Large Power Transformer Source: ABB Conversations (2013)

Preface. This post contains excerpts from two Department of Energy documents and one about large geomagnetic storms and how they would affect Large power transformers (LPT) and the U.S. electric grid. They are key essential critical infrastructure to keep the electric grid up, and enormous, up to 800,000 pounds making them expensive and hard to deliver. And vulnerable to supply chain failures because the largest ones are not made in the U.S.

If large power transformers are destroyed by a geomagnetic disturbance (GMD) electromagnetic pulse (EMP), cyber-attack, sabotage, severe weather, floods, or simply old age, parts or all of the electric grid could be down in a region for 6 months to 5 years.

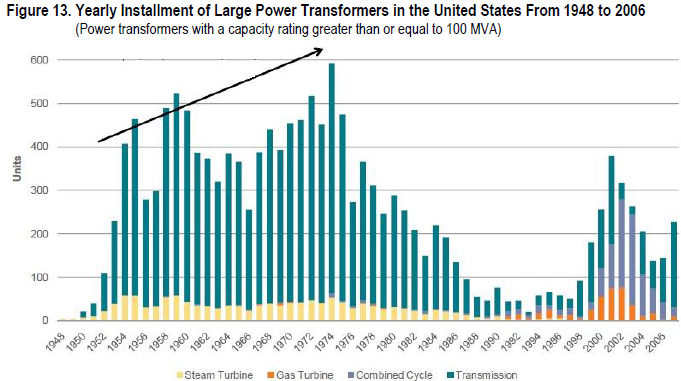

This is because the USA imports 85% of them (and all of the largest ones), there is competition with other nations for limited production and raw materials such as special grade electrical steel, a high cost ranging from $2.5 to $10 million dollars in 2014 (including transport/installation), and they are custom built, with long lead times to design, bid, manufacture, and deliver, with components that depend on long foreign production and supply chains. The United States large power transformers are aging faster than they’re being replaced, and even more are needed for new intermittent renewable generation, which has the potential to damage them if not integrated carefully into the existing electric grid. There are possibly tens of thousands of LPT’s in America, mostly built between 1954 and 1978, so an increasing percentage of these aging LPT’s will need to be replaced within the next few decades.

And they’re getting old! Their average age is 40 years, the end of their expected life time. More than 70% of U.S. LPTs are more than 25 years old. And some are over 70 years old. All of which make the electric infrastructure vulnerable to supply chain bottlenecks when they need to be replaced.

The first DOE summary from 2022 below is one of 14 looking at the vulnerability of supply chain risks in these critical sectors. The remedy for all of them is to make the key components and mine the needed metals, in this case to keep the grid up, which is falling apart.

If we don’t mine and make key products here, we risk hostile nations unwilling to sell to us, or at astronomical prices, and may have to wait years for delivery. Other risks are that foreign suppliers could go out of business or be unable to deliver goods because of wars, natural disasters, or energy shortages, so even when the U.S. does make a component offshore, they are still vulnerable to these supply chain failures.

Even if we tried do it all across these 14 sectors, it’s not likely to happen, there are too many obstacles. We don’t have the patents. We don’t have mines for many metals. Labor is far more expensive than abroad so unprofitable. The U.S. lacks skilled employees. Especially power engineers, with about half of them retiring within the next decade. Nor the skilled employees to make special steel, large power transformers, HDVC transmission and much more.

As energy declines, these products will become even more expensive since they consume a lot of energy. Here are some verbs I yanked out of the manufacturing descriptions of various components of LPT and HDVC transmission in the first DOE report. Contemplate the implied energy: melt, purify, cast, hot mill, trim, anneal, pickle, wind, weld, separate, coat, mount, laminate, impregnate, assemble, cut, dry, screen print, stack, dice, burn, sinter, flatten, fire, and spray.

Alice Friedemann www.energyskeptic.com Author of Life After Fossil Fuels: A Reality Check on Alternative Energy; When Trucks Stop Running: Energy and the Future of Transportation”, Barriers to Making Algal Biofuels, & “Crunch! Whole Grain Artisan Chips and Crackers”. Women in ecology Podcasts: WGBH, Jore, Planet: Critical, Crazy Town, Collapse Chronicles, Derrick Jensen, Practical Prepping, Kunstler 253 &278, Peak Prosperity, Index of best energyskeptic posts

***

DOE (2022) Electric Grid Supply Chain Review: Large Power Transformers & High Voltage Direct Current Systems. Supply Chain Deep Dive Assessment. U.S. Department of Energy Response to Executive Order 14017, “America’s Supply Chains”

The need to modernize and enlarge the capacity of the U.S. power grid is increasing due to growing population, aging infrastructure, grid resilience requirements, operational flexibility needs, and a growing portfolio of renewable energy.

Many critical components supporting the power grid have no or limited manufacturers in the U.S.

Here’s a summary of the main issues, followed by details about what this stuff is and additional obstacles:

- The need to modernize and increase the capacity of the power grid is growing due to increased energy demand, aging infrastructure, grid resilience, security requirements and global and national clean energy goals.

