[ Below are excerpts from this 5 page paper, slightly rearranged, go here to see all of the text, figures, and tables. Alice Friedemann www.energyskeptic.com author of “When Trucks Stop Running: Energy and the Future of Transportation, 2015, Springer]

Murphy, D.J., Hall, C.A.S. 2011. Adjusting the economy to the new energy realities of the second half of the age of oil. Ecol. Model. doi:10.1016/j.ecolmodel.2011.06.022

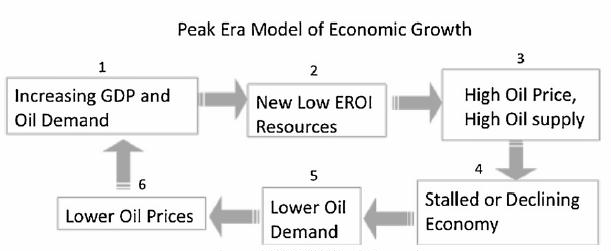

Fig 8 Peak era model of the economy

Is Growth still Possible?

Due to the depletion of conventional, and hence cheap, crude oil supplies (i.e. peak oil), increasing the supply of oil in the future would require exploiting lower quality resources (i.e. expensive),and thus will most likely occur only at high prices. This situation creates a system of feedbacks where economic growth, which requires more oil, would require high oil prices that will undermine that economic growth. We conclude that the economic growth of the past 40 years is unlikely to continue unless there is some remarkable change in how we manage our economy.

Numerous theories have been posited over the past century that have attempted to explain business cycles, or to generate some means of accelerating a return to rapid growth during slow or non-growth times. Many offer a unique explanation for the causes of and solutions to recessions. They include ideas based on: Keynesian Theory, the Monetarist Model, the Rational Expectations Model, Real Business Cycle Models, Neo- Keynesian models, etc. (Knoop, 2010).

Yet, for all the differences amongst these theories, they all share one implicit assumption: that there will be a return to a growing economy, i.e. growing GDP. Historically, there has been no reason to question this assumption as GDP, incomes, and most other measures of economic growth have in fact grown steadily over the past century.

But if we are entering the era of peak oil, then for the first time in history we may be asked to grow the economy while simultaneously decreasing oil consumption, something that has yet to occur in the U.S. for 100 years.

Oil more than any other energy source is vital to today’s economies because of its ubiquitous application as nearly the only transportation fuel, as a portable and flexible carrier and as feedstocks for manufacturing and industrial production.

Historically, spikes in the price of oil have been the primary cause of most recessions. On the other hand, expansionary periods tend to be associated with the opposite oil signature: prolonged periods of relatively low oil prices that increase aggregate demand and lower marginal production costs, all leading to, or at least associated with, economic growth.

By extension, for the economy to sustain real growth over time there must be an increase in the flow of net energy (and materials) through the economy. Quite simply economic production is a work process and work requires energy. This logic is an extension of the laws of thermodynamics, which state that: (1) energy cannot be created nor destroyed, and (2) energy is degraded during any work process so that the initial inventory of energy can do less work as time passes. As Daly and Farley (2003) describe, the first law places a theoretical limit on the supply of goods and services that the economy can provide, and the second law sets a limit on the practical availability of matter and energy. In other words, the laws of thermodynamics state that to produce goods and services, energy must be used, and once this energy is used it is degraded to a point where it can no longer be reused to power the same process again. Thus to increase production over time, i.e. to grow the economy, we must either increase the energy supply or increase the efficiency with which we use our source energy. This is called the energy-based theory of economic growth, which was advanced significantly by the work of Nicolas Georgescu-Roegen (GeorgescuRoegen, 1971), amongst many others (Costanza, 1980; Cleveland et al., 1984; Ayres, 1999; Hall et al., 2001; Daly and Farley, 2003; Ayres and Ware, 2005; Hall and Day, 2009).

