Now that the right-wing authoritarians are getting dangerously powerful and in general the military, political, and economic systems are increasingly corrupt, govtrack.us is one way to see what Congress is up to, help you how to decide to vote in the next election, and maybe even write a few letters

Bills under consideration by committees (Aging, Agriculture, etc):

Bills & Resolutions coming up, trending now, top bills tracked by GovTrack users

Voting records

Each bill shows the yea and nay votes, if you select a bill you can see how your house or senate representative voted.

Track Members of Congress

Homepage https://www.govtrack.us/

Find legislation that affects you on

- Agriculture & food

- Animals

- Armed Forces & National Security

- Arts, Culture, Religion

- Civil Rights & Liberties, minority issues

- Commerce

- Crime & Law Enforcement

- Economics and Public Finance

- Education

- Emergency Management

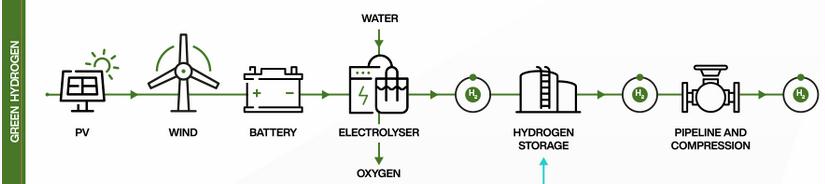

- Energy

- Environmental Protection

- Families

- Finance

- Foreign trade & international finance

- Geographic areas

- Government Operations and Politics

- Health

- Housing & community development

- Immigration

- International Affairs

- Labor and Employment

- Law

- Native Americans

- Private Legislation

- Public Lands and Natural Resources

- Science, technology, Communications

- Social Sciences & History

- Social Welfare

- Sports & Recreation

- Taxation

- Transportation & Public Works

- Water Resources Development

Preface. This post is a book review of Be Wilson’s Swindled. From Poison Sweets to Counterfeit Coffee – The Dark History of the Food Cheats.

Preface. This post is a book review of Be Wilson’s Swindled. From Poison Sweets to Counterfeit Coffee – The Dark History of the Food Cheats.