- Without improving domestic GOES steel production capabilities, LPT manufacturers will be dependent on foreign sources.

- The U.S. manufacturers of LPTs are not competitive compared to the global manufacturers because of multiple issues including workforce skill gaps, high capital investment, lacking test space, and unstable material costs.

- Leading HVDC suppliers are present in the United States. However, their manufacturing plants are based in Asia and Europe where most demand resides.

- The semiconductor required for manufacturing HVDC converters are not manufactured in the U.S. States, either.

- As the world seeks to adopt more carbon-free electricity, demand for HVDC devices will increase, and procuring these devices with no local manufacturers will be more challenging and make the United States heavily dependent on foreign markets and politics.

Large Power Transformers (LPT)

LPT transformers step up voltage to decrease power losses from electricity transmission, and step down voltage for distribution at lower, more usable voltage levels. Over 90% of the nation’s electric power passes through an LPT (Office of Electricity, 2021).

And they’re getting old! Their average age is ~40 years, which is the end of their expected life time. More than 70% of U.S. LPTs are aged more than 25 years. Some are over 70 years old. All of which make the electric infrastructure vulnerable to supply chain bottlenecks. LPTs are expensive, difficult to transport, and highly customized devices that often have long lead times.

The cost and availability of a new LPT depends on raw material suppliers of grain-oriented electrical steel (GOES), continuously transposed conduction (CTC) copper wire, component supplies of bushings, tap changers, and insulating. The two weakest segments are GOES and LPT manufacturing. There is only one GOES manufacturer in the United States far more expensive and lower quality than imported LPT makers. Offshore GOES steel makers are shifting to non-oriented electrical steel (NOES) for EVs, which is more profitable.

High-Voltage Direct Current (HVDC) Transmission

This technology increases the power grid’s capacity to receive, transmit, and deliver a large amount of energy and cheaper over long distances than HVAC. And essential to connect distant large-scale renewable resources in remote or offshore areas far from cities to keep too much power from being lost during transmission.

But there’s so little HDVC in the U.S. that the main components are made overseas. And it’s hard to build HDVCs since it requires collaboration from multiple Regional Transmission Organizations (RTOs) who aren’t eager to cooperate. HDVC lines are expensive, so getting permission to raise rates on customers is hard to justify when existing, lower cost transmission systems already exist.

Large Power Transformers supply chain mapping

Raw material suppliers (copper ore, iron ore, crude oil, wood, Clay/sand, PCBs, pressboard, paper, aluminum, plastics, silica gel) have the most influence on component and transformer prices due to material availability, including metals, insulating materials, oil, and sealing materials. The material suppliers for components such as GOES, CTC copper wire, insulating materials, and polymers also have a significant influence on the final products. The component suppliers provide bushings, insulators, tap changers, switches, valves, and other mechanical components to the transformer manufacturers.

A 2020 U.S. Department of Commerce survey of 87 domestic LPT component manufacturers found that companies have difficulties hiring employees with necessary skill sets and qualifications fort transformer manufacturing such as welding, coil winding, and transformer testing(U.S. Department of Commerce, 2020).They also claimed that few post-secondary institutions offer specializations in manufacturing engineering, power engineering, and electrical design engineering (U.S. Department of Commerce, 2020), perhaps due to a larger focus on other high demand areas, such as computer science and electronics.

Workers wages are much higher than other countries, which also makes increasing domestic production difficult.

The overall large power transformer market share in terms of revenue by global region in 2020 was as follows: Asia-Pacific (39%), Europe (24%), Middle East/Africa (17%), North America (15%), and Latin America (4.0%) (Global Market Insights, 2021).

With only one GOES steel producer in the United States of a quality not good enough for many LPTs, so 82% are imported. the United States is highly vulnerable to supply chain disruptions. In 2020, 85% of imported GOES came from South Korea, 6% from Brazil and 4% from Russia (USA Trade Online, 2021).Although the largest supplier is from South Korea – a friendly country – their recent move of expanding production capacity of NOES to serve the EV sector and reduce GOES production for transformers causes concerns for LPT manufacturers of upcoming GOES supply shortage. When one breaks down, a new one can take over 2 years or more to replace it due to long manufacturing and delivery times.

But hard to make in U.S. Not enough trained workers, salaries too high to be competitive with overseas manufacturing. Not profitable to make here. HVDC also depends heavily on imports.

Foreign competition is a major challenge to GOES and LPT production as companies in other countries benefit from subsidies and government protection (U.S. Department of Commerce, 2020). Lastly, LPT manufacturers reported continuing labor challenges with an aging workforce and difficulty attracting and retaining younger workers (U.S. Department of Commerce, 2020). This is true for shop floor labor and engineering labor. These companies believe that power system engineering is not in high demand as other fields within electrical engineering such as electronics and computer science. Even within the field of power systems engineering, more research and education focus has been on microgrid and other forms of renewable energy than transformer design and manufacturing

In HVDC projects, stakeholders raised concerns about collaboration among RTOs. For large transmission projects, RTOs need to work together to exchange data and technical details. However, RTOs do not necessarily have incentives to pursue transmission projects beyond their regions. If an RTO is interested in a transmission project, they face obstacles in obtaining data from utility companies in another RTO. Another aspect related to RTO is lacking HVDC expertise. Similar to the case of LPT, there are very few people trained in HVDC systems in the United States. For projects that require interconnect, without proper expertise, the uncertainty of a project gets higher, with longer delays in technical design, installation, and operation.