An energy-based theory of economic growth

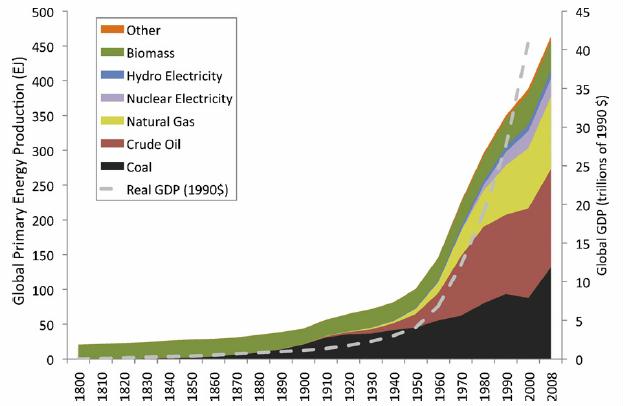

This energy-based theory of economic growth is supported by data: the consumption of every major energy source has increased with GDP since the mid-1800s at nearly the rate that the economy has expanded (Fig. 1). Throughout this growth period, however, there have been numerous oscillations between periods of growth and recessions.

Fig. 1. Energy production and GDP for the world from 1830 to 2000.

Cleveland et al. (2000) analyzed the causal relation between energy consumption and economic growth and their results indicate that, when they adjusted the data for quality and accounted for substitution, energy consumption caused economic growth. Other subsequent analyses that adjusted for energy quality support the hypothesis that energy consumption causes economic growth, not the converse (Stern, 1993, 2000).

In sum, our analysis indicates that about 50% of the changes in economic growth over the past 40 years are explained, at least in the statistical sense, by the changes in oil consumption alone. In addition, the work by Cleveland et al. (2000) indicates that changes in oil consumption cause changes in economic growth. These two points support the idea that energy consumption, and oil consumption in particular, is of the utmost importance for economic growth. Yet changes in oil consumption are rarely used by neoclassical economists as a means of explaining economic growth. For example, Knoop (2010) describes the 1973 recession in terms of high oil prices, high unemployment and inflation, yet omits mentioning that oil consumption declined 4% during the first year and 2% during the second year. Later in the same description, Knoop (2010) claims that the emergence from this recession in 1975 was due to a decrease in both the price of oil and inflation, and an increase in money supply. To be sure, these factors contributed to the economic expansion in 1975, but what is omitted, again, is the simple fact that lower oil prices led to increased oil consumption and hence greater physical economic output. Oil is treated by economists as a commodity, but in fact it is a more fundamental factor of production than either capital or labor (Hall et al., 2001).

Thus we present the hypothesis that higher oil prices and lower oil consumption are both precursors to, and indicative of, recessions. Likewise, economic growth requires lower oil prices and simultaneously an increasing oil supply. The data support these hypotheses: the inflation-adjusted price of oil averaged across all expansionary years from 1970 to 2008 was $37 per barrel compared to $58 per barrel averaged across recessionary years, whereas oil consumption grew by 2% on average per year during expansionary years compared to decreasing by 3% per year during recessionary years (Figs. 2 and 4). Although this analysis of recessions and expansions may seem like simple economics, i.e. high prices lead to low demand and low prices lead to high demand, the exact mechanism connecting energy, economic growth, and business cycles is rather more complicated. Hall et al. (2009) and Murphy and Hall (2010) report that when energy prices increase, expenditures are re-allocated from areas that had previously added to GDP, mainly discretionary consumption, towards simply paying for the more expensive energy. In this way, higher energy prices lead to recessions by diverting money from the economy towards energy only. The data show that recessions occur when petroleum expenditures as a percent of GDP climb above a threshold of roughly 5.5% (Fig 5).

- [Every] time the U.S. economy emerged from a recession over the past 40 years, there was always an increase in the use of oil while a low oil price was maintained.

- Oil is a finite resource.

In light of these two realities, the following two questions become particularly germane: What are the implications for economic growth if (1) oil supplies are unable to increase with demand, or (2) oil supplies increase, but at an increased price?

There is a clear trend in the literature on energy return on (energy) invested (EROI) of global oil production towards lower EROIs. Gagnon et al. (2009) report that the EROI for global oil extraction declined from about 36:1 in the 1990s to18:1 in 2006. This downward trend results from at least two factors: first, increasingly supplies of oil are originating from sources that are inherently more energy-intensive to produce simply because firms have developed cheaper resources before expensive ones. For example, in the early 1990s fewer than 10% of oil discoveries were located in deep water areas. By 2005 the number jumped to greater than 50%.

