Preface. A book review of: Garcia, H. 2019. Sex, Power, and Partisanship. How evolutionary science makes sense of our political divide.

Although Chris Mooney’s book “The Republican Brain” was brilliant, it didn’t address that politics must surely go back to the origin of modern humans 300,000 years ago.

Garcia’s book addresses this, looking at politics from an evolutionary point of view. One finding I thought quite interesting was why women tend to be more liberal and men more conservative as can be seen in the 2024 U.S. election, men favor right-wing extremist Trump 25 points more than women in North Carolina, 19 points more in Michigan, 20 points more in Wisconsin, and 12 points more in Georgia & Pennsylvania.

“Evolutionary psychology is a field that rests on the understanding that we humans have spent 99% of our history in small bands of hunter-gatherers, living in environments very different from those in which we currently reside. Survival in those environments was harsh, with perpetual threats from predators, starvation, disease, and violence from outside tribes. These are the environments in which our political predispositions evolved.”

Continue reading →

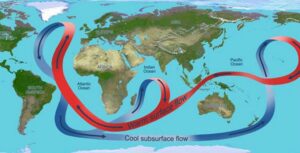

Preface. My greatest fear is nuclear war over the remaining resources on earth, since that has the potential of driving us extinct. I don’t believe there are enough fossil fuels left to do that via climate change because world conventional and unconventional oil peaked in 2018, the master resource that makes all others possible — coal and natural gas too (though for sure hundreds if not thousands of years of crazy weather and vastly reduced carrying capacity, perhaps enough to make agriculture difficult for a long time). But with the end of oil and endless growth capitalism depends on, the world will return resource wars, the time immemorial way to keep growing and gain wealth. Russia’s attack on Ukraine is all about resources, check this encyclopedia entry out, Ukraine has incredible fertile soil, minerals, and more (

Preface. My greatest fear is nuclear war over the remaining resources on earth, since that has the potential of driving us extinct. I don’t believe there are enough fossil fuels left to do that via climate change because world conventional and unconventional oil peaked in 2018, the master resource that makes all others possible — coal and natural gas too (though for sure hundreds if not thousands of years of crazy weather and vastly reduced carrying capacity, perhaps enough to make agriculture difficult for a long time). But with the end of oil and endless growth capitalism depends on, the world will return resource wars, the time immemorial way to keep growing and gain wealth. Russia’s attack on Ukraine is all about resources, check this encyclopedia entry out, Ukraine has incredible fertile soil, minerals, and more (