HVDC projects can only recover cost by getting new users who are willing to pay more to get better services. Since utilities are managing cost well to reduce energy cost, it is hard for a new HVDC project to compete. As a result, forecasting the demand and build a new customer base seems to be difficult HDVC raw materials: Germanium, mica, aluminum, ceramic, copper, nickel, silicon, chromium, polymers, tungsten, zinc, carbon/glass fiber, kaolin, petuntse, talc, feldspar, fluorspar, apatite, cryolite, steel goes into many components, subcomponents and devices such as semiconductors, capacitors, resistors, inductors, and more

***

DOE (2014) Large Power transformers and the U.S. electric grid. U.S. Department of Energy.

Large Power Transformers (LPT) have long been a concern for the U.S. Electricity Sector, because the failure of a single unit can cause temporary service interruption and lead to collateral damage, and it could be difficult to quickly replace it. Key industry sources have identified the limited availability of spare LPTs as a potential issue for critical infrastructure resilience in the United States.

The U.S. electric power grid serves one of the Nation’s critical life-line functions on which many other critical infrastructure depend, and the destruction of this infrastructure can cause a significant impact on national security and the U.S. economy. The U.S. electric power grid faces a wide variety of threats, including natural, physical, cyber, and space weather. LPTs are large, custom-built electric infrastructure. If several LPTs were to fail at the same time, it could be challenging to quickly replace them.

Large power transformers are a critical component of the transmission system, because they adjust the electric voltage to a suitable level on each segment of the power transmission from generation to the end user. In other words, a power transformer steps up the voltage at generation for efficient, long-haul transmission of electricity and steps it down for distribution to the level used by customers. Power transformers are also needed at every point where there is a change in voltage in power transmission to step the voltage either up or down.

Although prices vary by manufacturer and by size, an LPT can cost millions of dollars and weigh between approximately 100 and 400 tons (or between 200,000 and 800,000 pounds). The procurement and manufacturing of LPTs is a complex process that includes pre-qualification of manufacturers, a competitive bidding process, the purchase of raw materials, and special modes of transportation due to its size and weight.

The result is the possibility of an extended lead time that could stretch beyond 20 months and up to five years in extreme cases if the manufacturer has difficulty obtaining any key inputs, such as bushings and other key raw materials, or if considerable new engineering is needed.

The United States is one of the world’s largest markets for power transformers, with an estimated market value of more than $1 billion in 2010, or almost 20% of the global market. The United States also holds the largest installed base of LPTs in the world. Using certain analysis and modeling tools, various sources estimate that the number of EHV LPTs in the United States to be approximately 2,000.

While the estimated total number of LPTs (capacity rating of 100 MVA and above) installed in the United States is unavailable, it could be in the range of tens of thousands, including LPTs that are located in medium-voltage transmission lines with a primary voltage rating of 115 kV.

Two raw materials— copper and electrical steel—account for more than half of the total cost of an LPT. Special grade electrical steel is used for the core of a power transformer and is critical to the efficiency and performance of the equipment; copper is used for the windings.

In recent years, the price volatility of these two commodities in the global market has affected the manufacturing condition and procurement strategy for LPTs. The rising global demand for copper and electrical steel can be partially attributed to the increased power and transmission infrastructure investment in growing economies, as well as the replacement market for aging infrastructure in developed countries.

The United States is one of the world’s largest markets for power transformers and holds the largest installed base of LPTs, and this installed base is aging.

The average age of installed LPTs in the United States is approximately 38 to 40 years, with 70% of LPTs being 25 years or older. While the life expectancy of a power transformer varies depending on how it is used, aging power transformers are potentially subject to an increased risk of failure.

Our power transformers are aging far faster than they’re being replaced:

Since the late 1990’s, the United States has experienced an increased demand for LPTs; however, despite the growing need, the United States has a limited domestic capacity to produce LPTs. In 2010, 6 power transformer manufacturing facilities existed in the United States, and together, they met approximately 15% of the Nation’s demand for power transformers at a capacity rating greater than or equal to 60 megavolt-amperes (MVA). Although the exact statistics are unavailable, global power transformer supply conditions indicate that the Nation’s reliance on foreign manufacturers was even greater for extra high-voltage (EHV) power transformers with a maximum voltage rating greater than or equal to 345 kilovolts (kV).