Enhanced oil recovery techniques are being implemented increasingly in the world’s largest conventional oil fields. For example, nitrogen injection was initiated in the once supergiant Cantarell field in Mexico in 2000, which boosted production for four years, but since 2004 production from the field has declined precipitously. Although enhanced oil recovery techniques increase production in the short term, they also increase significantly the energy inputs to production, offsetting much of the energy gain for society.

Roughly 60% of the oil discoveries in 2005 were in deep water locations (Fig. 6). Based on estimates from Cambridge Energy Research Associates (CERA, 2008), the cost of developing that oil is between $60 and $85 per barrel, depending on the specific deep water province. Oil prices therefore, at a minimum, must exceed roughly $60 per barrel to support the development of even the best deep water resources. But the average price of oil during recessionary periods has been $57/bbl, so it seems that increasing oil production in the future will require oil prices that are associated with recessionary periods.

All of this data indicates that an expensive oil future is necessary if we are to expand our total use of oil. In other words, growing the economy will require oil prices that will discourage that very growth. Indeed, it may be difficult to produce the remaining oil resources at prices the economy can afford, and, as a consequence, the economic growth witnessed by the U.S. and globe over the past 40 years may be a thing of the past.

EROI and the price of fuels

EROI is a ratio comparing the energy produced by an extraction process to that used to produce that energy (Murphy and Hall, 2010). As such it can be used as a proxy to estimate generally whether the cost of production of a particular resource will be high or low, and it also is probably a good determinant of the monetary costs of various energy resources. For example, the oil sands have an EROI of roughly 3:1, whereas the production of conventional U.S. crude oil has an average EROI of about 12:1 and Saudi crude probably much higher

The production costs for oil sands are roughly $85 per barrel compared to roughly $40 for average global oil and perhaps $20 (or less) per barrel for Saudi Arabian conventional crude (CERA, 2008). As we can see from this data there is an inverse relation between EROI and price, indicating that low EROI resources are generally more expensive to develop whereas high EROI resources are on average relatively inexpensive to develop (Fig. 7). As oil production continues, we can expect to move further towards the upper right of Fig. 7. In summary, relatively low EROI appears to translate directly into higher oil prices.

It is important to emphasize that these models assume that society will continue to pursue business-as-usual economic growth, i.e. the models assume that business persons will continue to assume that oil demand will continue to increase indefinitely in the future (whether or not they understand the role of the oil).

For the economy of the U.S. and any other growth-based economy, the prospects for future, oil-based economic growth are bleak. Taken together, it seems clear that the economic growth of the past 40 years will not continue for the next 40 years.

Summary

The main conclusions to draw from this discussion are:

- Over the past 40 years, economic growth has required increasing oil consumption.

- The supply of high EROI oil cannot increase much beyond current levels for a prolonged period of time.

- The average global EROI of oil production will almost certainly continue to decline as we search for new sources of oil in the only places we have left: deep water, arctic and other hostile environments.

- Increasing oil supply in the future will require a higher oil price because mostly only low EROI, high cost resources remain to be discovered or exploited, but these higher costs are likely to cause economic contraction.

- Using oil-based economic growth as a solution to recessions is untenable in the long-term, as both the gross and net supplies of oil has or will begin, at some point, an irreversible decline.

Due to the depletion of high EROI oil the economic model for the peak era, i.e. roughly 1970-2020, is much different from the pre-peak model, and can be described by the following feedbacks ( Fig. 8): (1) economic growth increases oil demand, (2) higher oil demand increases oil production from lower EROI resources, (3) increasing extraction costs leads to higher oil prices, (4) higher oil prices stall economic growth or cause economic contractions, (5) economic contraction leads to lower oil demand, and (6) lower oil demand leads to lower oil prices which spur another short bout of economic growth until this cycle repeats itself.

