “at rock bottom,” said Nils-Henrik Bjurstroem, a senior project manager at Oslo-based consultants Rystad Energy AS. “There will definitely be a strong impact on oil and gas supply, and especially oil.

Global inventories have been buoyed by full-throttle output from Russia and OPEC, which have flooded the world with oil despite depressed prices as they defend market share. But years of under-investment will be felt as soon as 2025, Bjurstroem said. Producers will replace little more than one in 20 of the barrels consumed this year, he said.

There were 209 wells drilled through August this year, down from 680 in 2015 and 1,167 in 2014, according to Wood Mackenzie. That compares with an annual average of 1,500 in data going back to 1960.

Overall, the proportion of new oil that the industry has added to offset the amount it pumps has dropped from 30 percent in 2013 to a reserve-replacement ratio of just 6 percent this year in terms of conventional resources, which excludes shale oil and gas, Bjurstroem predicted. Exxon Mobil Corp. said in February that it failed to replace at least 100 percent of its production by adding resources with new finds or acquisitions for the first time in 22 years.

“That’s a scary thing because, seriously, there is no exploration going on today,” Per Wullf, CEO of offshore drilling company Seadrill Ltd., said by phone.

4 Responses to Global oil discovered 7.7 times less than consumption in 2019