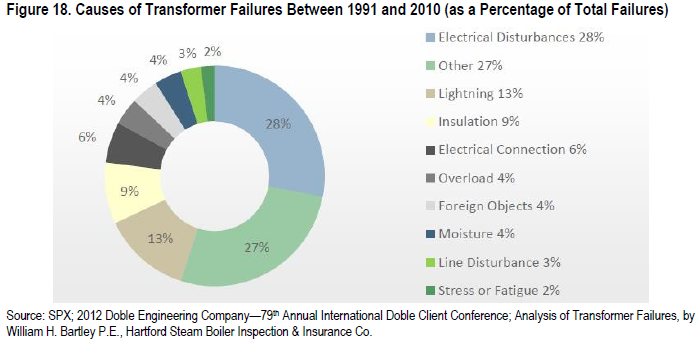

[As more unreliable, intermittent, uncertain, variable wind and solar are added, the risks of damage from line disturbance, overload, and electrical disturbances increases]:

Electrical disturbances” included phenomena such as switching surges, voltage spikes, line faults/flashovers, and other utility abnormalities, but excludes lightning.

Although age is not included as a cause of transformer failure in Figure 18, age is certainly a contributing factor to increases in transformer failures. Various sources, including power equipment manufacturers, estimated that the average age of LPTs installed in the United States is 38 to 40 years, with approximately 70% of LPTs being 25 years or older. According to an industry source, there are some units well over 40 years old and some as old as over 70+ years that are still operating in the grid. An LPT is subjected to faults that result in high radial and compressive forces, as the load and operating stress increase with system growth. In an aging power transformer failure, typically the conductor insulation is weakened to the degree at which it can no longer sustain the mechanical stresses of a fault.

Given the technical valuation that a power transformer’s risk of failure is likely to increase with age, many of the LPTs in the United States are potentially subject to a higher risk of failure. In addition, according to an industry source, there were also some bad batches of LPTs from certain vendors. The same source also estimated that the failure rate of LPTs is around 0.5 percent. In addition to these traditional threats to power transformers, the physical security of transformers at substations has become a public safety concern due to a coordinated physical attack on cyber infrastructure of a California substation in 2013.

Throughout this report, the term large power transformer (LPT) is broadly used to describe a power transformer with a maximum capacity rating greater than or equal to 100 MVA unless otherwise noted.

In addition to the need for the replacement of aging infrastructure, the United States has a demand for transmission expansion and upgrades to accommodate new generation connections and maintain electric reliability.

In particular, this study addresses the considerable dependence the United States has on foreign suppliers to meet its growing need for LPTs. The intent of this study is to inform decision makers about potential supply concerns regarding LPTs in the United States. This report provides the following observations: The demand for LPTs is expected to remain strong globally and domestically. Key drivers of demand include the development of power and transmission infrastructure in emerging economies (e.g., China and India) and the replacement market for aging infrastructure in mature economies (e.g., United States), as well as the integration of alternative energy sources into the grid and an increased focus on nuclear energy in light of climate change concerns.

The United States has limited production capability to manufacture LPTs. In 2010, only 15% of the Nation’s demand for power transformers (with a capacity rating of 60 MVA and above) was met through domestic production. Although the exact statistics are unavailable, power transformer market supply conditions indicate that the Nation’s reliance on foreign manufacturers was even greater for EHV power transformers with a capacity rating of 300 MVA and above (or a voltage rating of 345 kV and above).

While global procurement has been a common practice for many utilities to meet their growing need for LPTs, there are several challenges associated with it. Such challenges include: the potential for an extended lead time due to unexpected global events or difficulty in transportation; the fluctuation of currency exchange rates and material prices; and cultural differences and communication barriers. The utility industry is also facing the challenge of maintaining an experienced in- house workforce that is able to address procurement and maintenance issues. The U.S. electric power grid is one of the Nation’s critical life-line functions on which many other critical infrastructure depend, and the destruction of this infrastructure can have a significant impact on national security and the U.S. economy. The electric power infrastructure faces a wide variety of possible threats, including natural, physical, cyber, and space weather.

The failure of a single unit could result in temporary service interruption and considerable revenue loss, as well as incur replacement and other collateral costs. Should several of these units fail at the same time, it will be challenging to quickly replace them.

LPTs are special-ordered machines that require highly skilled workforces and state-of-the-art manufacturing equipment and facilities. The installation of LPTs entails not only significant capital expenditures but also a long lead time due to the intricate manufacturing processes, including the securing of raw materials. As a result, asset owners and operators invest considerable resources to monitor and maintain LPTs, as failure to replace aging LPTs could present potential concerns, including increased maintenance costs, equipment failures, and unexpected power failures.

The workshop considered four risk scenarios concerning the Electricity Sector, including a severe geomagnetic disturbance (GMD) or electromagnetic pulse (EMP) event that damaged a difficult-to-replace generating station and substation equipment causing a cascading effect on the system.