This system of insidious feedbacks is aptly described as a growth paradox: maintaining business as usual economic growth will require the production of new sources of oil, yet the only sources of oil remaining require high oil prices, thus hampering economic growth. This growth paradox leads to a highly volatile economy that oscillates frequently between expansion and contraction periods, and as a result, there may be numerous peaks in oil production. Campbell (2009) has referred to this as an undulating plateau. In terms of business cycles, the main difference between the pre and peak era models is that business cycles appear as oscillations around an increasing trend in the pre-peak model while during the peak-era model they appear as oscillations around a flat trend. It is important to emphasize that these models assume that society will continue to pursue business-as-usual economic growth, i.e. the models assume that businesspersons will continue to assume that oil demand will continue to increase indefinitely in the future (whether or not they understand the role of the oil).

But what if economic growth was no longer the goal? What if society began to emphasize energy conservation over energy consumption? Unlike oil supply, oil demand is not governed by depletion, and incentivizing populations to make incremental changes that decrease oil consumption can completely alter the relation between oil and the economy that was described in the aforementioned model. Decreasing oil consumption in the U.S. by even 10% would release millions of barrels of oil onto the global oil markets each day.

For the economy of the U.S. and any other growth-based economy, the prospects for future, oil-based economic growth are bleak. Taken together, it seems clear that the economic growth of the past 40 years will not continue for the next 40 years unless there is some remarkable change in how we manage our economy.

References

- Ayres, R., Ware, B., 2005. Accounting for growth: the role of physical work. Structural Change and Economic Dynamics 16, 181–209.

- Ayres, R.U., 1999. The second law, the fourth law, recycling and limits to growth. Ecological Economics 29, 473–483.

- Campbell, C., 2009. Why dawn may be breaking for the second half of the age of oil. First Break 27, 53–62.

- CERA, 2008. Ratcheting Down: Oil and the Global Credit Crisis. Cambridge Energy Research Associates.

- Cleveland, C.J., Costanza, R., Hall, C.A.S., Kauffmann, R., 1984. Energy and the U.S. economy: a biophysical perspective. Science 225, 890–897.

- Cleveland, C.J., Kaufmann, R.K., Stern, D.I., 2000. Aggregation and the role of energy in the economy. Ecological Economics 32, 301–317.

- Costanza, R., 1980. Embodied energy and economic valuation. Science 210, 1219–1224.

- Daly, H.E., Farley, J., 2003. Ecological Economics: Principles and Applications. Island Press.

- Faber, M., Manstetten, R., Proops, J., 1996. Ecological Economics: Concepts and Methods. Edward Elgar, Cheltenham. Federal, R., 2009. St. Louis Federal Reserve.

- Gagnon, N., Hall, C.A.S., Brinker, L., 2009. A preliminary investigation of the energy return on energy invested for global oil and gas extraction. Energies 2, 490–503.

- Georgescu-Roegen, N., 1971. The Entropy Law and the Economic Process. Harvard University Press, Cambridge.

- Hall, C.A., Balogh, S., Murphy, D.J., 2009. What is the minimum EROI that a sustainable society must have? Energies 2, 1–25.

- Hall, C.A.S., Day, J.W., 2009. Revisiting the limits to growth after peak oil. American Scientist 97, 230–237.

- Hall, C.A.S., Lindenberger, D., Kummel, R., Kroeger, T., Eichhorn, W., 2001. The need to reintegrate the natural sciences with economics. Bioscience 51, 663–673.

- Hayward, T., 2010. BP Statistical Review of World Energy. Report, British Petroleum. Jackson, P.M., 2009. The Future of Global Oil Supply. Energy Research Associates, Cambridge.

- Knoop, T.A., 2010. Recessions and Depressions: Understanding Business Cycles. Praeger, Santa Barbara.

- Murphy, D.J., Hall, C.A.S., 2010. Year in review – EROI or energy return on (energy) invested. New York Annals of Science 1185, 102–118.

- NBER, 2010. US Business Cycle Expansions and Contractions. National Bureau of Economic Research.

- Smil, V., 2010. Energy Transitions: History, Requirements, Prospects. Praeger, Santa Barbara, CA.

- Stern, D.I., 1993. Energy use and economic growth in the USA, a multivariate approach. Energy Economics 15, 137–150. S

- Stern, D.I., 2000. A multivariate cointegration analysis of the role of energy in the US macroeconomy. Energy Economics 22, 267–283.

2 Responses to Murphy & Hall 2011 Adjusting the economy to the new energy realities of the second half of the age of oil