The size of a power transformer is determined by the primary (input) voltage, the secondary (output) voltage, and the load capacity measured by MVA. Of the three, the capacity rating, or the amount of power that can be transferred, is often the key parameter rather than the voltage.13 In addition to the capacity rating, voltage ratings are often used to describe different classes of power transformers, such as extra high voltage (EHV), 345 to 765 kilovolts (kV); high voltage, 115 to 230 kV; medium voltage, 34.5 to 115 kV; and distribution voltage, 2.5 to 35

Power Transformers in the Electric Grid. North America’s electricity infrastructure represents more than $1 trillion U.S. dollars in asset value and is one of the most advanced and reliable systems in the world. The U.S. bulk grid consists of approximately 390,000 miles of transmission lines, including more than 200,000 miles of high-voltage lines, connecting to more than 6,000 power plants.

An LPT can weigh as much as 410 tons (820,000 pounds (lb)) and often requires long-distance transport.

Physical Characteristics of Large Power Transformers. An LPT is a large, custom-built piece of equipment that is a critical component of the bulk transmission grid. Because LPTs are very expensive and tailored to customers’ specifications, they are usually neither interchangeable with each other nor produced for extensive spare inventories. According to an industry source, approximately 1.3 transformers are produced for each transformer design. Figure 2 illustrates a standard core-type LPT and its major internal components. Although LPTs come in a wide variety of sizes and configurations, they consist of two main active parts: the core, which is made of high-permeability, grain- oriented, silicon electrical steel,

Power transformer costs and pricing vary by manufacturer, market condition, and location of the manufacturing facility. In 2010, the approximate cost of an LPT with an MVA rating between 75 MVA and 500 MVA was estimated to range from $2 million to $7.5 million in the United States; however, these estimates were Free on Board (FOB) factory costs, exclusive of transportation, installation, and other associated expenses, which generally add 25 percent to 30 percent to the total cost (see Table 2).

LPTs require substantial capital and a long-lead time (in excess of six months) to manufacture, and its production requires large crane capacities, ample floor space, and adequate testing and drying equipment. The following section provides further discussions on the production processes and requirements of LPTs, including transportation and key raw commodities.

LPTs are custom-made equipment that incurs significant capital costs. Utilities generally procure LPTs through a competitive bidding process, in which all interested producers must pre-qualify to be eligible to bid. Pre-qualification is a lengthy process that can take several years. A typical qualification process includes an audit of production and quality processes, verification of certain International Organization for Standardization (ISO) certifications, and inspection of the manufacturing environment. This process can often be rigorous and costly to purchasers; however, it is an important step, because the manufacturing environment and capability can significantly affect the reliability of the product, especially of high-voltage power transformers.

LPTs are custom-designed equipment that entails a significant capital expenditure and a long lead time due to an intricate procurement and manufacturing process. (1) Request for proposal (2 months), (2) Submit Bid (1-2 months), (3) contract negotiation/technical specification (1-2 months), (4) Design (2-4 months), (5) purchase materials (2-4 months), (6) production (2-4 months), (7) Testing (days to weeks), (8) Transportation & Site Set-up (weeks to months).

Bidding Process. A standard bidding process is initiated by a purchaser, who sends commercial specifications to qualified LPT producers. The producers then design LPTs to meet the specifications, estimate the cost, and submit a bid to the purchaser. The bids not only include the power transformer, but also services such as transportation, installation, and warranties. Except for a few municipalities, most utilities do not announce the amount of the winning bid or the identity of the winning bidder. The winning bidder is notified, and bid terms normally require that the results be kept confidential by all parties involved.

Production. The typical manufacturing process of an LPT consists of the following steps: 1. Engineering and design: LPT design is complex, balancing the costs of raw materials (copper, steel, and cooling oil), electrical losses, manufacturing labor hours, plant capability constraints, and shipping constraints. 2. Core building: The core is the most critical component of an LPT, which requires a highly-trained and skilled workforce and cold-rolled, grain-oriented (CRGO) laminated electrical steel. 3. Windings production and assembly of the core and windings: Windings are predominantly copper and have an insulating material. 4. Drying operations: Excess moisture must be removed from the core and windings because moisture can degrade the dielectric strength of the insulation. 5. Tank production: A tank must be completed before the winding and core assembly finish the drying phase so that the core and windings do not start to reabsorb moisture. 6. Final assembly of the LPT: The final assembly must be done in a clean environment; even a tiny amount of dust or moisture can deteriorate the performance of an LPT. 7. Testing: Testing is performed to ensure the accuracy of voltage ratios, verify power ratings, and determine electrical impedances.

In 2010, the average lead time between a customer’s LPT order and the date of delivery ranged from five to 12 months for domestic producers and six to 16 months for producers outside the United States. The LPT market is characterized as a cyclical market with a correlation between volume, lead time, and price. In other words, the average lead time can increase when the demand is high, up to 18 to 24 months. This lead time could extend beyond 20 months and up to five years in extreme cases if the manufacturer has difficulty obtaining any key inputs, such as bushings and other key raw materials, or if considerable new engineering is needed.

Once completed, a power transformer is disassembled for transport, including the removal of oil, radiators, bushings, convertors, arrestors, and so forth. The proper transportation of a power transformer and its key parts is critical to ensuring the high reliability of the product and minimizing the period for onsite installation.

Transporting an LPT is challenging—its large dimensions and heavy weight pose unique requirements to ensure safe and efficient transportation. Current road, rail, and port conditions are such that transportation is taking more time and becoming more expensive. Although rail transport is most common, LPTs cannot be transferred over normal railcars, because they cannot be rolled down a hill or bumped into other rail cars, which can damage the power transformer. This is because the heaviest load a railroad normally carries is about 100 tons, or 200,000 lb, whereas an LPT can weight two to three times that amount. A specialized railroad freight car known as the Schnabel railcar is used to transport extremely heavy loads and accommodate height via railways. There are a limited number of Schnabel cars available worldwide, with only about 30 of them in North America. Certain manufacturers operate a Schnabel car rental program and access to a railroad is also becoming an issue in certain areas due to the closure, damage, or removal of rail lines.

Photos: 1) A German machine called the Goldhofer, which “looks like a caterpillar with 144 tires and features a hydraulic system” to handle the heavy weight, is another mode of transportation used on the road. 2) Workers move wires, lights, and poles to transport a 340-ton power transformer, causing hours of traffic delay.

Logistics and transportation accounted for approximately three percent to 20% of the total cost of an LPT for both domestic and international producers. While important, this is less significant than the cost of raw materials and the potential sourcing concerns surrounding them. The next section describes some of the issues concerning raw materials vital to LPT manufacturing.

Raw Materials Used in Large Power Transformers. The main raw materials needed to build power transformers are copper conductors, silicon iron/steel, oil, and insulation materials. The cost of these raw materials is significant, accounting for well over 50% of the total cost of a typical LPT. Specifically, manufacturers have estimated that the cost of raw materials accounted for 57% to 67% of the total cost of LPTs sold in the United States between 2008 and 2010. Of the total material cost, about 18% to 27% was for copper and 22% to 24% was for electrical steel. For this reason, this section examines the issues surrounding the supply chain and price variability of the two key raw materials used in LPTs— copper and electrical steel.

Electrical Steel and Large Power Transformers. The electrical steel used in power transformer manufacture is a specialty steel tailored to produce certain magnetic properties and high permeability. A special type of steel called cold-rolled grain-oriented electrical steel (hereinafter refer to as “electrical steel”) makes up the core of a power transformer. Electrical steel is the most critical component that has the greatest impact on the performance of the power transformer, because it is designed to provide low core loss and high permeability, which are essential to efficient and economical power transformers. Electrical steel is produced in different levels of magnetic permeability: conventional and high – permeability. Conventional products are available in various grades from M-2 through M-6, with thickness and energy loss increasing with each higher number (see Figure 5). High-permeability product allows a transformer to operate at a higher level of flux density than conventional products, thus permitting a transformer to be smaller and have lower operating losses. The quality of electrical steel is measured in terms of loss of electrical current flowing in the core. In general, core losses are measured in watts per kilogram (W/kg), and the thinner the material, the better the quality. An industry source noted that an electrical steel grade of M3 or better is typically used in LPTs to minimize core loss.

The average annual prices of electrical steel ranged from $1.20 to $2.20 per pound between 2006 and 2011, with peak prices occurring in 2008. According to an industry source, the price of electrical steel has been recorded as high as $2.80 per pound (lb). As a reference, approximately 170,000 to 220,000 lb of core steel is needed in a power transformer with a capacity rating between 300 and 500 MVA. The continued increase in global demand for grain oriented electrical steel, particularly in China and India;

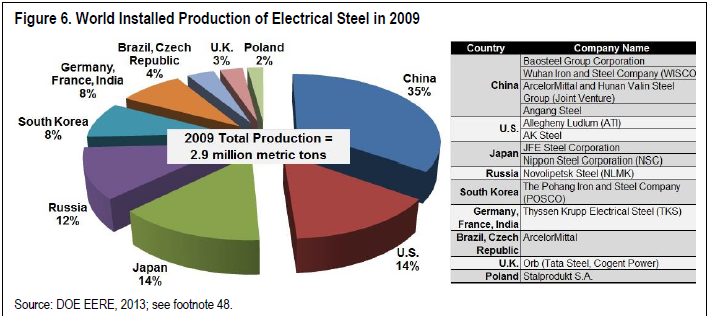

Global Electrical Steel Suppliers. The availability of electrical steel supply sources worldwide is limited. In 2013, there were only two domestic producers—AK Steel and Allegheny Ludlum. In addition to the 2 domestic producers, there were 11 major international companies producing grain oriented electrical steel. However, only a limited number of producers worldwide are capable of producing the high- permeability steel that is generally used in LPT cores. AK Steel is the only domestic producer of the high-permeability, domain-refined (laser- scribed) core steel used in high-efficiency stacked cores.

In 2009, China’s four companies produced 35% of the world’s electrical steel, the majority of which were consumed domestically. Conversely, Japan produced 14% of the world’s electrical steel mainly for the purpose of export. The two U.S. producers accounted for 14% of the world’s electrical steel production.

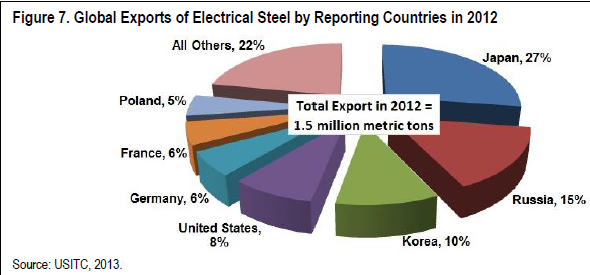

According to the USITC, in 2012, a total of 1.5 million metric tons of electrical steel were exported around the world, and exports from three countries—Japan, Russia, and South Korea— accounted for more than half of that total. While China was the largest producer of electrical steel, it contributed only 2% of the total global export in 2012. Japan was the largest exporter of electrical steel with 27%, followed by Russia and Korea, each exporting 15% and 10% of total global electrical steel in 2012, respectively.

The average price of copper more than quadrupled between 2003 and 2013, costing more than $4.27 per pound by 2011.

In 2012, China was the single largest buyer of steel in the world, consuming more than 45% of the world’s total steel consumption of 1,413 million metric tons that year. Although China’s primary need for steel is in the construction sector, China also has a significant demand for power transmission infrastructure. China’s and India’s demands for steel, including high-efficiency, grain-oriented steel, are expected to continue to affect the availability and price of steel and copper to the rest of the world.

Global Power Generation Capacity. In 2013, the world had more than five trillion watts of power generation capacity, which was growing at an annual rate of 2%. China and the United States had the largest generation capacity, with each holding about 21% and 20% of the world’s total installed capacity, respectively.

The key catalyst for power infrastructure investment in developed countries (e.g., United States) was the replacement market for aging infrastructure. In addition to aging infrastructure, the United States has a need for transmission expansion and upgrade to accommodate new generation connections and maintain electric reliability.

Large Power Transformer Manufacturing Capacity in North America. The United States was not an exception to the global, strategic consolidation of manufacturing bases. By the beginning of 2010, there were only 6 manufacturing facilities in the United States that produced LPTs. Although certain manufacturers reported having the capability to produce power transformers with a capacity rating of 300 MVA or higher, industry experts cautioned that the capacity to produce does not necessarily warrant actual production of power transformers of that magnitude. Often, domestic producers did not have the required machinery and equipment to produce power transformers of 300 MVA, or 345 kV, and above. A number of firms identified constraints in equipment (e.g., cranes, ovens, testing, winding, and vapor phase systems) and the availability of trained personnel set limits to their production capacity.

Ocean and inland transportation, compliance with specifications, quality, testing, raw materials, and major global events (e.g., hurricanes) can significantly influence a supplier’s lead time and delivery reliability. In addition, some railroad companies are removing rail lines due to infrequent use and other lines are not being maintained. This can pose a challenge to moving the LPTs to certain locations where they are needed.

Foreign factories may not understand the U.S. standards such as the Institute of Electrical and Electronics Engineers (IEEE) and the National Institute of Standards and Technology (NIST) or have appropriate testing facilities. Foreign vendors may not have the ability to repair damaged power transformers in the United States. It is expensive to travel overseas for quality inspections and to witness factory acceptance testing. The utility industry is also facing the challenge of maintaining an experienced, well trained in-house workforce that is able to address power transformer procurement and maintenance issues.

Dr. Jeff Masters. 3 Apr 2009. A future Space Weather catastrophe: a disturbing possibility. https://www.wunderground.com/blog/JeffMasters/a-future-space-weather-catastrophe–a-disturbing-possibility.html

We have the very real possibility that a geomagnetic storms of an intensity that has happened before–and will happen again–could knock out the power to tens of millions of Americans for multiple years. The electrical grids in Europe and northern Asia have similar vulnerabilities, so a huge, years-long global emergency affecting hundreds of millions of people and costing many trillions of dollars might result from a repeat of the 1859 or 1921 geomagnetic storms.

A May 2013 study by AER and Lloyd’s (available here) concluded that the total US population at risk of extended power outage from a Carrington-level storm is between 20-40 million, with durations of 16 days to 1-2 years. The duration of outages will depend largely on the availability of spare replacement transformers. If new transformers need to be ordered, the lead-time is likely to be a minimum of five months. The total economic cost for such a scenario is estimated at $0.6-2.6 trillion USD.

Increased vulnerability to geomagnetic storms?

On the other hand, the evolution of open access on the electrical transmission system in recent years has resulted in the transport of large amounts of energy across the power system in order to maximize the economic benefit of delivering the lowest-cost energy to demand centers. The magnitude of power transfers has grown, and the increased level of transfers, coupled with multiple equipment failures, could aggravate the impacts of a storm. For example, the long distance between Hydro-Quebec’s hydro-generation stations and load centers is one of the factors that is believed to have contributed to its crash during the 1989 Superstorm. In a remarkable 2008 National Academy of Sciences report, “Severe Space Weather Events–Understanding Societal and Economic Impacts Workshop Report”, John Kappenman of Metatech Corporation theorizes that a future repeat of the Carrington event or the 1921 geomagnetic storm could result in catastrophic failure of large portions of the electrical grid that would last for years, costing 1-2 trillion dollars in the first year, and putting million of lives at risk. Full recovery from the event would take 4-10 years. The possible extent of a power system collapse from a repeat of the great magnetic storm of May 14-15, 1921–the second strongest geomagnetic storm in recorded history (Figure 2)–shows that a large region of the U.S. with a population of 130,000,000 might be affected.

The strong electric currents that would flow through the the electrical grid during a repeat of the Carrington event are likely to cause melting and burn-through of large-amperage copper windings and leads in electrical transformers. These multi-ton, multi-million dollar devices generally cannot be repaired in the field, and if damaged in this manner, they need to be replaced with new units. There are only a handful of spares in reserve, so most of the region affected by the collapse would remain without power until new transformers could be custom built. During the March 13, 1989 Superstorm, geomagnetic-induced currents (GICs) melted the internal windings of a 500kV transformer in the Salem Nuclear plant in southern New Jersey (Figure 3). The entire nuclear plant was unable to operate until this damaged transformer was replaced. Fortunately, a spare from a canceled nuclear plant in Washington State was available, and the Salem plant was able to reopen 40 days later. Had the spare not been available, a new custom-built transformer would have been required, potentially idling the power plant for years. The typical manufacture lead times for these transformers are 12 months or more. According to a January 2009 press release from Metatech, Inc., 300 Extra High Voltage (EHV) transformers in the U.S. would be at risk of permanent damage and require replacement in the event of a geomagnetic storm as intense as the 1921 or 1859 events. Here’s where it gets really scary. According to the press release:

* Manufacturing capability in the world for EHV-class transformers continues to be limited relative to present market demand for these devices. Further, manufacturers would be unable to rapidly supply the large number of replacement transformers needed should the U.S. or other power grids suffer a major catastrophic loss of EHV Transformers.

.

* Manufacturers presently have a backlog of nearly 3 years for all EHV transformers (230 kV and above). The earliest delivery time presently quoted for a new order is early 2011.

.

* Only one plant exists in the U.S. capable of manufacturing a transformer up to 345 kV. No manufacturing capability exists in the U.S. at present for 500 kV and 765 kV transformers, which represent the largest group of At-Risk transformers in the U.S.

January 2009 press release from Metatech, Inc., “An Overview of the National Academy of Sciences Report on Severe Space Weather and the Vulnerability of US Electric Power Grid”.

August 2008 Scientific American article, “Bracing the Satellite Infrastructure for a Solar Superstorm”.

2008 National Academy of Sciences study, , “Severe Space Weather Events–Understanding Societal and Economic Impacts Workshop Report”

March 2009 newscientist.com article on Space Weather threats.

Excellent 2007 lecture by John Kappenman of Metatech Corporation, “Electric Power Grid Vulnerability to Geomagnetic Storms” (50 minutes).

Related articles

- Cyber Attacks an unprecedented threat to U.S. National Security, a review of U.S. House of representatives March 21, 2013 session on Cyber attacks

- Will we go out with a whimper instead of a bang? Cyberwar more likely than nuclear war

- It’s only a matter of time before Cyber Terrorists launch attacks

- Military Threats: Peak oil, population, climate change, pandemics, economic crises, cyberattacks, failed states, nuclear war.

- China is working on cyber attacks of our infrastructure and stealing secrets

- Emergency drill: Cyberattack on electric grid. Wald, Matthew L. August 16, 2013. As Worries Over the Power Grid Rise, a Drill Will Simulate a Knockout Blow. New York Times.

- Cyber Attack Methods. Who are the cyber attackers?

- Energy infrastructure cyberattack targets

- Actual cyber attacks

- House hearing: protecting small businesses against cyber-attacks 2013

- S. House: Iranian cyber threat to the United States

Electric Grid

- Electric grid large power transformers take up to 2 years to build. Excerpts from Department of Energy “Large Power transformers and the U.S. electric grid”.

- EMP effect on electrical transformers. A review of Dr. Jeff Masters 2009 “A future Space Weather catastrophe: a disturbing possibility”.

- The EMP Commission estimates a nationwide blackout lasting one year could kill up to 9 of 10 Americans through starvation, disease, and societal collapse

- Electromagnetic pulse threat to infrastructure (U.S. House hearings) from the transcripts of the 2012 and 2014 hearings

- Chip Fab Plants need electricity 24 x 7. The electric grid needs chips. The Financial system needs both.

- Electric Grid Overview

- Terrorism and the Electric Power Delivery System. National Academy of Sciences. Excerpts from the National Academy of Science 2012 “Terrorism and the Electric Power Delivery System” & 2013 “The Resilience of the Electric Power Delivery System in Response to Terrorism and Natural Disasters”

- What would happen if the electric grid was cyberattacked?

One Response to The electric grid could be down for years if LPTs destroyed